First Signs of Improvement in Shipping Reliability and Reduced Delays

After months of reports of delays and bottlenecks as volumes strained the global shipping industry, the worst appears to have passed. According to new data from analytics firm Sea-Intelligence while reliability and delays are still prevalent, there however was a marked improvement in schedule reliability and the first signs of reversing the deteriorating trend for late-arriving vessels. The data is also supported by anecdotal reports at ports around the globe.

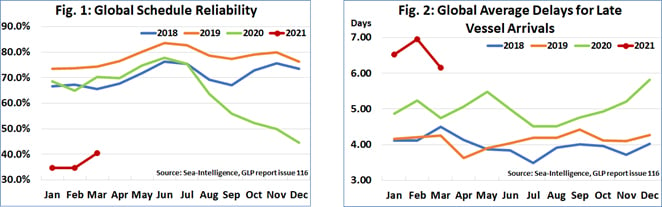

Sea-Intelligence published issue 116 of its Global Liner Performance (GLP) report, with schedule reliability figures up to and including March 2021. The report covers schedule reliability across 34 different trade lanes and 60-plus carriers.

Global schedule reliability showed its first month-over-month improvement reaching just over 40 percent, a nearly six percent improvement from the prior month. That still however means that only four out of every ten containerships arrived in port on schedule.

(Source Sea-Intelligence)

“It seems as if the worst has passed,” said Alan Murphy, CEO, Sea-Intelligence. “That said, there is a long way to go to reach the levels of the previous years, as this was still the lowest schedule reliability for April in the 10 years that we have measured schedule reliability. Versus 2020, it is a sharp gap down 29.9 percentage points.”

The average delay for late vessel arrivals also reversed its deteriorating trend, according to the latest report. The March 2021 figure is 0.79 days lower month-over-month, but it remains higher by 1.42 days versus the year ago. At 6.16 days, late arrivals were still the highest ever for March.

“The average delay in the first quarter of 2021 was higher than the extraordinary high delays caused by the U.S. West Coast labor dispute in the first quarter of 2015,” said Murphy. “It was also the highest for each month in all months since April 2020.”

The Sea-Intelligence report also traces the performance of the major carriers. Only three of the shipping companies, Maersk, Hamburg Süd, and Wan Hai, had better than 40 percent schedule reliability, with nearly all the carriers registering between 30 and 4 percent schedule reliability. Maersk had the highest figure with nearly half of its ships arriving on time.

All carriers recorded a month-on-month improvement in schedule reliability, but none recorded a year-over-year improvement in March 2021. Wan Hai recorded the largest monthly improvement of 17.6 percentage points while HMM recorded the largest year-on-year decline of a staggering decline of 45.4 percentage points, according to Sea-Intelligence.

that matters most

Get the latest maritime news delivered to your inbox daily.

The San Pedro Bay port complex is a good example of the improvements and remaining challenges. The Maritime Exchange of Southern California which overseas movements into and port of the ports of Los Angeles and Long Beach reported yesterday that combined 100 vessels were in the two ports. A total of 23 containerships were in the anchorage with 21 awaiting berths, which is down from the peak of over 60 at the end of January 2021. With nine of the box ships currently waiting for terminal space at the Port of Los Angeles, the average wait time is still reported at 7.7 days, but currently all but one of the vessels has been at anchor between one and four days, with only the Ever Legend waiting 10 days.

The major carriers are also continuing to reroute services to avoid congestion. Last year, MSC, for example, announced that it would join other major carriers who have diverted ships away from the southern California ports. MSC’s Santana route starting in mid-May will reroute to Yantian – Shanghai – Tacoma – Yantian, substituting the Pacific Northwest port for Southern California.