Synchronization Across Maritime Value Chains Can Ease Inflation

[By Mikael Lind, Wolfgang Lehmacher, Jan Hoffmann, Lars Jensen, Theo Notteboom, Torbjörn Rydbergh, Peter Sand, Sandra Haraldson, Rachael White, Hanane Becha and Patrik Berglund]

Value chain disruptions are increasingly blamed for inflationary tendencies, although there are multiple other factors that can drive consumer prices up. Since the summer of 2020, continuous challenges caused by tighter capacity of boxes, ships, port infrastructure and hinterland transport have caused far reaching impacts on supply chains and national economies. Continuous disruptions are increasing transportation and logistics costs along chains with record high ocean freight rates as one of the results. Reports indicate that value chain actors tend to “optimize” for themselves, which only exacerbates the issues at system level. This contribution addresses the need for visibility and transparency in vessel dynamics across the global shipping network to cope better with value chain disruptions. Data sharing and time slots empower different parties through more informed decisions, flexible practices and plans. The slot management concept ensures an expansion of the just-in-time (JIT) vessel arrival approach as well as enabling synchronization across the global intermodal supply chain that consist of a stakeholder network of consumers, retailers, logistics providers and hubs, carriers, producers, manufacturers etc., as well as infrastructure, equipment, resources, and processes.

The choked maritime value chain drives inflation

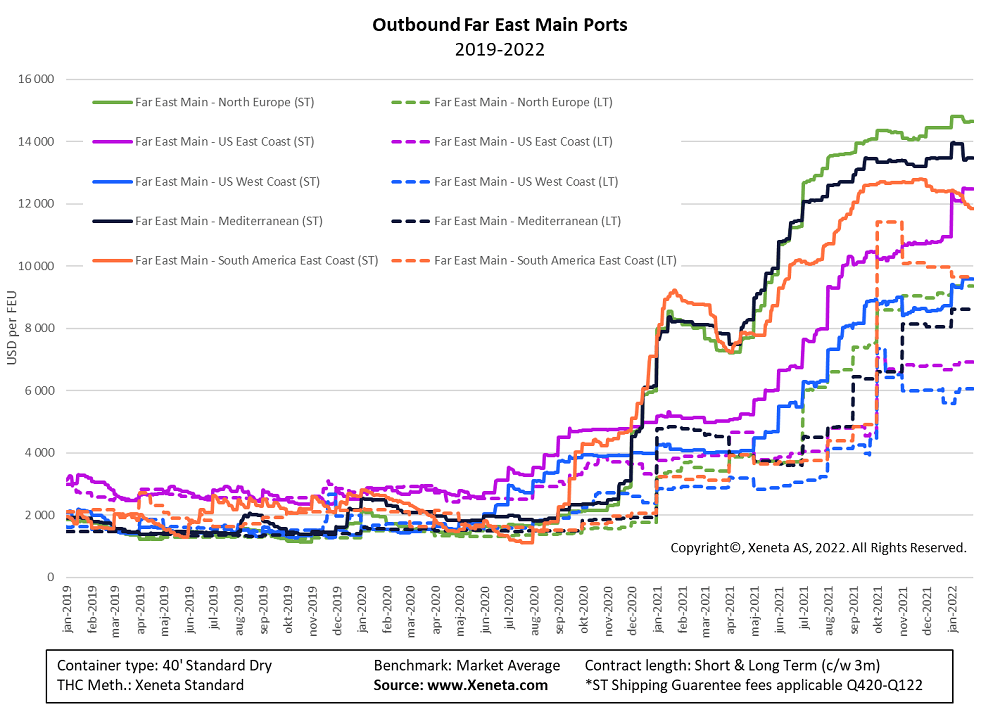

Today’s intermodal supply chains are increasingly ‘disjointed’ Logistics hubs. In particular ports, are insufficiently synchronized with ship journeys on the one hand and multimodal transport capacity in the hinterland on the other. Record high ocean freight rates (figure 1) and rising costs of landside transport, such as road, rail, barges, as well as airfreight moves are a clear invitation to reassess current practices in goods flow management. The historically high freight rates combined with port congestion and other surcharges, plus rising dwell time charges in ports’ have led on some trade routes to a fivefold or even tenfold increase in transportation costs compared to pre-pandemic levels, thereby contributing to rising inflation.

Figure 1: Development of long- and short-term freight rates for a 40’ container on selected trades outbound Far East main ports during January 1st 2019 to January 27th 2022

For a forty-foot container unit (FEU) filled with higher value products such as sport shoes or mid-priced clothing with a combined retail value of USD 1 million, ocean and port costs on the Far East-North Europe trade now represent 1.5-2% of shelf value. This used to be less than 0.3%. UNCTAD’s Review of Maritime Transport 2021[i] estimates that the high levels of freight rates have led to a 1.5% global increase in consumer prices. The Kansas City Federal Reserve Bank estimates that a 15% increase in shipping costs leads to a 0.10 percentage point increase in core inflation after one year.[ii] According to UNCTAD, Small Island Developing States are affected 5 times more strongly than the average increase, with a consumer price hike of 7.5%.

For voluminous low value products of USD 50,000 per FEU, such as low-end assembled furniture, the share of ocean and port costs in total retail value has mushroomed from 5-6% in 2019 to a hefty 30-40% now. This has pushed retailers to consider a significant upward shelf price correction. High value products are also affected, given that during the process of their production inputs are transported numerous times, and at each stage of the value chain higher transport costs add to the total production costs.

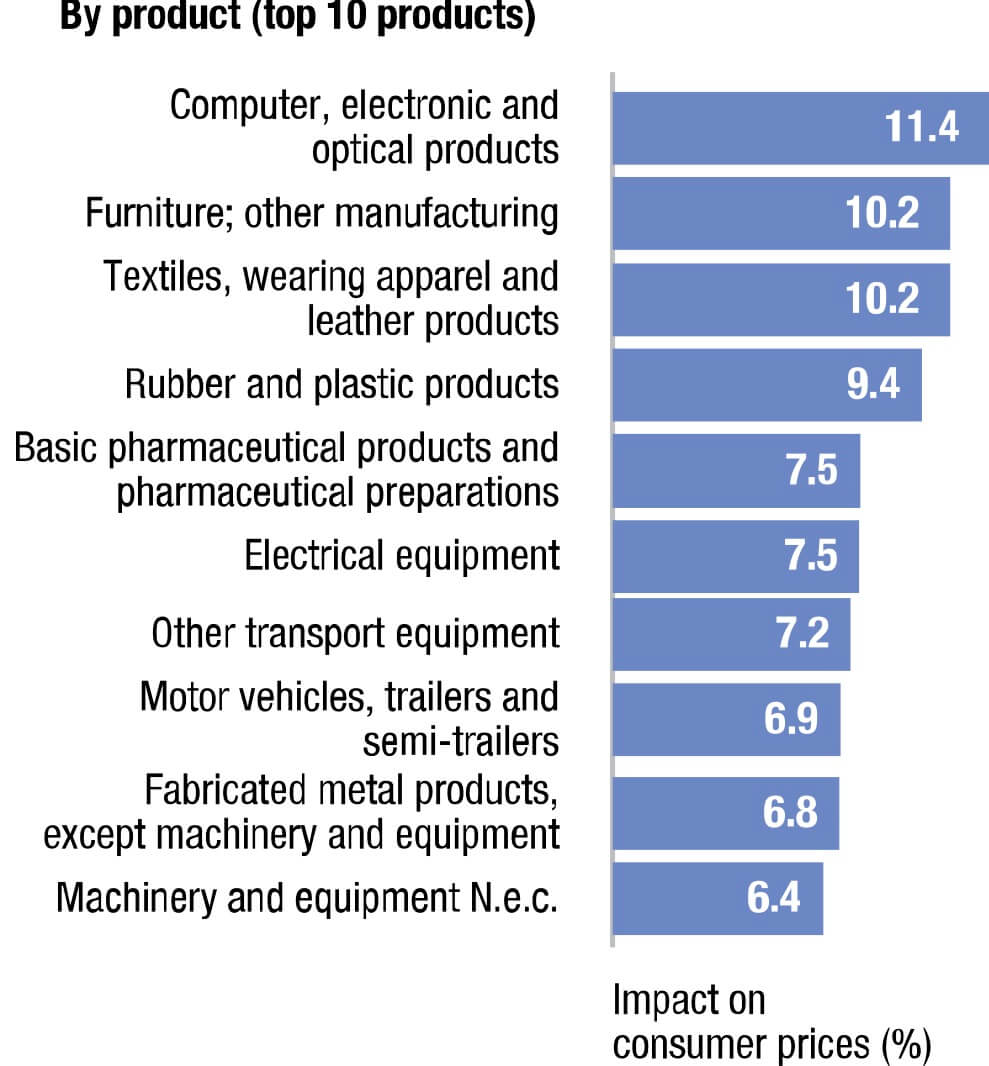

As UNCTAD’s Review of Maritime Transport shows, there are two types of products most strongly affected by the high freight rates:

- Relatively low value goods, such as furniture

- Products that involve a deep supply chain, with several stages where transport is purchased (Figure 2).

Figure 2: Simulated impacts of the container freight rate surge on consumer price levels, by product (UNCTAD Review of Maritime Transport 2021)

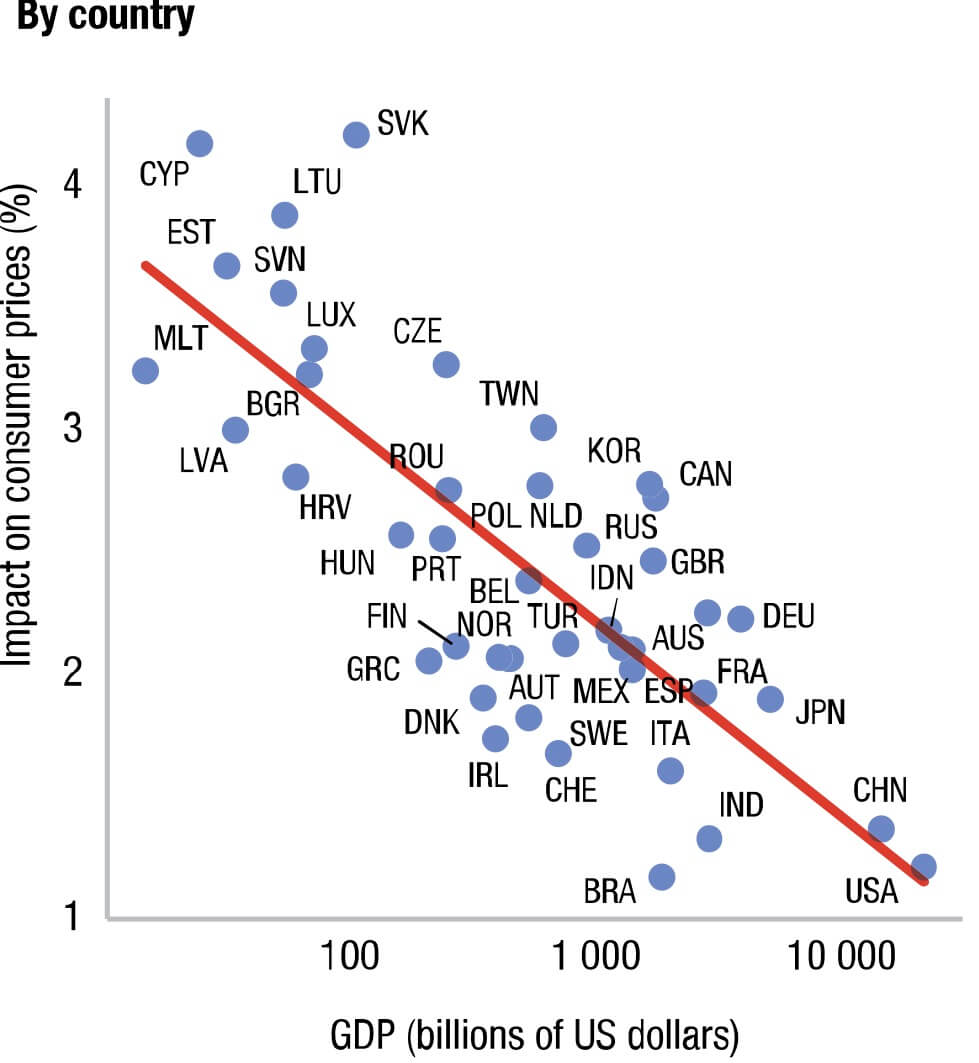

As regards differences between countries, it is interesting to note the importance of economies of scale. Smaller economies are affected more strongly by the surge in freight rates than larger nations (Figure 3).

Figure 3: Simulated impacts of the container freight rate surge on consumer price levels, by country (UNCTAD Review of Maritime Transport 2021)

The severe and unpredictable delays of cargo lead to concerns amongst consumers that goods they wish to buy may not be available or run out of stock. This increases consumers' willingness to buy goods at full retail prices rather than waiting for them to go on sale at a later stage. This also contributes to inflation. Just the narrative of broken supply chains and exploding freight rates may raise the consumers’ acceptance of higher retail prices. Supply chains are complex, and the average consumer lacks a detailed understanding of the impact of increasing freight costs on specific goods.

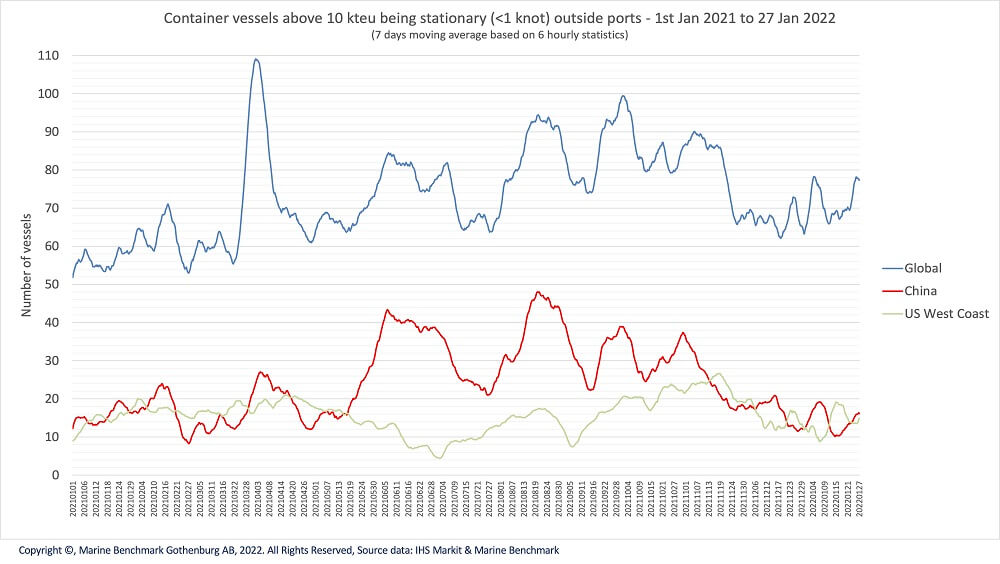

The congested port is a global phenomenon

Many ports across the globe are facing extreme disruptions (see figure 4). These disruptions are also due to the decisions and behavior of various supply chain actors. Reports indicate that some shippers are not picking up containers at the terminals, are holding empty containers very long or are treating ships waiting outside the port as ‘convenient’ storage facilities for their cargo. Shippers, carriers and ports are optimizing their part of the chain in their best interest. While understandable, this may not be optional for the overall system.

Figure 4: Number of container ships being stationary outside ports globally and outside China and U.S. West Coast ports between 1 January 2021 and 27 January 2022

The current port congestion reveals the shortcomings in infrastructure and resource capabilities at both the ship-shore and port-hinterland interfaces. Manning availability at ports and in inland transport have been questioned. Hinterland transport capacity and infrastructure is seen as insufficient, with driver shortages appearing as a bigger issue than tight supply of chassis and trucks. But the situation is more complex than a simple capacity shortage of ships, containers, trailers, trains, and vehicles, as the reasons for constrained port infrastructure are many, including Covid-driven temporary suspensions of port operations (mainly in China), factory closures creating supply shocks and stimulus packages fueling consumer demand, particularly in the US, at a time when disposal income has not been going to leisure activities such as eating out, travel etc.

Reducing demand or expanding supply would deblock the chokepoints and bring a downward pressure on rates. But this will probably not happen before 2023/2024 when new ships are put into service, supply chain backlogs have been cleared and additional semiconductor capacity is established. The driver shortage, however, may be here to stay until at some point, autonomous vehicles may bring relief combined also with a more intense use of rail and inland barge transport.

Basically, the maritime industry has two options to reach a better normal. First, it can increase the pool of equipment and expand capacity which obviously takes time. Alternatively, the sector can introduce measures to handle more volume with the existing capacity which should reap results in the shorter term. In the longer term, we expect a combination of both solutions to materialize.

Slot management for better synchronization

Adopting the concept of slot management can ease current pressures on costs and prices. As is the case for other practices grounded in the appointment economy,[iii] the slot time is the unit of analysis, allowing us to move beyond coordination based on physical arrival and the principles of first-come, first-served. A slot time provides each involved actor, on a fair and equal basis, with the opportunity to plan ahead, regularly monitor progress and coordinate their activities towards the common goal of satisfactory, predictable and timely delivery. At the same time, supply chain visibility for all those that need to know is improved, meaning less ‘nasty surprises’ necessitating adjustments at short or no notice.

We see opportunities in expanding the model of JIT shipping to cover a range of typical scenarios by delimiting arrival and departure slots. In this context, predictions of departure are important as these provide an understanding of when the infrastructure being used for one ship can be made available for another. Such expansion would utilize the slot time, incorporating both arrival and departure time, as the common denominator which involved actors could coordinate in relation to when a disruption occurs at port of origin or at port of destination. The driver would be to enhance capacity utilization of ships and port infrastructure and cater for a high environmental sustainability.

Slot times as a foundation for maritime supply chain visibility allow cargo shippers to receive up-to-date information about possible delays and help shipping companies to make well-founded decisions on how to best serve their clients. The optimal speed and route to destination are decisions to be made by the shipping company and a ship’s captain based on the timing and possibilities that a port offers to serve the ship

Introducing slot time management will change the relationship between container shipping companies and ports. Contracts will need to be rethought and operating practices redesigned;[iv] information systems aligned and protocols harmonized. The solutions and bodies to drive harmonization exist today, at least partially. It is the belief or otherwise in the benefits of data sharing and data usage that will determine whether the maritime industry will move into this direction.

Informed by Maritime Informatics (www.maritimeinformatics.org), the maritime sector can take important steps to establish the foundations for enhanced predictability serving all parties equally rather than sub-optimized for one particular group.

Shipping costs rarely figure in economists' inflation and GDP calculations and most companies are more concerned about raw materials and labor costs than transportation. That might change as the current surge in container freight rates could increase global import prices by 11% and consumer price levels by 1.5% between now and 2023[v]. The longer the rates stay at a high level the higher the risk that they will have a lasting effect on prices. However, despite the high rates and the severe operational disruption all the five largest U.S. container-importers with public accounts have shown strong profit improvements in 2021, clearly sending a message to the carriers that their largest customers can afford rates in the longer term which are markedly higher than the pre-pandemic reality.

The surge in container freight rates is the result of the mismatch between soaring demand and reduced supply capacity, labor and equipment shortages and continued on-and-off Covid-19 measures and restrictions imposed by governments. Shipping and logistics costs are expected to continue to rise and fuel inflation in 2022. Some industry insiders say high freight rates could even stretch into 2023. It's likely that logistics will remain more expensive going forward, and not return to the low pre-pandemic level. Resilience built into future supply chains comes at a price. Any move away from global just-in-time logistics towards increased buffer stocks has a price tag. Will shippers change their behaviors, after experiencing a significantly disrupted market for one and a half years? Most likely yes.

Although slot management is not the silver bullet to solve all maritime network problems, its data sharing aspect will bring beyond a potential relief on costs and prices and more situational awareness which can drive behavioral changes by the different stakeholder groups that may contribute to a more optimized and balanced system overall. Introducing slot management in the maritime domain would pave the way to link all slots of arrivals and departures along the end-to-end multi-modal supply chain providing foundations for synchronized and sustainable supply chains (for more information on slot management [vi]).

About the authors

Mikael Lind is the world’s first Professor of Maritime Informatics and is engaged at Chalmers, Sweden, and is also Senior Strategic Research Advisor at Research Institutes of Sweden (RISE). He serves as an expert for World Economic Forum, Europe’s Digital Transport Logistic Forum (DTLF), and UN/CEFACT. He is the co-editor of the first book of maritime informatics recently published by Springer.

Wolfgang Lehmacher is operating partner at Anchor Group. The former head of supply chain and transport industries at the World Economic Forum and President and CEO Emeritus of GeoPost Intercontinental is advisory board member of The Logistics and Supply Chain Management Society, ambassador of The European Freight and Logistics Leaders' Forum, and founding member of the think tanks Logistikweisen and NEXST.

Jan Hoffmann is Head of the Trade Logistics Branch of UNCTAD, leading the organization’s work on the Review of Maritime Transport, the Liner Shipping Connectivity Index, and the Maritime Country Profiles. Previous positions include ECLAC, IMO, University of Hamburg, and Hoffmann Shipping. Past president of IAME, Jan is member of the board of various associations and academic journals.

Lars Jensen is a leading analyst in the container shipping sector, having worked 20 years in the field of predicting short and long-term trends, initially as Chief Analyst for Maersk and the past decade as an independent advisor and consultant in Vespucci Maritime (formerly known as SeaIntelligence Consulting).

Theo Notteboom is a maritime and port economist. He is Chair Professor at the Maritime Institute of Ghent University and Professor at Antwerp Maritime Academy and University of Antwerp. He also is Visiting Research Professor at Shanghai Maritime University. He is co-director of Porteconomics.eu, member of the Risk and Resilience Committee of International Association of Ports and Harbors (IAPH) and honorary president of the International Association of Maritime Economists (IAME).

Torbjörn Rydbergh is founder and Managing Director of Marine Benchmark and has a M. Sc in Naval Architecture from Chalmers and has been in the shipping and car industry for the last 25 years. He has worked for IHS Markit, Lloyd’s Register, and Volvo Cars among others.

Peter Sand is Xeneta’s Chief Analyst. Heading a team that delivers expert insights on container shipping and air cargo industries - from a logistics perspective. They support the fright rate benchmarking offering by giving decision-supportive intelligence to customer. Focus is on the essential drivers, demand and supply - and obviously the freight rates that impact us all.

Sandra Haraldson is Senior Researcher at Research Institutes of Sweden (RISE) and has driven several initiatives on digital collaboration, multi-business innovation, and sustainable transport hubs, such asthe concept of Collaborative Decision Making (e.g. PortCDM, StationCDM, YardCDM) enabling parties in transport ecosystems to become coordinated and synchronised by digital data sharing.

Rachael White is Managing Director of Cool Logistics Resources, CEO of Next Level Information, Content Consultant at TOC Events Worldwide and a Member of Independent Port Consultants. She has spent the last 35 years in the maritime trade logistics world, designing, convening and chairing industry conferences, associations and communities and advising companies on industry trends

Dr. Hanane Becha, Senior Innovation and Standards Advisor, is the UN/CEFACT Vice Chair, Transport & Logistics and the Lead of the UN/CEFACT Cross Industry Supply Chain Track and Trace Project. She initiated and led the first Global Smart Container standards at the UN/CEFACT, and she is actively involved in many standards organisations including DCSA, SMDG, and IATA.

Patrik Berglund is the CEO and Co-Founder of Xeneta, the leading ocean and air freight rate benchmarking and market analytics platform. Berglund possesses a passion for modernizing logistics procurement and overall supply chain processes. He has in-depth logistics and transportation experience from several years at Kuehne + Nagel in various roles. Berglund was the 2016 recipient of the prestigious Lloyd's List Next Generation in Shipping award.

References:

[i] https://unctad.org/system/files/official-document/rmt2021_en_0.pdf

[ii] https://www.kansascityfed.org/research/economic-bulletin/rise-international-shipping-costs-affect-us-inflation-2016/

[iii] https://applied.economist.com/articles/welcome-to-the-appointment-economy

[iv] Lind M., Becha H., Simha A., Larsen S. E., Ben-Amram E., Marchand D. (2020) The maritime ecosystem needs ecosystem innovation to avoid “paving the cow paths”, The Maritime Executive, 9/12-2020 (https://www.maritime-executive.com/editorials/maritime-ecosystem-needs-innovation-to-avoid-paving-the-cow)

that matters most

Get the latest maritime news delivered to your inbox daily.

[v] https://unctad.org/system/files/official-document/rmt2021_en_0.pdf

[vi] https://maritimeinformatics.org/wp-content/uploads/2022/01/An-Expanded-JIT-Approach.pdf

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.