EIA: U.S. High Sulfur Fuel Demand will Rebound in 2022

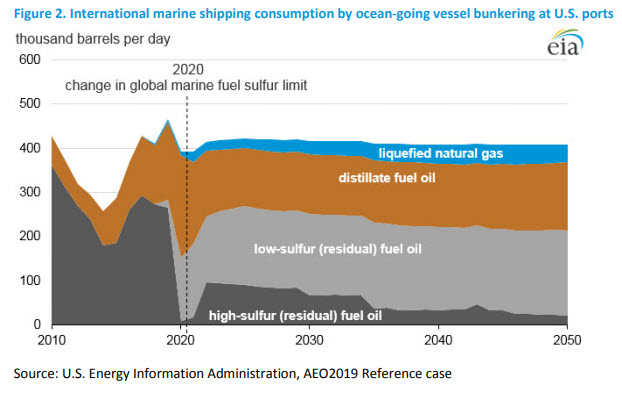

The U.S. Energy Information Administration (EIA) predicts that the share of high sulfur residual fuel oil consumed as bunker in the U.S. will drop from 58 percent in 2019 to three percent in 2020, and then rebounds to 24 percent in 2022.

The report, The Effects of Changes to Marine Fuel Sulfur Limits in 2020 on Energy Markets, indicates that despite a recent increase in scrubber installation and orders, the number of vessels installed with scrubbers required to continue using high sulfur residual fuel oil remains limited. As a result, a large but brief increase in the share of distillate fuel oil and low-sulfur residual fuel oil is predicted in 2019 and shortly after 2020.

A recovery in high sulfur residual fuel oil consumption driven by scrubber installations is not expected to occur until 2022 but at levels far lower than before the 2020 IMO sulfur cap.

After 2023, high sulfur residual fuel oil consumption is expected to decline down to a 22 percent share of U.S. oceangoing marine vessel bunker fuel by 2025. Low sulfur residual fuel oil consumed is expected to increase from 38 percent in 2020 to 43 percent in 2025. Similarly, the EIA projects that the need to use distillate in lower sulfur bunker fuels will increase distillate’s share of U.S. bunker demand from 36 percent in 2019 to 57 percent in 2020, although this share declines to 29 percent by 2025.

The EIA forecasts that the use of LNG in marine bunkering will be limited through 2020. It's use is expected to be limited for the next five due to the limited current infrastructure at U.S. ports. In the medium and long term, this infrastructure barrier is expected to decrease, and LNG’s share of U.S. bunkering is expected to grow to seven percent in 2030 and to 10 percent by 2050.

that matters most

Get the latest maritime news delivered to your inbox daily.

Despite bunker fuel’s relatively small share of both the global and U.S. liquid fuels markets, EIA expects a shift in demand in the global bunker fuel market from high sulfur fuel oil to low sulfur distillate fuel and low sulfur fuel oil. This shift will result in a change in the relative prices of those fuels, and EIA expects the demand shift to increase global prices for light and low sulfur refined petroleum products such as diesel fuel, gasoline, jet fuel and low sulfur fuel oil. This shift, in turn, will lead to a decrease in the price of high sulfur fuel oil. This price premium for lower sulfur refined products will be most evident at the wholesale (refinery and bulk terminal) level in the form of higher refining margins for low sulfur products such as diesel.

The report is available here.