Offshore GOM Output May Hit Record in 2017

The U.S. Energy Information Agency announced Thursday that it predicts Gulf of Mexico offshore crude production to reach a record high in 2017, despite current low prices. The EIA expects daily output of 1.8 million barrels in the Gulf in 2017, up from 1.6 million this year.

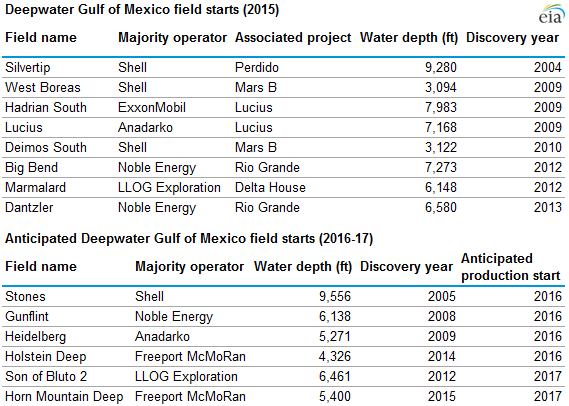

The agency attributes the rise in production to 14 projects recently started, under development or anticipated over the next year. Eight came online in 2015, the majority in the form of tiebacks, newly drilled subsea wells connected to existing production platforms. Many of the expected wells over the next year will also be tiebacks, reducing the cost of additional development.

Additionally, short term price changes have less of an immediate effect on offshore activity than on production in North Dakota, the EIA said – but the expectation of long-term low prices, as voiced by many analysts and offshore firms, has prompted considerable pullback in the sector. The agency notes that its forecast is based on the continuation of projects currently planned, and that many offshore developments have been recently canceled over concerns about low or negative profit margins in the current price regime. “These changes added uncertainty to the timelines of many Gulf of Mexico projects, with those in the early stages of development at greatest risk of delay or cancellation,” EIA said.

As offshore production rises in the Gulf, it is expected to contribute a greater proportion of U.S. production capacity, rising to 21 percent in 2017, the EIA said.

Separately, the U.S. Bureau of Ocean Energy Management announced Thursday that the administration intends to lease an additional 45 million acres in the Gulf of Mexico outer continental shelf for oil and gas development.

that matters most

Get the latest maritime news delivered to your inbox daily.

The two offerings, Central Planning Area Lease Sale 241 and Eastern Planning Area Lease Sale 226, will be held consecutively in New Orleans, Louisiana, on March 23. The sales will be the ninth and tenth offshore auctions under the administration's Outer Continental Shelf Oil and Gas Leasing Program over the last five years.