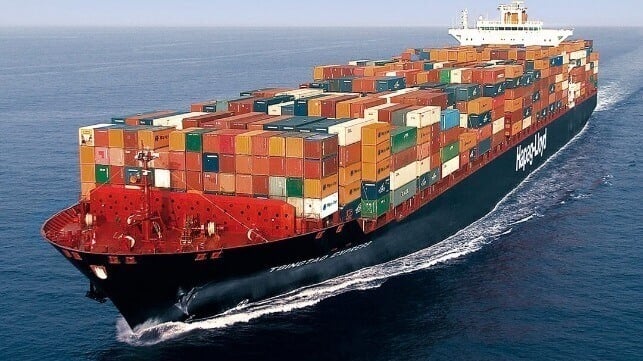

Hapag's Preliminary Results Show Financial Strength of Boxships in 2024

Hapag-Lloyd released preliminary financial results for 2024 coming in at the top of the profitability forecasts the company had already revised upward in October 2024. As the first of the major carriers to release results it also gives a glimpse into the financial strength of the sector despite what was seen as a very challenging year.

The preliminary figures show an anticipated quadrupling of earnings in the fourth quarter from a nearly breakeven level in 2023 to a profit of $1.4 billion in the December quarter of 2024. For the full year, the company is anticipating a slight year-over-year increase in profitability to $5 billion (EBITDA). Revenues for the full year are projected to be up more than 8 percent to $20.7 billion.

“The increases can primarily be attributed to higher transport volumes combined with a stable average freight rate, which stood at $1,492/TEU and thereby remained at the prior-year level (2023: $1,500/TEU),” said Hapag in its release. It reported that revenues rose, “particularly owing to stronger demand for container transports. Transport volumes increased by roughly 5 percent, to 12.5 million TEU – despite the rerouting of ships via the Cape of Good Hope due to the security situation in the Red Sea and the associated longer voyage times.”

In October 2024, Hapag reported that based on recent higher-than-expected demand and improved freight rates – and despite increased transport expenses – it was increasing its forecast for the year to EBITDA in the range of $4.6 to $5.0 billion. It however had warned, “Given the highly volatile development of freight rates and persistent major geopolitical challenges, this forecast remains subject to uncertainty.”

The company said it would announce its 2024 results on March 20. At the same time, it will comment on the outlook for the year ahead and release its projections.

Analysts have speculated that the industry could face strong challenges in 2025 as freight rates are already under pressure and potentially could collapse when the Red Sea routes are restored. Excess capacity that was helping to offset the longer transit times around Africa would flood back into the market with the Red Sea routes restored while there are also fears about fundamental changes in trade patterns if Donald Trump proceeds with his threats to impose tariffs.

Investors, however, today drove the price of Hapag-Lloyd’s shares up by nearly 1.5 percent while others such as Maersk and NYK were up nearly 2 percent. Share prices for the container segment were under pressure for all of 2024 as investors heard repeated cautions from industry executives over the volatility in the sector.