WTO Predicts "Weak" Merchandise Trade Growth for Early 2020

The World Trade Organization has released its goods trade analysis for December 2019, and the results indicate that "trade volume growth may continue to weaken into early 2020," even without taking the COVID-19 coronavirus epidemic into account.

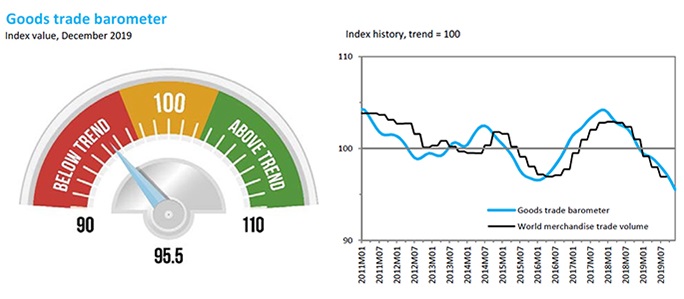

WTO trade statistics show that the volume of world merchandise trade was down 0.2 percent in the third quarter of 2019 compared to the previous year. The December 2019 "goods trade barometer" index comes in at 95.5 - below the business-as-usual mark of 100 and lower than the level seen the prior month. Readings of 100 indicate growth in line with medium-term trends; readings greater than 100 suggest above-trend growth, while those below 100 indicate below-trend growth (below).

WTO reported that the December index was pulled down by declines in container shipping and agricultural goods, with continued low performance in the air freight and electronic components segments weighing on the numbers as well. The organization suggests that year-on-year growth in trade is likely to continue to remain below trend for the early part of 2020, and it could be reduced further by the new global health threat.

First-quarter trade impact visible

The impact of the coronavirus on global containerized trade is already visible. China has borne the brunt of the epidemic, and Chinese authorities initially clamped down with restrictions on movement in key manufacturing provinces. According to the American Chamber of Commerce in Shanghai, about 80 percent of U.S.-run factories in China have had difficulty getting workers to return and restart production.

Dozens of sailings from Chinese ports have been canceled due to a fall-off in factory productivity and shipment volumes, and many of the ships that do sail are departing with substantially less cargo on board. Maersk alone has blanked nearly 30 sailings to date.

that matters most

Get the latest maritime news delivered to your inbox daily.

In the other direction, China is widely expected to request a delay in buying a promised $200 billion worth of extra American goods and services - including nearly $80 billion in U.S.-made manufactured goods - in 2020 and 2021. This purchase agreement was negotiated as part of a "phase one" trade deal between the Trump administration and Beijing in January, and it contains a clause allowing flexibility in the event of an unforseen catastrophe.

“All the signs are that there has been a major dislocation in global supply chains and commodity trade as well,” said Caroline Bain, chief commodities economist at Capital Economics, speaking to Bloomberg. "It’s only going to get worse in February data [for some products].”