Bentzel: U.S. Should Rethink Reliance on China for Containers

In a report released Wednesday, Commissioner Carl Bentzel of the U.S. Maritime Commission warned that the Chinese government's dominance in container and chassis manufacturing could pose a threat to American shipping interests.

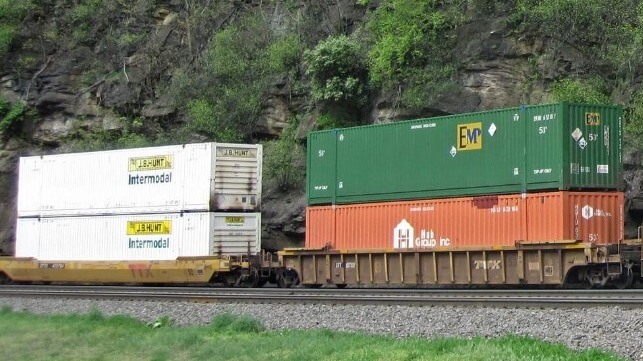

Three Chinese companies control 86 percent of chassis manufacturing and 95 percent of container manufacturing, and all three are owned by the Chinese government, according to Bentzel's report. Chinese factories also make all of the 53-foot intermodal containers commonly used in American trucking and rail transport.

Since these products are essential to modern commerce, Bentzel recommended that the world's shippers should not be solely reliant on Beijing's decisions for a steady supply, and that the U.S. government may wish to consider measures to diversify production.

"The fact that the PRC controls an industry that has a near defacto worldwide monopoly in the production of shipping containers should be deeply concerning," wrote Bentzel. "Imbalances such as the availability of operational equipment (intermodal chassis and containers) can upend the entire intermodal chain."

According to Bentzel, the container shortage that occurred during the COVID-19 cargo surge was partly a result of "market manipulation of Chinese container manufacturers, who jointly decided to reduce production" during the early days of the pandemic.

The Department of Commerce has found that China's main state-owned container and chassis manufacturing firm, CIMC, has received direct subsidy benefits from government entities and state-owned enterprises. This includes subsidized electricity, steel, land use rights and bank loans. In a 2015 investigation, DOC found that CIMC benefited from subsidies of up to 28 percent to manufacture containers bound for the U.S. market.

Industry insiders consulted by Bentzel reported that the Chinese container manufacturers are "aware of their market dominance and have taken coordinated steps [in the past] . . . to suppress manufacture of containers, facilitating price increases." Though container manufacturing has ramped up again, supplies are still scarce and costs are still high, partly because of the production slowdown in 2019-20 and partly because of extreme market demand.

that matters most

Get the latest maritime news delivered to your inbox daily.

In a separate inquiry into the chassis market, the DOC found that American chassis manufacturers were harmed by the import of subsidized Chinese chassis, justifying new protective tariffs on CIMC's products. Those tariffs are now in effect, and with the playing field leveled, more American manufacturers are investing in factory space and are stepping up to compete in the market, Bentzel said. This policy intervention would not apply for containers, but it illustrates the potential for a turnaround.

"Our nation recognizes the need and value of certain types of products like semi-conductors, but in this author’s view, has not yet recognized our nation’s absolute reliance on containerized shipping, and therefore our complete and utter reliance on the lowly shipping container," concluded Bentzel. "Consideration should be given to whether to consider further actions to combat market domination, or to provide economic stimulus to incent the production of U.S. intermodal chassis and containers."