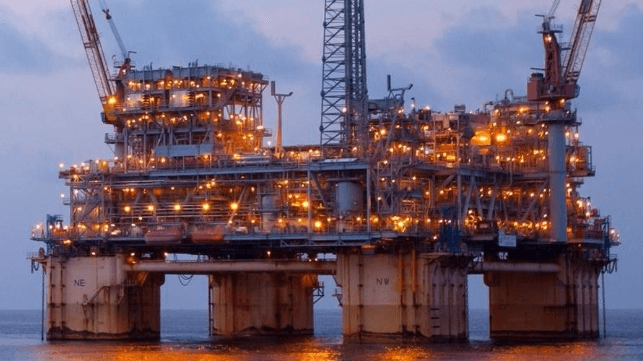

BOEM Holds First Offshore E&P Lease Sale Since 2023

The Department of the Interior has completed its first offshore oil and gas lease auction in two years, handing out more than one million acres of E&P rights in the U.S. Gulf for a total of about $280 million.

The biggest winners of this auction round were Shell, Chevron and BP, the largest players in the Gulf. In all, more than 200 bids were submitted on parcels amounting to just over one percent of the available lease acreage on offer.

“The strong bidding we saw today reflects sustained industry confidence in the long-term potential of the U.S. outer continental shelf and the clear direction of this Administration to expand responsible offshore development,” said Acting Bureau of Ocean Energy Management Director Matt Giacona in a statement.

This year, bidders benefited from a reduced royalty rate for offshore oil and gas production. Under the Biden Administration, during the last lease round, the minimum royalty was about 17 percent. Thanks to the One Big Beautiful Bill Act, the minimum federal share for production from federal waters has been lowered back down to 12.5 percent, a rate last seen for deepwater leases in 2007. The Bureau of Ocean Energy Management said that it offered this low rate in order to encourage more investment and participation.

BP submitted the highest total in bid value at $61 million for 50 lease tracts. Woodside, Chevron and Murphy Oil followed, along with half a dozen other names. Most blocks received just a single bid, but some were bid up, including a parcel that went to Chevron for more than $18 million.

that matters most

Get the latest maritime news delivered to your inbox daily.

"After two years of unnecessary delay in federal offshore leasing, today’s sale marks the beginning of a new generation of opportunity for safe, responsible development in the Gulf," American Petroleum Institute VP of Upstream Policy Holly Hopkins said in a statement.

From here out, Gulf lease auctions will be more frequent because of new language in the 2025 reconciliation bill, which requires more frequent acreage sales. BOEM officials say that each auction will likely be smaller in total bidding volume because of the increased tempo. Oil majors will not feel compelled to buy up parcels in volume during a rare auction window, and will be able to wait for the most convenient timing, BOEM says.