COVID-19: The Most Affected Economies

UNCTAD has published a technical note entitled Global trade impact of the coronavirus (COVID-19) Epidemic, noting the most affected economies.

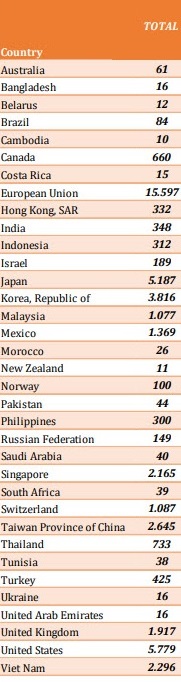

Global effects of China’s slowdown through global value chains ($ million from a two percent reduction of China exports in intermediate inputs)

The table above from the note reports the potential effect of COVID-19 on exports in the most exposed countries to Chinese supply disruptions. Overall, the most impacted economies will be the European Union (machinery, automotive, and chemicals), the U.S. (machinery, automotive, and precision instruments), Japan (machinery and automotive), South Korea (machinery and communication equipment), Taiwan (communication equipment and office machinery) and Vietnam (communication equipment).

Over the last two decades, China has become the world’s largest exporter, but over the last month, it has seen a dramatic reduction in its manufacturing Purchasing Manager’s Index (PMI) to 37.5, its lowest reading since 2004. This drop implies a two percent reduction in output on an annual basis and is a direct consequence of the spread of the coronavirus. Currently, about 20 percent of global trade in manufacturing intermediate products originates in China (up from four percent in 2002).

Source: National Bureau of Statistics of China

So far the epidemic has caused an estimated drop of about $50 billion. The most affected sectors include precision instruments, machinery, automotive and communication equipment. For many companies, the limited use of inventories brought by a lean and just-in-time manufacturing process would result in shortages that will impact their production capabilities and overall exports.

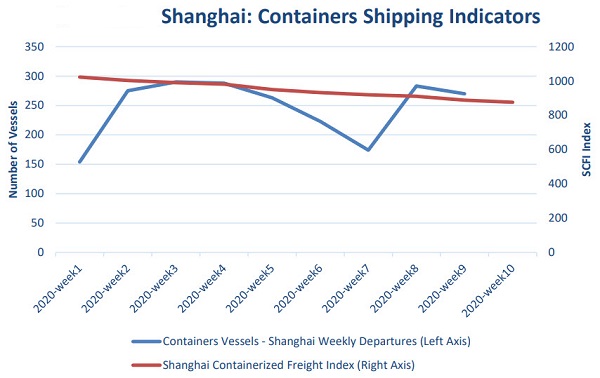

Container vessel departures from Shanghai were substantially lower in the first half of February with an increase in the second half. However, the Shanghai Containerized Freight Index continues its decline indicating excess shipping capacity and lower demand for container vessels.

Source: MarineTraffic global ship tracking intelligence provider and Shanghai Shipping Exchange.

that matters most

Get the latest maritime news delivered to your inbox daily.

Separately, Abudi Zein, CEO of ClipperData, has noted in an UNCTAD article that the slowdown in port calls is occurring worldwide, not just in China. "Shipping companies have been reducing scheduled capacity since about August of 2018 on most trade lanes as trade wars slow global demand for cargo capacity. In the second half of January and early February, this drop accelerated significantly. The centrality of China to the movement of goods around the world explains this: if Chinese ports are not loading or discharging containers, there is no reason to stop at the port where the shipment is supposed to go to or come from. The move towards bigger container ships is another important factor at play: a missed port call now has a more profound impact on available capacity."

Zein says: " The epidemic has yet to run its course, but even after the spread subsides and China starts to return to normal business activity, it will take a long time to unwind the stresses inflicted on the world’s trading system. A return to medium and long-term trends in shipping and trade is unlikely before the second half or even fourth quarter of 2020."