Buying Maritime VSAT for Today and Tomorrow

How to Protect Yourself from Price Gouging and Technological Obsolescence

By Alan Gottlieb, Managing Director, Gottlieb International Group Inc.

Choosing a maritime VSAT system isn’t simple anymore. Changing technologies, different frequencies and a mind-boggling assortment of antenna technologies and other hardware evolving at warp speed have left potential buyers in a state of confusion. Given the complexity of choices, many have just chosen to wait.

Unfortunately, demand for unfettered Internet access is soaring and pressuring maritime executives to act. Driven by the advent of younger, computer-savvy crew that demand Internet access and a host of new, cost-saving software applications that improve operational efficiency aboard ship, waiting is becoming less and less of a viable option. Shipowners, then, need to move ahead and install VSAT and, in doing so, choose systems and contractual agreements flexible enough to allow them to adopt the best emerging technologies. This article is about how to ensure that flexibility.

Choosing the Right Network: Ku-Band vs. Ka-Band vs. Hybrid VSAT Services

Selecting a VSAT service is not easy, and choice of technology and vendor must be based on a comprehensive analysis of current and future IT needs and business objectives.

In terms of radio frequency, there will be three system alternatives that will soon be competing for the VSAT investment dollar: Ku-Band, Ka-Band, and “hybrid” networks that combine both frequencies – all of which vary in the flexibility they provide for future growth and expansion.

Ku-Band

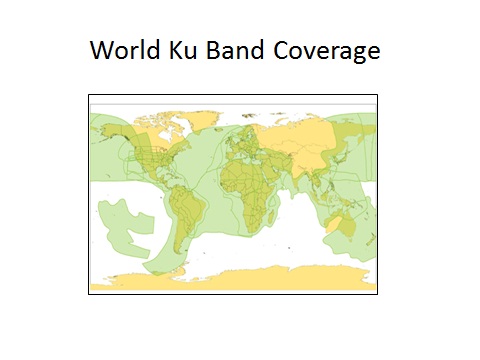

Ku-Band is proven. Installed on 8,000 to 10,000 vessels worldwide, maritime VSAT services based on the Ku-Band frequency are currently the only broadband services deployed. Operating at a frequency above traditional, low-capacity L-Band services such as Fleet Broadband and Iridium, the frequency is popular due to its ability to support high-speed broadband services and still maintain a high degree of resistance to interference by precipitation, a condition known as “rain fade.” Satellite bandwidth based on this frequency is highly competitive and sold by several competing satellite operators including Intelsat, SES and Telesat. It is resold, along with value-added services, by nearly every maritime VSAT vendor.

Ka-Band

Ka-Band systems operate at a higher frequency than Ku-Band. Traditionally deployed in high-power Spot Beam configurations and used over land for high-speed consumer Internet services, they have yet to be proven in maritime environments. Typically, the Ka-Band frequency is much more sensitive to rain fade, making its use in tropical areas problematic. While this effect may be minimal in temperate climates and Ka-Band maritime services could be practical in those locales, Ka-Band users could experience severe disruption of service in the Tropics. Inmarsat will be the first operator to challenge this assumption with the launch of Global Xpress, the first and only global Ka-Band service to be announced.

Ku-Band vs. Ka-Band: Coverage, Capacity and Price

In terms of coverage, Inmarsat’s Global Xpress and Ku-Band services offer similar coverage. While proponents of Ka-Band are quick to point out the ability of such services to deliver superior high-capacity broadband, they fail to mention that lower frequency Ku-Band can also provide the same advantages when deployed in a similar Spot Beam configuration. In fact, the capacity of the new Epic constellation to be launched by Intelsat with Spot Beam Ku technology actually significantly exceeds the capacity of Inmarsat’s Global Xpress across the highly trafficked Great Circle shipping routes of the North Atlantic.

In reality, while the difference in capacity between Intelsat and Inmarsat systems is of interest, it remains a relevant factor only for vessels that consume a very large quantity of bandwidth, such as cruise ships, ferries and offshore service vessels. Container ships, tankers and bulk carriers can easily be served by either existing or future Ku and Ka Band systems. In terms of price, there is also little difference. While it is beyond the scope of this article to delve into provider economics, so far Inmarsat Xpress Link and upgrades to Global Xpress are being offered at prices competitive with existing Ku-Band services.

Hybrid Networks – Ka and Ku-Band Combined

While Inmarsat Global Xpress is the only global Ka-Band network, several regional Ka-Band networks are coming. Telenor’s innovative Thor 7 services will offer coverage from the Middle East across Europe to North America. Ka-Sat will cover most of Europe. Yahsat 1b, NewSat Australia, Eutelsat and Avanti Communications will also provide Middle East coverage, offering mariners with strictly regional European and Middle East sailings a Ka-Band alternative to Global Xpress.

What is interesting is that new “roaming” technologies will enable these regional Ka-Band services to work with global Ku-Band services to effectively create global Ka-Band/Ku-Band hybrid networks. For example, these combination networks could enable vendors to provide pricing based on where a shipowner’s vessels are typically distributed around the globe rather than forcing customers to subscribe to what could be a more expensive global-only service. The technologies required to facilitate hybrid networks are already well under development and consist of dual-band satellite antennas, Ku and Ka-Band switchable antennas, and the use of equivalent modem/hub infrastructure.

In simplest terms, each satellite connection requires a modem at the antenna site and a compatible “hub” or “manager” in the satellite gateway, the teleport that sends and receives the signal from the vessels. Connectivity between the hub and modem on the vessels is proprietary, and most service providers use a hub and modem infrastructure manufactured by iDirect, a company based in Herndon, Virginia.

As far as hybrid antennas are concerned, there are several major manufacturers including Seatel, Intellian and Orbit, all of which have developed and will soon be marketing antennas that are capable of instantly switching between Ku-Band and Ka-Band networks. Those who install systems based on iDirect infrastructure and auto-switchable antennas will be able to enjoy the highest probability of accommodating any technology advances that could occur during the useful life of the equipment provided they negotiate favorable terms with their vendors.

Negotiating Favorable Contract Terms

In order to assure future flexibility and avoid the logistically difficult and costly exercise of de-installing infrastructure, shipowners need to buy or “lease to own” the antennas and below-decks equipment – an arrangement not currently offered by many providers due to the attractive financial advantage of securing ongoing lease payments after the hardware has been depreciated. Consequently, users who do not own their equipment at the expiration of their lease would have no alternative but to de-install the hardware and suffer the inconvenience and added costs of switching back to another provider.

Guidelines

Rapidly changing VSAT technologies and falling bandwidth prices demand that buyers of maritime VSAT systems avoid being “locked in” to obsolete technologies and potentially arbitrary price increases. As many maritime IT managers are not well-acquainted with VSAT services or satellite technology in general, they can be especially vulnerable to persuasion by name-brand vendors and can easily find themselves seduced by low-priced “Trojan Horse-like” offers with onerous contract terms and limited exit options. To avoid such traps, users should follow these guidelines:

First, lease to own or buy your own antennas and below-decks equipment, thereby assuring you have the freedom to easily and economically change bandwidth providers should you be dissatisfied with price escalation or quality of service.

Second, acquire auto-switchable Ku-Band to Ka-Band antennas. This is especially important should you opt for Inmarsat Global Xpress service.

Third, work with vendors that utilize iDirect hub and modem infrastructure as this is the most widely deployed VSAT modem and hub system.

Fourth, review contracts carefully and reject any agreements incorporating “termination of services” penalties.

Finally, it is important to note that requirements for systems differ substantially based on a vessel owner’s individual needs. Not only do requirements differ by vessel type but also by (i) the software programs to be used over a VSAT link, (ii) whether and how much Internet access you wish to provide to your crews, and (iii) what additional value-added services you wish to deploy.

Following these simple guidelines will ensure that you always have the freedom of provider choices, protection from equipment obsolescence, and the ability to control costs. – MarEx

---

Alan Gottlieb is Managing Director of Gottlieb International Group Inc., a recognized global authority on the use of VSAT in maritime and oil & gas VSAT markets. He is the author of numerous articles in Sat News, Digital Ship, and Satellite Market Research and a frequent speaker at industry events.

Alan Gottlieb is Managing Director of Gottlieb International Group Inc., a recognized global authority on the use of VSAT in maritime and oil & gas VSAT markets. He is the author of numerous articles in Sat News, Digital Ship, and Satellite Market Research and a frequent speaker at industry events.