U.S. Treasury Fines "Egregious" Iran Sanctions Violator

Berlin-based industrial equipment firm Aiotec has been hit with a multimillion-dollar sanctions penalty for an elaborate scheme to buy and ship an entire polypropylene plant to Iran, in violation of U.S. sanctions. The penalty is for repeated, "egregious" and "willful" sanctions violations, but the U.S. Treasury decided to suspend $9.5 million of the $14.5 million fine in exchange for Aiotec's promise to comply in the future - thereby allowing the small German company to remain in business.

Aiotec GmbH, an industrial equipment sourcing company, got in touch with an American equipment brokerage in 2015 about the possibility of buying a polypropylene manufacturing plant located in Australia. The broker was handling the sale on behalf of the plant's Australian owners, and since the broker was located in the United States, U.S. sanctions on Iran applied.

Aiotec agreed to buy the plant and told the U.S. broker that it would be dismantled and shipped to Turkey, where it would be reassembled and put into use. The firm made repeated statements that it would remain in compliance with all U.S. sanctions measures: its executives signed documents stating that it had no other destinations in mind for the equipment, had no other foreign partners, and would not ship the goods to any sanctioned country or entity. Based on these assurances, the U.S. broker concluded the deal with Aiotec and allowed the German firm to begin removing equipment from the site.

In reality, Aiotec had reached a secret resale and transfer agreement with an Iranian petchem operator, Petro-Iranian Downstream Industries Development Co. (PIDID). In 2016, Aiotec began to dismantle the plant, and equipment exports began in 2017 from the Australian port of Newcastle. The company hired two freight forwarders to handle the shipments, and it instructed both of the forwarders to falsify the destination on Australian customs documents as either the UAE or Turkey. However, each time a ship was loaded out with the plant's gear, the ultimate destination was actually Port Bandar Imam Khomeini, Iran - a clear violation of U.S. sanctions on the Iranian energy industry.

Aiotec repeatedly sent the U.S. broker reassurances and documents purporting to show that the shipments complied with all U.S. sanctions measures, including the protective agreement that the equipment would only be delivered to Istanbul and reassembled in the city of Van, Turkey. This was false, and could have been discovered using AIS data to monitor the movements of the vessels involved (or to detect a suspicious absence of AIS transmissions). Despite apparent misgivings and multiple requests for clarification, the U.S. broker accepted Aiotec's assurances and allowed it continued site access at the plant in Australia.

In August 2018, an anonymous source sent the U.S. broker a copy of Aiotec's resale agreement with Iranian firm PIDID. The broker immediately suspended site access at the plant, stranding some of the last components in Australia. When the U.S. broker demanded clarification, Aiotec denied the PIDID document's authenticity; provided falsified bills of lading that purported to show that the shipments had gone to the UAE, then on to Turkey; sent a copy of a forged "agreement" with a Turkish company regarding the sale; and sent a fake threat from the Turkish "buyer" that promised to scuttle the deal if the last equipment shipments weren't delivered.

In November 2018, the U.S. broker and the Australian owner of the plant agreed to believe Aiotec, and they restored site access. Aiotec promptly proceeded to ship the last of the gear to Iran; the last chartered ship departed Australia in April 2019, and Aiotec delivered its final falsified shipping documents to the U.S. broker in June 2019. The U.S. broker was properly paid for the transaction, receiving a total of $9.5 million in 11 installments.

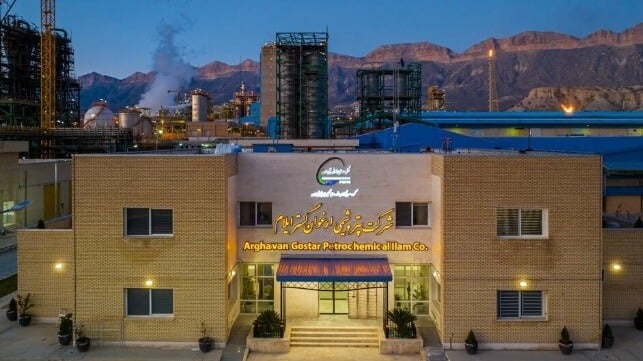

The plant's potential strategic value was significant. Treasury noted that the facility could provide a new revenue stream to Iranian petrochemical industries, which have long been a target of U.S. economic restrictions.

that matters most

Get the latest maritime news delivered to your inbox daily.

Treasury noted that Aiotec is a small company with few employees, and agreed not to impose the burden of the full statutory maximum fine of $19.5 million - or even the assessed fine of $14.5 million. So long as Aiotec hires a compliance officer and undergoes annual audits, it will only pay $5 million.

Iran is still working on bringing a plant online to make polypropylene using Australian equipment.