Report: Shipping CO2 Emissions Returned to 2008 Peak as Volumes Erase Gains

The shipping industry’s greenhouse gas (GHG) emissions rose while carbon intensity reductions slowed in the period after the pandemic returning emissions to peak 2008 levels according to a new report from the UCL Energy Institute and UMAS. The report highlights the interplay of a series of factors between 2018 and 2022 as shipping volumes surged after the pandemic which influenced emissions trends while saying it necessitates further action to achieve the IMO’s targets for reducing emissions.

The report highlights that as shipping slowed during the pandemic there were measurable gains but they were quickly reversed with the surge in trade in 2021. The increase in demand resulted in a spike in transport work they highlight with reduced efficiency and faster average speeds contributing to increasing overall emissions.

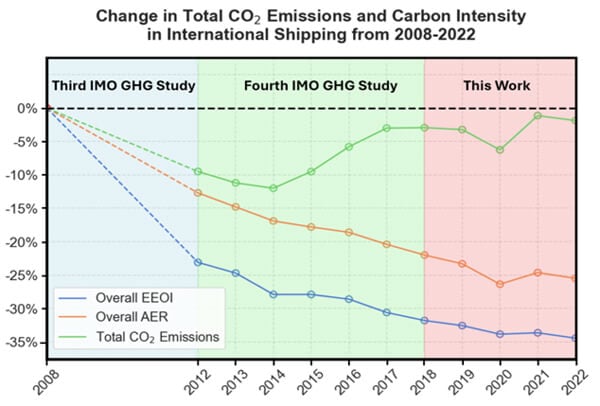

Following from the IMO’s Third and Fourth GHG studies, the new report extends the data from 2018 to 2022. Total CO2 emissions increased during the fourth study reversing the previous declines. As of the end of 2022, the report believes emissions have reached back to the 2008 reference point having reversed the more than 10 percent decline recorded in 2014.

The report highlights the rapid efficiency improvements achieved in 2008-2012. They point out that this was achieved both with operational improvements induced through slow steaming and technology improvements such as “eco ships” contributing technical efficiency gains. The report points out that this progress however appears to have plateaued.

The low rate of carbon intensity/energy efficiency improvement in 2012-2022 the report says can be attributed to weak drivers of further efficiency after the initial efficiency “corrections” on both ship speed and design in 2008-12. The authors state that known market barriers and failures inhibit the business case and motivation for efficiency improvements and continue to leave many technical and operational efficiency measures under-used.

The results they believe also evidence the low efficacy of the EEDI regulation in driving fleet-wide efficiency improvement. The 2018-2022 period showed only a small increase in transport work and tonne nautical miles of approximately one percent annually, significantly lower than the approximate three percent annual growth observed in 2008-2018. Similarly, the trend in carbon intensity they highlight has slowed with an estimated 1.1 percent annual reduction between 2018-2022, contrasting with a higher average of approximately three percent improvements over the period 2008-2018.

“The IMO has imminent key decisions on both efficiency and energy policy in 2025,” points out Dr. Tristan Smith, Professor of Energy and Transport at the UCL Energy Institute. “The message from this analysis is that the fleet actually has a latent efficiency opportunity - because during the period to 2022, utilization and speeds of many ship categories actually trended in directions countering efficiency improvements. But these are trends that can be rapidly reversed with minimal technological intervention and should also come with cost reductions to trade.”

The report concludes that the absence of any driver beyond market forces and IMO’s EEDI regulation limited the incentive to go beyond the “lowest hanging fruit” in efficiency. They write that the CII regulation that entered into force in 2023 needs to have both stringency and enforcement to drive strong efficiency improvements in line with the IMO’s revised strategy, otherwise the efficiency opportunity will “be left behind.”

“This analysis reveals a stagnation in emissions reductions from international shipping since 2018 and highlights the need for renewed efforts in fleet efficiency and carbon intensity improvements,” says Dr. Haydn Francis, Consultant at UMAS. “While this can in part be attributed to the effects of COVID-19 on supply chains, there remains a clear need to focus on targeted strategies that address the varying trends across segments and support a cohesive path toward decarbonization.”

that matters most

Get the latest maritime news delivered to your inbox daily.

The report concludes that there is an opportunity if demand in different segments of international shipping comes more in line with the fleet capacity/supply over the coming years. They emphasize that there is a lot of potential for higher utilization and rapid improvement in operational carbon intensity as measured by EEOI. Given that the average ship sizes are higher, the technical efficiency of individual ships is (modestly) lower, and average speeds are, at least in 2022, remaining low.

The full report is available online for downloading.