Lloyd's Ledgers Reveal Key Role in 18th-Century Slave Trade

After allowing researchers to review its ledger books from the 18th and 19th centuries, Lloyds of London has agreed to pay $50 million for its role in the slave trade, which accounted for a share of its business at the time.

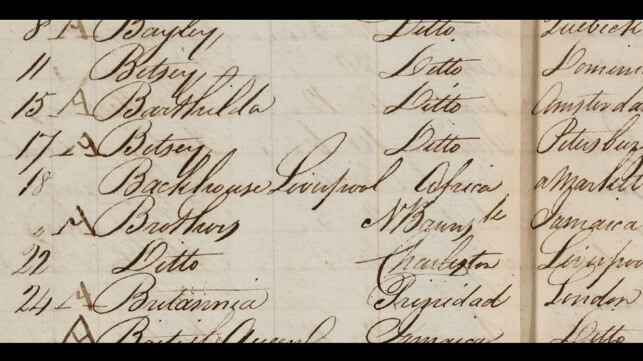

An independent research group based at Johns Hopkins University was granted access to the Lloyd's archives in order to delve into the financial history of the trade. (Lloyd's played no editorial role.) At Lloyd's, the researchers found records available nowhere else, like the 1807 "risk book" of prominent London underwriter Horatio Clagett. The elegant script of this handwritten ledger describes Clagett's share of the coverage for hundreds of voyages (image at top). Most were for dry cargo, but the book also details 59 slave ship voyage legs, accounting for more than one third of all known slaving voyages departing Britain in that year. As Lloyd's had many other members besides Clagett - some of whom had deep ties to the slave trade - the researchers reasoned that this percentage could be an undercount.

They also found detailed policies, listing the terms for each slave voyage and the individual underwriters who would each assume a share of the risk. A sample document shows that slave ship policies contained unique language for the risks of the trade, like specific coverage for vessel damage caused by slave insurrections, which affected about one voyage out of five. If the cargo was covered as well as the ship, each captive was assigned a value payable in the event of death, except for natural death by "disease" or "despaire [sic]," which were viewed as uninsurable. For the vessel value and cargo value in this contract, the 20 percent premium might be in the six figures in present-day dollars, divided among the individual Lloyd's members who underwrote the policy - for one voyage.

“Lloyd’s was quite central, we can see, to the maintenance of the Atlantic slave trade, and also profited,” said project leader Alexandre White, assistant professor at Johns Hopkins, speaking to the FT.

Plantation owners and slave merchants were also well-represented in the ranks of Lloyd's subscribers in this period. Clagett, the underwriter whose risk book was recovered, was also a merchant dealing in tobacco from the plantations of the American South. Joseph Marryat, a West Indies plantation owner and pro-slavery politician, became chairman of Lloyd's in 1811.

Lloyd's has previously acknowledged its role in the slave trade, and it has vowed a thorough response to the latest findings.

that matters most

Get the latest maritime news delivered to your inbox daily.

“We’re deeply sorry for this period of our history and the enormous suffering caused to individuals and communities both then and today. We’re resolved to take action by addressing the inequalities still seen and experienced by Black and ethnically diverse individuals," said Bruce Carnegie-Brown, Chairman of Lloyd’s.

As recompense, Lloyd's will pay $15 million for a program to increase ethnic diversity in its own ranks, and will invest another $50 million in African and inter-American development banks.