Harland & Wolff Cuts Revenue Forecast Due to Delays

The revival of famed shipbuilder Harland & Wolff is sailing into turbulent waters. Supply chain constraints have affected one major contract, while geopolitical uncertainties and inflation have forced the deferment of others. These headwinds have had an impact on the timing of the company's projected revenues, reducing its top-line numbers for 2022.

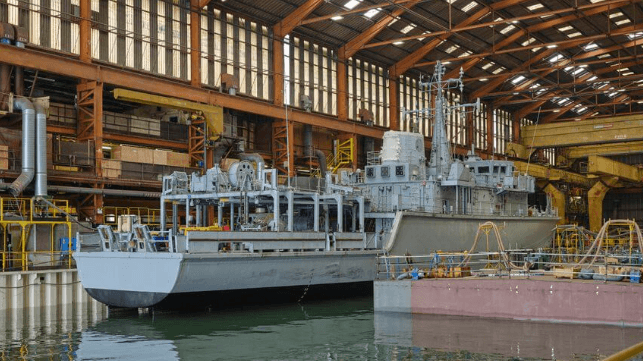

Harland & Wolff, which has been on a turnaround trajectory since it was acquired out of bankruptcy in 2019, announced in a trading update that a $66 million project to regenerate the former Royal Navy mine-hunting vessel HMS Quorn is facing challenges. The company is temporarily unable to undertake “certain key workstreams” due to lack of materials and specialized OEM parts. Global supply chain issues are to blame, the firm said.

The company was awarded the contract to renovate and restore HMS Quorn in August. The vessel is expected to be delivered to the Lithuanian government in 2024.

The UK Ministry of Defence contract stipulates that payments will be spread over a three-year period, and are contingent on progress. Because of the supply chain challenges, Harland & Wolff now expects about $24 million of revenues from the contract to be deferred into the first half of 2023.

The company said that the overall project is still on track and on schedule, though the revenue couldn't be booked in 2022.

This is one of the headwinds that are slowing the company's revival. Though initially Harland & Wolff had projected annual revenues of $78-90 million, the expectations have been significantly revised downwards to about $34-37 million.

“Whilst it is disappointing that we have not met our aspirations for financial year 2022 due to timing issues, we have made significant progress over the last 12 months, and I am confident that we will see a robust 2023 with deferred revenue from 2022 which will start getting booked during the course of half one in 2023,” said John Wood, Harland & Wolff Group CEO.

The UK government is putting massive efforts into a revival of the iconic Harland & Wolff name. That includes ensuring that the company restarts shipbuilding after years of focusing on repairs at its yards in Scotland and Northern Ireland. The company was bought out of bankruptcy by the infrastructure investment firm InfraStrata in 2019 and has since been trying to regain its famed history in the shipbuilding industry.

However, Harland & Wolff is subject to the same global headwinds that have affected manufacturers everywhere. According to the company's trading update, geopolitical uncertainties and inflation have hit its cruise and ferry business, with clients either deferring contracts or reducing the scope of work. The impact is a loss of revenues to the tune of $10-12 million. The company expects the lost revenue to be deferred to the first half of next year, when clients are scheduled to place contracts for drydocking in Belfast with new budgets.

that matters most

Get the latest maritime news delivered to your inbox daily.

In addition, the shipbuilder has reached an agreement with Italian offshore engineering contractor Saipem to terminate a contract for four wind turbine jackets for the Neart na Gaoithe (NnG) offshore project. Since the signing of the contract last April, the firm has encountered issues with payments, delays and defective materials, resulting in cost escalation. Saipem and Harland & Wolff have not been able to agree on a way to split the extra costs, and instead of proceeding with a loss-making project, Harland & Wolff decided to withdraw from the contract.

The company is still upbeat about its prospects for 2023, and believes that most of the revenue that it had expected to receive late last year will arrive in the first half of this year.