Bulker Values Plummet as BDI Hits 484

On December 15, the benchmark Baltic Dry Index fell to yet another all-time low at 484 points, its lowest level since 1985 and the third record low in a month. The drop tracks manufacturing trends in Asia; market observers say that China will import less iron and coal this year than last, the first annual decline in a decade. The two bulk commodities are the largest carried by tonnage. China is overwhelmingly the world’s largest importer of iron ore and competes with India for the title of largest importer of coal.

“It doesn’t help that Chinese steel production is about to see the most dramatic decline to the lowest in 20 years,” analyst Herman Hildan told media. “Demand growth is collapsing.”

The BDI number is below profitability for engaging in the trade, experts say, leaving owners with unpalatable choices: cold stacking their ships, selling them for fire sale figures, or taking older vessels to the shipbreakers for scrap (at low and falling scrap prices).

The same day, ship market data firm VesselsValue.com released timely numbers on the state of the bulker vessel market. The report suggests that bulker sale prices have tracked the BDI ever downward as demand drops and ship supply stays steady.

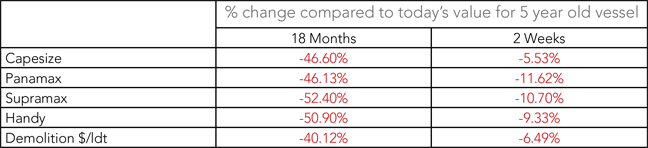

The value of most bulker ships has taken a tremendous hit from the BDI’s fall. VesselsValue.com indicates that all bulk carrier classes, from Handy to Capesize, have lost about half of their value over the past year and a half.

.png)

Data courtesy VesselsValue.com

Handy, Supramax and Panamax ships have seen a decline of about 10 percent in value over the past two weeks alone; Capesize have not fared much better, down about 5 percent in the same period.

Other analysts have confirmed the news, indicating that bulkers have been trading at 0.8 times their book value. The recent merger of COSCO and CSCL included what some described as a “high” sale valuation of barely under book for bulkers owned by subsidiary China Shipping Development, part of the reason for its stock’s good performance upon resumption of trading December 14.

To add to the high global ratio of supply to demand, China Merchants Energy Shipping recently announced a plan to purchase ten newbuild Valemax Very Large Ore Carriers (VLOCs) from domestic Chinese yards. A Valemax, intended for efficient carriage of iron ore from Brazil to China, carries ten times the tonnage of a Handy, at 400,000 dwt. This single buy will add another four million dwt to the global market.

VesselsValue.com’s data also shows that owners face a grim choice in beaching their old ships, as values at the shipbreakers are down by 40 percent over the same period. At low scrap rates, old bulkers may not exit the market, suggesting for some observers that overcapacity may not fall as quickly as it might have in prior downturns.