Unforeseen Changes Send Container Rates Back to Pandemic-Era Levels

The $10,000 container has returned

An unusual confluence of supply and demand is driving ocean freight rates back up towards late-pandemic highs, according to logistics insiders - and it is prompting some of the same market behavior, sending shippers scrambling to ensure that they can move their inventory. A market landmark, the $10,000 per container price point, has arrived on one premium-rate Asia-Europe sailing.

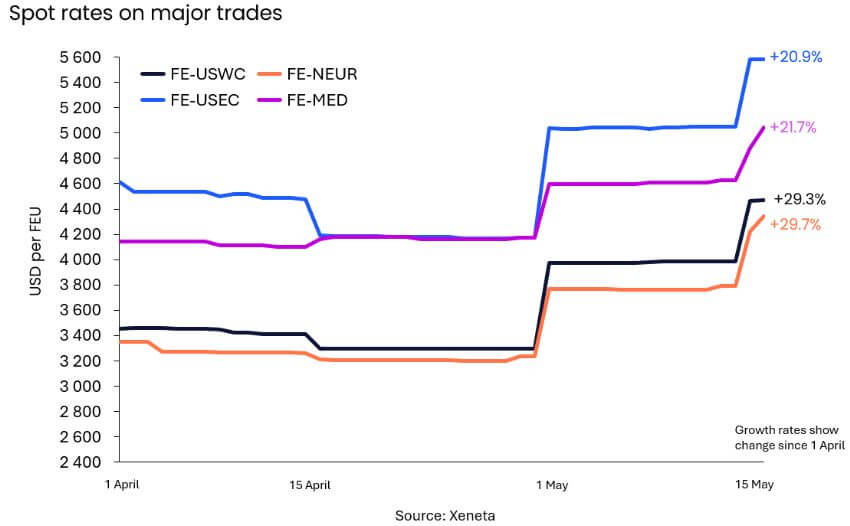

"Demand reached record levels in Q1 2024, up by 9.2 percent compared to Q1 2023," said Emily Stausbøll, Xeneta Senior Shipping Analyst. "There are numerous reasons for these rate increases, and the speed at which it has happened has caused nervousness in the market."

It's the latest rise in a four-year rollercoaster ride for ocean freight. COVID-19 lockdowns prompted a collapse in activity, then a boom in the container-freight business as Western consumers wound down their service-sector spending (food, entertainment, travel) and began buying more foreign-made items (home office equipment, exercise gear, electronics). U.S. and EU imports soared through 2021, driving Asia-U.S. West Coast rates above $20,000. Demand peaked in May 2022 and dropped into a down-cycle; by late 2023, many analysts predicted that low demand and a glut of new boxships would deliver a period of tonnage overcapacity lasting through 2030, accompanied by scrapping, layups and slow-steaming - even under "optimistic assumptions."

With the advent of the Houthi threat and the near-shutdown of the Red Sea late last year, those assumptions changed almost overnight. The Cape of Good Hope diversions appear to be absorbing all excess slot capacity and straining availabity of tonnage. This is prompting vessel reassignments, and shippers are seeing the return of the blanked sailing as an everyday phenomenon.

"As chance would have it the fleet growth essentially matches the need to go around Africa," explained Arcadio Martinez, Head of Global Tender Management Air & Sea at DSV, in a social media post. "All vessels are sailing. If you want to avoid a blank sailing on trade A, you might then take the vessel from trade B, causing a blank there instead."

that matters most

Get the latest maritime news delivered to your inbox daily.

Flexport's well-known CEO, Ryan Petersen, agrees that the surge in rates is mainly driven by the Red Sea crisis - but he thinks that there is more under the surface. In a recent bulletin, he pointed to half a dozen short- and medium-term factors that have all lined up at once. These include poor weather and congestion in Shanghai and Singapore; the possibility of a Canadian rail strike, which could affect the key container port of Prince Rupert; the looming contract expiration date for the International Longshoremen's Association, the union for dockers on the U.S. East Coast; the White House's signals of potential tariff hikes on Chinese goods; and a surge of demand from U.S. shippers, who perceive these risks and are paying extra to get their inventory early.

"Demand for air freight from Asia to the US is surging right now, as some shippers who can't get cargo moved fast enough by ocean are deciding to switch some of it to air," Petersen wrote.