In Panama, Hegseth Pledges Cooperation to Counter Chinese "Influence"

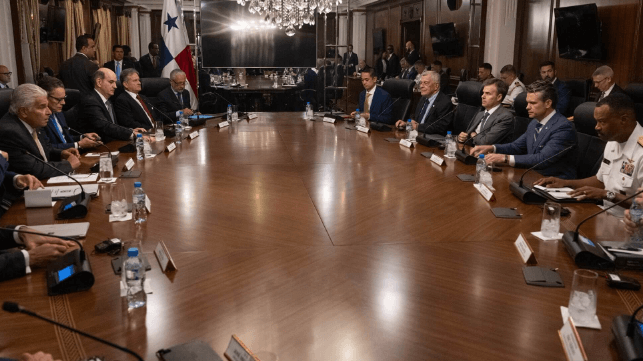

On Tuesday, U.S. Defense Secretary Pete Hegseth visited Panama to deliver a message: he pledged that the United States will "take back" the Panamanian government-operated canal from alleged Chinese influence.

In prepared remarks, Hegseth acknowledged that "China does not operate this canal," and he pledged that China will not be allowed to "weaponize" it via infrastructure construction contracts.

"The United States of America will not allow communist China or any other country to threaten the canal's operation or integrity," Hegseth said. "The United States and Panama have done more in recent weeks to strengthen our defense and security cooperation than we have in decades."

Shortly after his speech, a Panamanian tuna clipper hit the newly-built pier while moving astern.

Panama reviews terminal lease agreements

Just before his arrival, Panama's controller general released a review of the two container terminals at either end of the canal. Both are leased and operated by CK Hutchison, a private Hong Kong-based firm with extensive holdings around the world. The review found potential irregularities, and it could delay or jeopardize the sale of the two terminals to U.S. private equity firm BlackRock - an undesirable outcome for the Trump administration, which supports the sale and wants to see the terminals in American hands.

In his review, controller general Anel Flores concluded that CK Hutchison's local subsidiary underpaid Panama by about $300 million, and he claimed that the firm had not properly renewed its contract to operate the two terminals. According to Flores, the renewal was negotiated on terms that were lopsided in favor of CK Hutchison, and he claimed that the resulting deal was never approved by the controller general's office. "There must be something else going on here, because everyone [at the Panama Canal Authority] negotiated in favor of the company. Nobody wore the Panama jersey," Flores alleged.

Flores plans to submit a complaint with specific charges to prosecutors within days, and Panama's attorney general has already started an ex officio investigation.

The decision raises questions about whether Panama will recognize CK Hutchison's right to sell the leases to BlackRock or any other buyer; if the renewal is invalidated, Panama could in theory nationalize the terminals and auction off operating rights to a new concessionaire, Johns Hopkins Latin America expert Benjamin Gedan told the New York Times.

that matters most

Get the latest maritime news delivered to your inbox daily.

It is the latest in a series of setbacks for BlackRock. China's government is strongly opposed to the sale, and has pressured CK Hutchison to delay or cancel it for patriotic reasons. Chinese state-owned ports operators are said to be in talks with Hutchison executives about possible offers to take over the firm's network if the BlackRock deal falls through.

The total global value of the Hutchison-BlackRock deal comes to $22.8 billion, and includes dozens of other terminals around the world. The alleged $300 million payment shortfall at Hutchison's Panama subsidiary is equal to little more than one percent of the value of the overall transaction.