U.S. Natural Gas Supply Hits Record, Fueling Exports

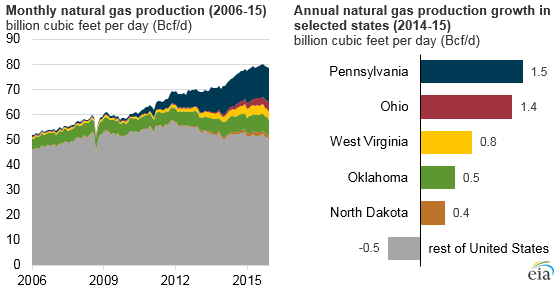

American natural gas production hit a new record high in 2015 at nearly 80 billion cubic feet per day, including natural gas liquids – up five percent from 2014 – on the back of strong increases in shale gas output in eastern states and in North Dakota, said the U.S. Energy Information Agency in a report Friday.

These regional contributions offset long-term declines in the Gulf of Mexico and Louisiana; but the EIA says that next year's gains will not be as remarkable, with low prices and falling rig activity cutting into new production and resulting in a projected one percent increase in 2017 and a two percent increase in 2018.

Reflecting the strong existing supply and low gas prices, the Baker Hughes Combined Rig Count – including natural gas drilling rigs – has fallen repeatedly over the course of the year to successive historic lows, and this week is no exception. On Friday, the index marked its fourth straight record low at 440, or 545 fewer active rigs than during the same period last year. Active gas rigs totaled to 89, down from 217 in the same period last year.

that matters most

Get the latest maritime news delivered to your inbox daily.

Drilling may be down, but a decade of marked gains in U.S. natural gas production from development of shale formations has also led to new economic opportunities, like Cheniere's new LNG export terminal in Sabine Pass, Louisiana, which is shipping its first commissioning cargoes this year.

Additionally, ethane production from the separation of natural gas liquids has exceeded the market’s ability to absorb it, fueling new initiatives to export it to Europe, and also to use it as a feedstock in domestic plants for the manufacture of ethylene. Thanks to cheap ethane from natural gas, American ethylene production is expected to rise by 40 percent over the next three years, and Dow Chemical alone has a $80 billion investment portfolio for new cracking plants. Many will be located in Texas, and the Port of Houston says that it is gearing up for a significant increase in container exports of ethylene to Asian plastics manufacturers. By its own estimates, resin export shipments at its terminals could double to 500,000 TEU per year by 2017 – about a quarter of the port’s annual volume.