More Containerships are Deployed on Asia to US East Coast Routes

Changes in consumer spending patterns and the surge in Asian imports to the U.S. are continuing to reshape the container shipping industry. New data from logistics and supply chain analytics firm Alphaliner highlights the shifting patterns in Asian trade that are impacting the industry and operations at major U.S. ports.

The record orderbook for new containerships will dramatically increase the future capacity and operations of the industry. However, so far much of the attention has been on the Asia to Europe routes where the first ultra-large 24,000 TEU containerships were deployed and are reshaping port operations and deployments. However, the industry is not waiting for the new vessels to change broader deployment patterns.

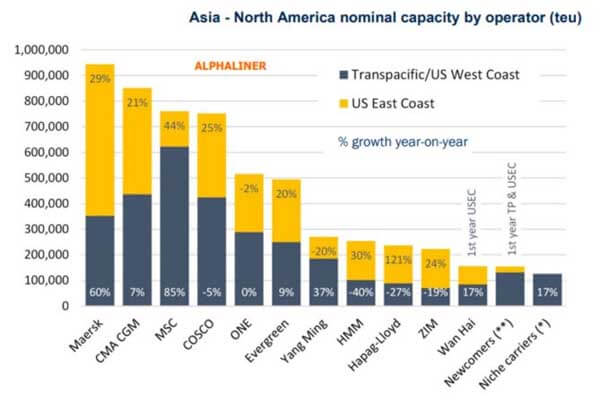

Alphaliner highlights the dramatic growth on the trans-Pacific routes. They report in the past year the container capacity on routes between Asia and North America increased by a quarter (24 percent) with most of the major carriers deploying additional capacity to capture a portion of the lucrative market. Many carriers highlighted the use of extra loaders beyond their normal schedules as well as introducing new routes and services to capture a share of the market.

As of the beginning of April 2022, Alphaliner calculates that there are a total of 702 containerships deployed between Asia and North America. In total, they report that capacity on Asia to North America routes has reached 5.75 million TEU.

While the reports of the dramatic backlogs of vessels lined up at Pacific coast ports would suggest that much of the new capacity was deployed on U.S. West Coast routes, the Alphaliner data highlights that the U.S. East Coast has been the biggest beneficiary of the growth and that it will continue to grow with additional new services being introduced.

“The total capacity of all ships deployed on Asia - US East Coast services has increased by 28.1 percent year-on-year, which compares to 20.5 percent growth for the fleet trading between Asia and the West Coast of North America,” reports Alphaliner. They cite increases in capacity from major carriers including Maersk, MSC, CMA CGM, COSCO, Evergreen, and Zim, as driving the volume growth to the East Coast ports.

This dramatic growth may well account for the significant backlogs that developed in 2021 and into 2022 off the U.S. East Coast ports. Analysts at Marine Traffic, for example, recently highlighted that at the beginning of April 2022, there was more container capacity waiting for berths at U.S. East Coast ports than at the notoriously backlogged West Coast ports.

The imbalance between east and west is likely to only increase in the coming months. Many analysts have predicted that the major carriers and shippers will be diverting shipments to East Coast and Gulf Coast ports to avoid potential disruptions as the West Coast longshoremen’s contract negotiations start in May ahead of a summer contract expiration.

Carriers continue to respond to the changing patterns of shippers, with Alphaliner highlighting the introduction in May of a new route operated by the Ocean Alliance between China and South Korea via the Panama Canal to the East Coast ports of Norfolk, Savannah, Charleston, Miami. They report that COSCO, OOCL, CMA CGM, and Evergreen will deploy ten vessels with a capacity ranging between 10,000 and 14,000 TEU to the route.

that matters most

Get the latest maritime news delivered to your inbox daily.

The strength of the Asia to North America market has also attracted smaller carriers into the market resulting in a surprising finding from Alphaliner that goes against many of the arguments. “The joint market share of the three major alliances has dropped from 82.2 percent to 67.7 percent,” reports Alphaliner, in contrast to the Biden administration that blamed the alliances for many of the current market issues.

In the near term with no sign of letup for import demand, these trends are likely to continue to develop. Ports along the U.S. East Coast have all been rushing to make critical infrastructure investments to increase capacity and their ability to handle the larger generations of ultra-large containerships expected to be deployed to the ports in the coming years.