Import Volumes Climbing at US Ports but Projected Below Pandemic Peaks

Import cargo volume at the U.S.’s major container ports is expected to start a steady climb lasting into the summer of 2023 but will remain below record-setting levels seen during most of the pandemic, according to the Global Port Tracker report released today by the National Retail Federation. The retail trade association believes that container volumes bottomed out in February and will rise slowly over the next five months through August as retailers slowly grow inventories in preparation for the traditionally busy end of summer and holiday season sales.

“Last spring and summer were the busiest ever as consumers spent freely and retailers brought in merchandise to meet demand,” said Jonathan Gold, the NRF’s Vice President for Supply Chain and Customs Policy. “This year won’t repeat that, but the numbers we’re expecting would have been considered normal before the pandemic. The priority at the moment is resolving labor negotiations at the West Coast ports and avoiding any self-inflicted supply chain challenges on top of those we’ve faced the past three years.”

The NRF’s statements came as the ports of Los Angeles and Long Beach came to a halt during Thursday’s evening shift and again on Friday as ILWU Local 13 members who operate the cranes and cargo-handling equipment failed to report for work.

The NRF highlights that it sent a letter signed by 238 national, state, and local trade associations to President Biden encouraging further engagement by the administration in the West Coast talks. In addition, NRF President and CEO Matt Shay met with Port of Los Angeles Executive Director Gene Seroka to hear the latest developments regarding the status of negotiations. Seroka has publicly said that he believes shippers are diverting volume away from the West Coast and that it is critical to quickly complete the negotiations. The Biden administration has been closely monitoring the talks regularly in contact with the Pacific Maritime Association, which represents the employers, and the union.

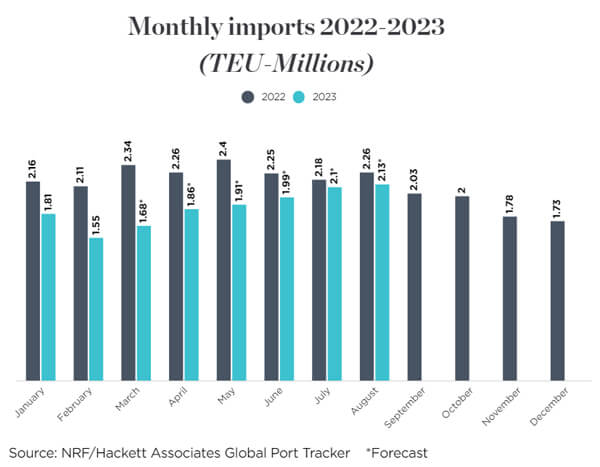

A prolonged disruption it is feared could step back the expected growth in container volumes projected for the coming months. The NRF in its report notes that February, which is traditionally a slow month, was at levels last seen in May 2020. February’s container volume at 1.55 million TEU was down more than 14 percent from January and nearly 27 percent year-over-year.

“Compared with last year, the flow of import containers on the West Coast continues to decline along with demand as carriers increasingly drop service to Los Angeles-area ports but stretch voyages to include other ports of call to help absorb excess capacity,” said Ben Hackett founder of Hackett Associates. “Meanwhile, freight rates have been impacted by the fall in demand, but new ships are starting to show up and more have been ordered – a sign that carriers expect demand will improve by the time the new vessels are delivered.”

that matters most

Get the latest maritime news delivered to your inbox daily.

The NRF expects that monthly container volumes will remain below 2022’s peak levels but rise month-over-month. When March’s volumes are tallied, they project it will come in at 1.68 million TEU which would be down 28 percent from last year. However, they project it will rise surpassing the 2 million TEU level in July and August.

The first half of 2023 is forecast at 10.8 million TEU, down 20 percent from the first half of 2022. Imports for all of 2022 totaled 25.5 million TEU, down just over one percent from the record of 25.8 million TEU set in 2021.