DNV: CARB's New At-Berth Regs Will be Tough for Tankers to Reach

In a new report commissioned by the Western States Petroleum Association, class society DNV found that tankers may not be able to comply with CARB's future at-berth emission regulations for oil terminals in California. The necessary systems and standards are not fully developed, DNV warns - and the odds are slim that good options will be ready by the time that the new rules take effect in 2027.

Shore power limitations

For boxships and cruise ships, shore power is the obvious answer for cutting at-berth emissions, and it's a popular fix in California. The move to shore power infrastructure has been under way at the San Pedro Bay container terminals for at least a decade.

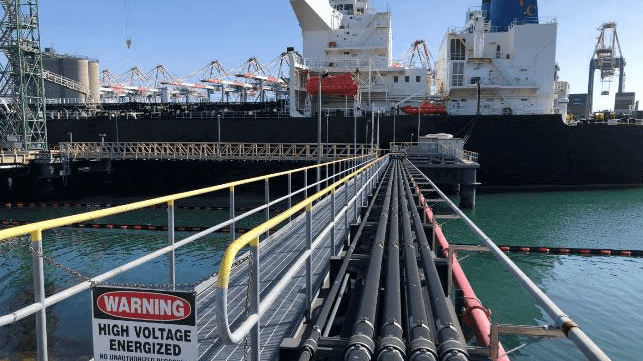

However, shore power is not as easy for tankers, according to DNV. There is no standard for the connection location on board, the industry lacks a safety and operational standard for shore power and - critically - there is no approved ex-proof connection socket that could be used in a hazardous zone on board a tanker.

Logistically, the manifold area would be one of the most convenient spots for putting a shore power connection, since it would line up with the same spot on the pier regardless of vessel length - but it's the very definition of the hazardous zone. Installing a shore power connection there could require building a pressurized, inerted miniature deckhouse to surround the connection point.

Further, the relevant global standards for creating such an ex-proof connection do not currently exist. This is "likely to delay implementation, increase safety risks, or lead to confusion over technology deployment and investment," concluded DNV. "This is especially a concern regarding use of shore power for tankers at berth because the cargo operations involve hazardous products and interfaces with hazardous zones on the terminals and onboard the ship."

If the technical hurdles could be overcome, the installation cost per vessel would be about $70-750,000 depending on ship size and complexity, rising to $2-3 million if the ship also needs new electrical cargo pumps. The cost per terminal would be $2.5-14 million per berth (or more, if it requires additional infrastructure upgrades).

There is one further factor: the installation timeline for each terminal would be about 14 years, estimated DNV. That puts this option firmly out of reach for compliance with CARB's 2027 deadline.

Capture and control

Boxships in Los Angeles / Long Beach can also avail themselves of "sock on a stack" exhaust gas cleaning solutions, which capture and remediate ship emissions while the vessel is at the pier. Like shore power, however, this isn't an easy option for tankers. A safe and practicable capture system for tankers doesn't currently exist, and it would have to be designed in a way that would not interfere with safety requirements and standards for petroleum terminal operations.

It could be coming, however. A barge-based exhaust gas cleaning system for tankers has recently been designed and is nearing the prototype phase, and it could be ready within about five years. "It is even possible some barge-based systems could be in operation on a few tankers prior to the regulatory deadline," DNV suggested.

The designer of the system, Clean Air Engineering-Maritime (CAEM), has been operating emissions capture equipment in Los Angeles / Long Beach since 2015. The company estimates that construction cost for the first unit would come to about $13 million, and could be available on the right timeline. "We've been doing this for a long time, so we think we can have our first tanker-ready unit on the market by 2025," says Nick Tonsich, president and CEO of CAEM.

that matters most

Get the latest maritime news delivered to your inbox daily.

However, DNV noted that there are currently no industry standards for running an exhaust gas cleaning operation while transferring hazardous liquid cargo. "A common framework anchored in industry regulations or guidelines should be developed, but there is currently no timeline for addressing these gaps, and it is unclear who is responsible for initiating these efforts," DNV noted.

For any potential solution, there is one further issue: society at large is pursuing low-carbon transport, and the shipping industry is following suit. Even if costly infrastructure is built out to abate HFO/VLSFO emissions from tankers, it may not have value in the decades ahead if the industry successfully transitions to low-carbon fuels.