Drilling Begins at Johan Sverdrup Field

Right on schedule, contractors for Statoil on the dual-derrick semi-submersible Deepsea Atlantic have begun predrilling at the Johan Sverdrup oil field, among the largest finds ever offshore Norway. The field contains as much as three billion recoverable barrels, and its developers expect it to “prolong the life of the Norwegian oil industry for several decades.”

Odjfell has a contract with Statoil for the rig and for drilling services, and Baker Hughes is providing integrated drilling services. The start of drilling is good news for Odjfell, which reported Monday that its fourth quarter 2015 results were hurt by a temporary layup of the Atlantic while awaiting the start of work on Johan Sverdrup.

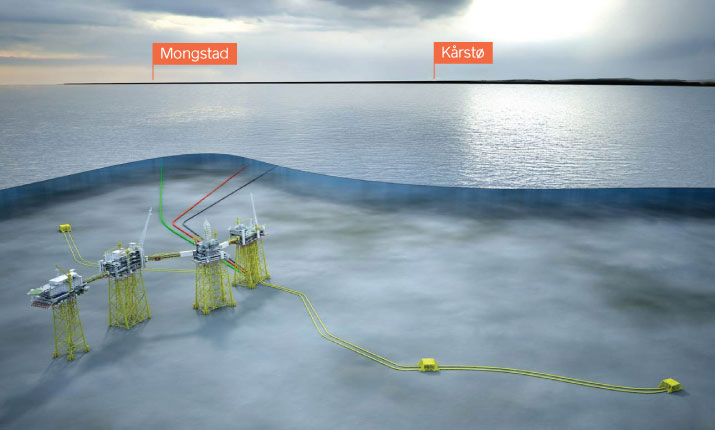

The first phase of the field will be developed using a predrilling template weighing 300 tons, with slots for eight wells; it was installed in August 2015, and when the first platform modules are installed starting in 2018, Statoil will be able to begin production quickly as Deepsea Atlantic will have completed much of the work. First oil is scheduled for 2019.

Construction on platforms and jackets has begun, but will not be complete for some time – the riser platform jacket alone will be the largest and most complex ever deployed offshore Europe, said Statoil senior vice president Kjetel Digre. It is designed to accommodate over 50 conduits for production and injection, plus the electrical supply from the mainland and the export of oil and gas to shore. It will be one of four in a linked chain of platforms for living quarters, production, drilling, and risers.

Once the production wells have been predrilled, Deepsea Atlantic will move on to drill water injection wells for maintaining production levels.

that matters most

Get the latest maritime news delivered to your inbox daily.

Johan Sverdrup was expected to cost in the range of $26 billion to develop, but in a buyers’ market for offshore services and oil and gas equipment, Statoil has recently lowered the projection to as little as $19 billion.

Ownership and revenue sharing were subject to controversy last year as early license-holder Det norske protested the Ministry of Petroleum and Energy's ruling on how revenue would be divided. Norway's King in Council ruled in December that Statoil should proceed as operator with 40 percent ownership, with the remainder split between Lundin (23 percent), Petoro (17 percent), Maersk Oil (8 percent) and Det norske (12 percent). The ruling was even lower than a previous proposal by the other partners for Det norske's share.