Schedule Reliability Dropped to Record Low at the End of 2021

Schedule reliability among the major container shipping lines hit a new low at the end of 2021 with the expectation being that with continuing port congestion there is unlikely to be a significant improvement. New data from Sea-Intelligence shows that containerships’ ability to maintain published schedules reached the lowest level in the decade the analytics and advisory service has been tracking the industry.

“Schedule reliability dropped again, this time by 1.2 percentage points month over month to 32 percent, the lowest ever global schedule reliability since Sea-Intelligence started the measurement in 2011,” notes Alan Murphy, CEO of Sea-Intelligence. “On a year-over-year level, schedule reliability was 12.5 percentage points lower.”

For all of 2021, schedule reliability across the 34 different trade lanes and more than 60 carriers Sea-Intelligence tracks remained fairly steady never surpassing 40 percent, and for the full year averaging just under 36 percent. The carriers had shown some improvement between March and June but between August and November remained mostly between 33 and 34 percent reliability.

Among the 14 largest carriers, schedule reliability was even lower according to Sea-Intelligence. In December they averaged under 26 percent schedule reliability although it varied widely depending on the route and the portion of the line’s business in Asia. Maersk and Hamburg Sud were over 40 percent while Evergreen showed the lower schedule reliability as just 14 percent. Other Asian-based carriers, including Wan Hia, OOCL, COSCO, and Yang Ming, were all under 20 percent.

“Nine carriers recorded a month over month improvement in schedule reliability,” notes Murphy. “While no carrier recorded a year over year improvement in schedule reliability, all but four carriers recording double-digit year over year declines.”

The average delay for late vessel arrivals increased to 7.33 days in December, the fifth consecutive month with the delay figure above 7 days. The yearly average for the delays has been increasing each year since 2018. The data shows it rose from just under 4 days to 6.8 days average delay for late-arriving vessels.

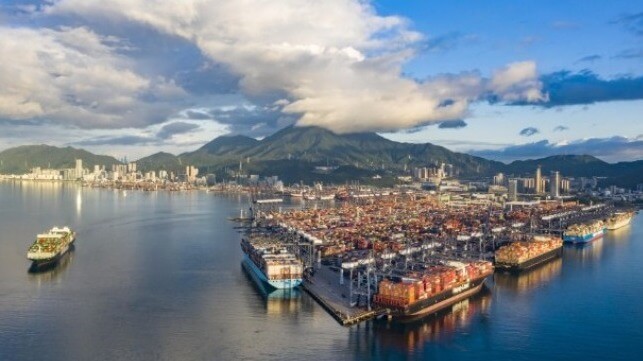

Congestion at many of the world’s ports has had a domino effect on the schedules of the major carriers. The lines have been forced in many cases to simply adjust schedules to reflect the current circumstances. In Asia at the busiest ports where many of the export containers originate improvements in the velocity of turning around arriving containers improved but they can not overcome delayed arrivals of ships.

Hutchison Ports for example advised in mid-January that the Yantian International Container was nearly full backlogged with export boxes waiting for ships to arrive. In the first weeks of January 2022, Hutchison says vessels scheduled to arrive at Yantian were on average delayed over 170 hours with an on-time ratio of less than 20 percent.

that matters most

Get the latest maritime news delivered to your inbox daily.

At the other end of the supply chain, the Marine Exchange for Southern California reports that there are 92 containerships scheduled to arrive at the twin ports. Because all the California ports have asked vessels to slow steam and wait further offshore, it is harder to determine the actual number of days vessels are waiting for terminal space. The Port of Los Angeles’ Signal report on inbound containers for example shows the average time awaiting berth, based on a 30-day average, is now at 17.9 days.

Shippers are expecting that near-term pressures will continue to impact the arrival of their cargoes. In a survey conducted by technology logistics company Container xChange over two-thirds of respondents said they expect Chinese New Year factory closures to further disrupt container shipping supply chains. Most respondents expect that the February Lunar New Year holidays will result in delayed transit times and reduced availability of containers.