Invasion of Ukraine Caused Steep Drop in Black Sea Container Traffic

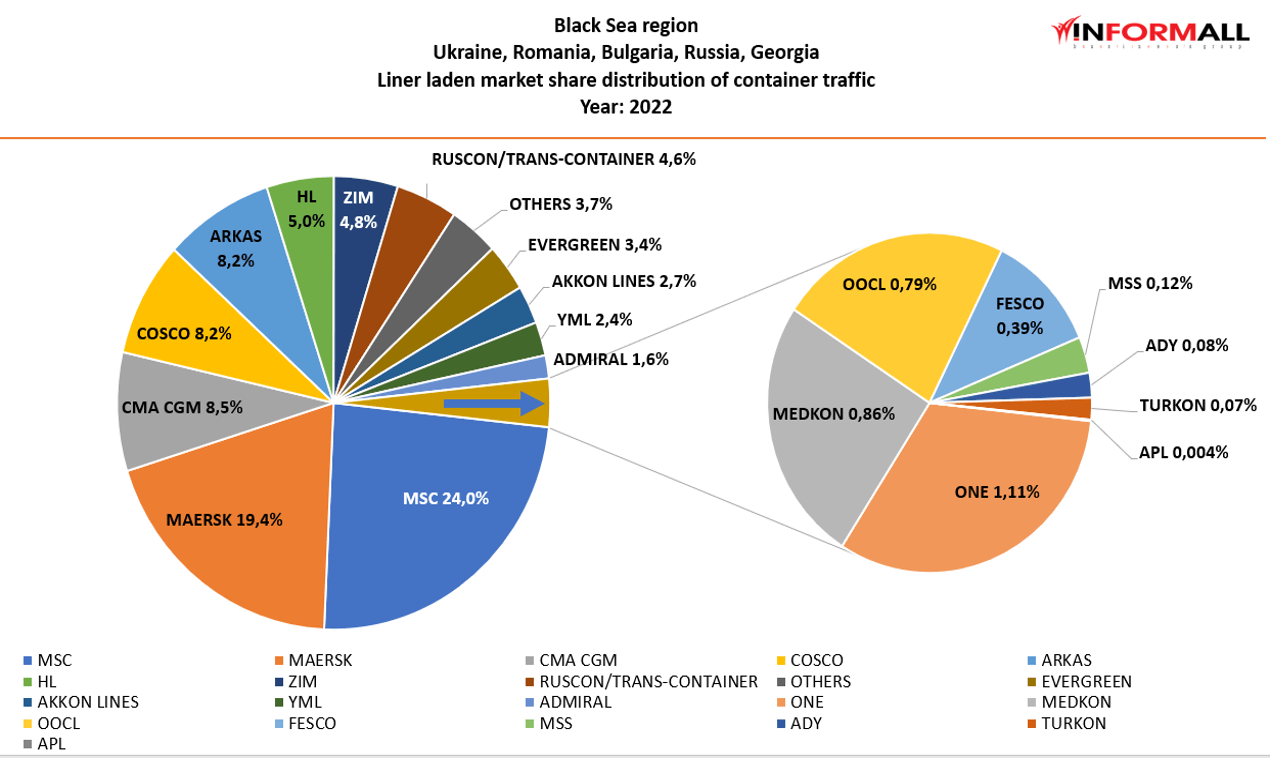

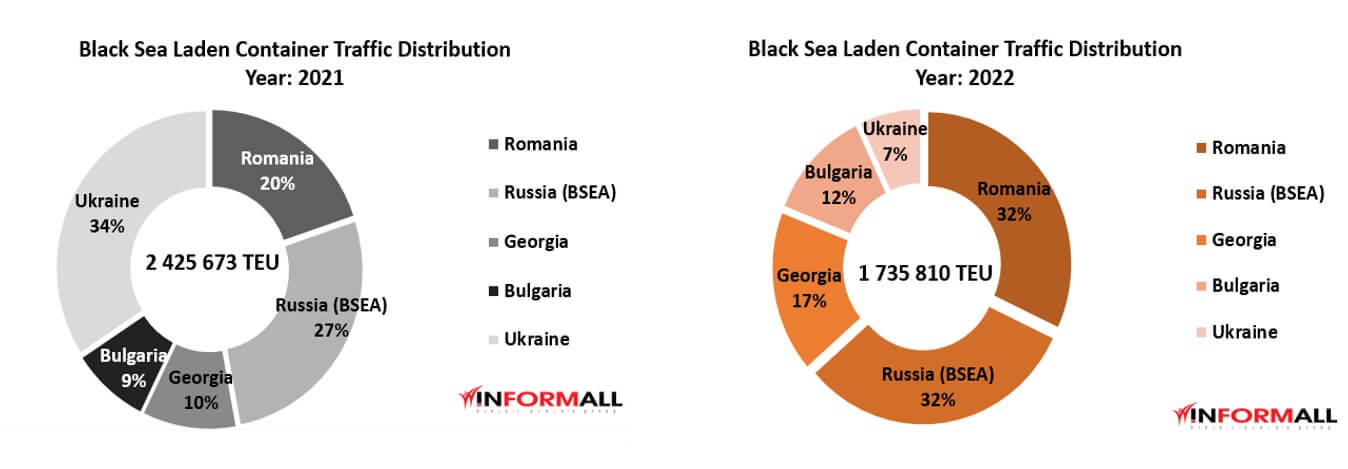

The Black Sea region has witnessed a considerable decline in its market volumes, with the ongoing Russian war in Ukraine resulting in a sharp drop in laden volumes by 28.4 percent (almost 690,000 TEU) in 2022. As per Informall BG's latest data, the region's laden import volumes fell by 25 percent, while laden export traffic declined by a staggering 33 percent. Although total regional turnover substantially decreased, the container ports of Romania and Georgia have seen laden volume growing since the beginning of Russian war.

The sharp drop in laden volumes in the Black Sea region is a stark reminder of the devastating impact of the Russian war on trade and commerce. It highlights the need for a swift and decisive resolution to the continuing crisis, along with measures to mitigate the impact of the ongoing conflict on businesses and stakeholders in the whole region.

Ukraine

Ukraine

The Ukrainian market, which has been one of the top destinations for container shipping among Black Sea countries with an annual turnover of over one million TEU, has experienced a significant setback due to the continuous military blockade of Ukrainian container ports by Russia. Since February 2022, Ukrainian container terminals in the Odesa region have been cut off from liner services, and prospects for their reopening in the near future remain bleak.

Despite the promising development of the recent "Grain Deal" brokered by Turkey, which suggests that direct container shipping via Ukrainian container terminals can be reinstated, Ukrainian expert team of Informall BG warns that more concerted efforts are required to fully leverage the potential of this deal.

The proposed “Black Sea Container Initiative”, put forth by a team of Ukrainian consultants, aims to expand on the "Grain Deal" to enable container shipping directly to Ukraine through one of Turkey's container hubs. This would allow for restoration of export of various food products in containers including meat, fruits and vegetables, grains and byproducts, vegetable oil and other foodstuffs. These products accounted for over 100,000 TEU in 2021, prior the war. Nonetheless, the experts emphasize that achieving the benefits of these initiatives for the restoration of direct liner service to Ukraine hinges on the exercise of political will and decisive actions, which have yet to be fully realized by the parties of the deal.

‘Black Sea Container Initiative’ model.

"Imagine an actively trading country once handling an average of 69,000 TEU of laden volume each month (2021), now is limited to 10,000 – 11,000 TEU per month estimated to be moving through foreign ports - mainly ports of Romania and Poland. This is the devastating impact of the Russian blockade on Ukrainian container terminals since the 2022 invasion," comments Daniil Melnychenko, data analyst at Informall BG. "Just when the market trends were indicating a quick recovery from the COVID-19 crisis and further growth in 2022, the invasion shattered any hopes of progress. The cost of delivering an ocean container to Ukraine has grown by up to 25 percent and delivery time went up by 300 percent compared to the previous year, leaving the country's ability to address nationwide humanitarian needs seriously compromised."

Ukraine – Danube River

Liner operators seeking to deliver containers directly to Ukraine avoiding overland transit currently have two options: the Ukrainian ports of Reni and Izmail on the Danube River. Despite not being designed to handle ocean containers, the port operators in cooperation with local transport stakeholders have adapted the existing infrastructure and developed logistics models to meet the demand for container shipping in the country.

In the end of July 2022, Turkey-based AKKON Line became the first liner operator to offer its own vessel, CHONA (IMO:9201877), on the service connecting Turkey with the Ukrainian port of Izmail. In March 2023, Maersk announced the official launch of a new container service that provides a direct shipping route to Ukraine via the Danube River port of Reni. This service has been in the testing phase since earlier in 2022, and it is being operated in collaboration with third-party transport operators. By leveraging the capacity of third-party vessels and barges on the river, this service offers a broader range of destinations beyond Reni, once containers are transshipped at the Constanta port. Both alternative logistics solution offers much-needed relief from overland transit trucking from Romania to Ukraine, which was previously the primary option.

Prior efforts to incorporate barges into the container shipping operations along the Danube River have proven to be suboptimal in comparison to utilizing smaller cellular or general cargo ships able to navigate the Black Sea-Danube canals (Bystre and Sulina). Moreover, the launch of the Grain Corridor reduced long-lasting congestions at the canals, resulting in faster container turnover on the route. Although river-sea going vessels offer a more efficient logistical solution for connecting Constanta with Reni and Izmail via the canals, they are still constrained by the seasonal fluctuations in river draft.

The container shipping industry in Ukraine is currently grappling with the most challenging crises in its history. In contrast, the trucking industry is experiencing a surge in growth and profitability. The shift towards trucking as the preferred mode of transportation to/from Ukraine has resulted in a significant uptick in freight rates and a tighter market capacity. Moreover, the unavailability of international liner services has forced many stakeholders in the shipping industry to look towards the European Union market as one of the few viable options for Ukrainian exporters and importers," says Vassiliy Vesselovski CEO of Informall BG. "The growth of the trucking industry in Ukraine and the exploration of alternative solutions to currently blocked seaports offer hope for a brighter future. By taking proactive steps to adapt and innovate, the transport industry of Ukraine can navigate through these challenging times and emerge stronger and more resilient."

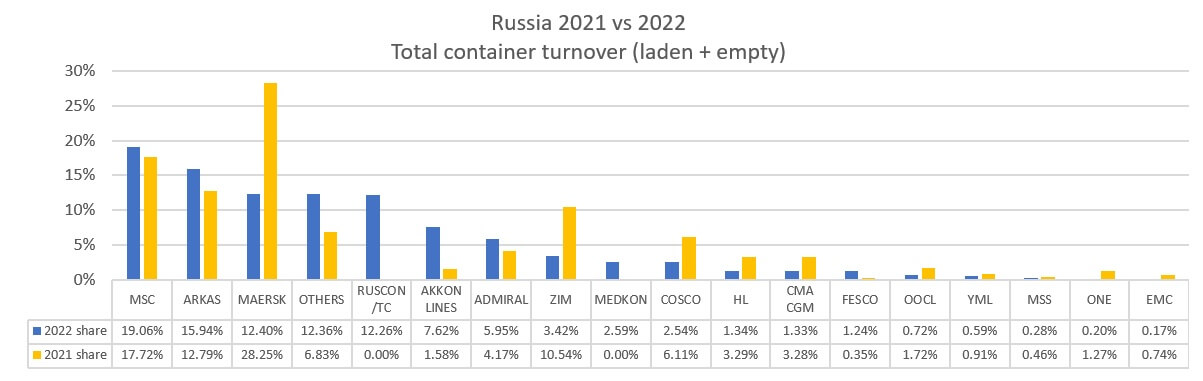

Russia

The Russian container market underwent substantial changes, with various players in the industry navigating the challenges and opportunities presented by the geopolitical landscape in 2022. In 2022, the Russian key container port of Novorossiysk, situated in the Black Sea, saw a notable decrease of 17 percent in volume, with a total of 548,000 TEU of laden containers being handled during 2022, in contrast to the previous year's 660,000 TEU figure. This dip is largely attributed to the international sanctions imposed on Russia in response to its brutal invasion of Ukraine, which prompted most global shipping lines to withdraw from the Russian market. The only exception was MSC, which, with its international service network, managed to handle 15 percent of total Russian shipments on the Black Sea in 2022 and continue its operation in 2023.

The reduction in the number of global liner services, coupled with limited access to the European market, resulted in a 30 percent decline in Russian exports. Conversely, imports from China, India, and Turkey continued to flow steadily to the country, leading to only a six percent decline in volume on the Black Sea. Turkish and Chinese liner carriers, as well as newly established Russian liner operators, were among the beneficiaries of the global liner carriers' exit from Russia in 2022.

The reduction in the number of global liner services, coupled with limited access to the European market, resulted in a 30 percent decline in Russian exports. Conversely, imports from China, India, and Turkey continued to flow steadily to the country, leading to only a six percent decline in volume on the Black Sea. Turkish and Chinese liner carriers, as well as newly established Russian liner operators, were among the beneficiaries of the global liner carriers' exit from Russia in 2022.

This situation created ample opportunities for growth for Russian intermodal operators like Ruscon, Trans-Container, and Fesco, whose cumulative market share in Novorossiysk's total laden turnover reached 17 percent in 2022. Regional Turkish carriers such as Arkas, Admiral, Medkon, and Akkon also experienced a surge in their cumulative market share, which grew to 30 percent in total. Despite the continued Russian war on Ukraine and adverse impact of international sanctions the market continued to evolve, with emerging players and shifting market dynamics for Russia on the Black Sea.

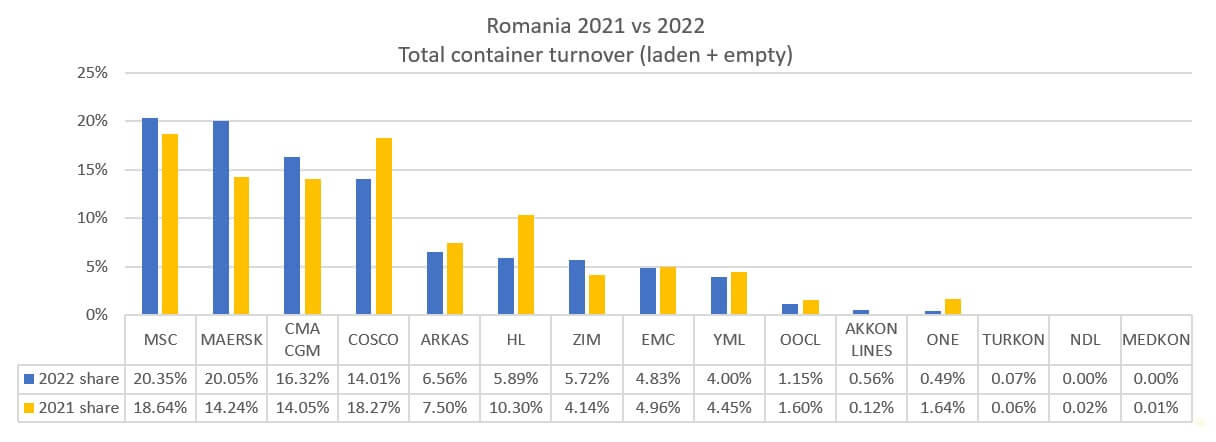

Romania

The container industry in Romania experienced a remarkable growth in 2022, with several international investment memorandums signed throughout the year to develop the port infrastructure of Constanta. Constanta is currently a vital container hub for Ukrainian import and export traffic, and this traffic significantly contributed to a 15.5 percent increase in the Romanian market share in the Black Sea region 2022. According to the Black Sea container market report by Informall BG, the Port of Constanta handled 75,000 more TEUs in 2022 than the previous year resulting in nearly 555,000 TEU. Some of this volume also belongs to neighboring Moldova, which has shifted its container traffic to the Port of Constanta due to the Russian blockade of Ukrainian container terminals.

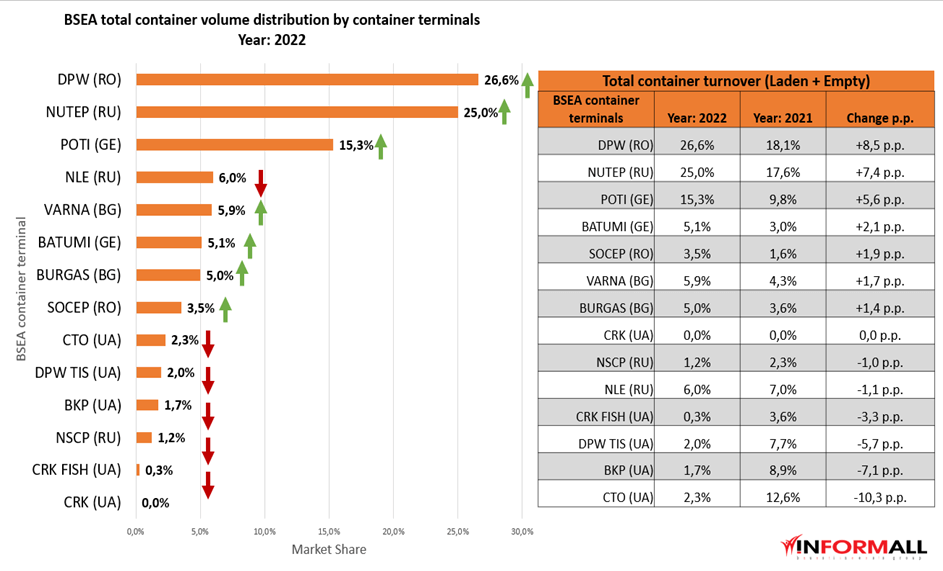

It is noteworthy that the DP World container terminal in Constanta took first place by total container turnover among the Black Sea terminals, handling 26.6 percent of the total regional container traffic in 2022. This achievement is an indication of the increasing significance of the Port of Constanta as a major hub for container shipping in the region and beyond.

It is noteworthy that the DP World container terminal in Constanta took first place by total container turnover among the Black Sea terminals, handling 26.6 percent of the total regional container traffic in 2022. This achievement is an indication of the increasing significance of the Port of Constanta as a major hub for container shipping in the region and beyond.

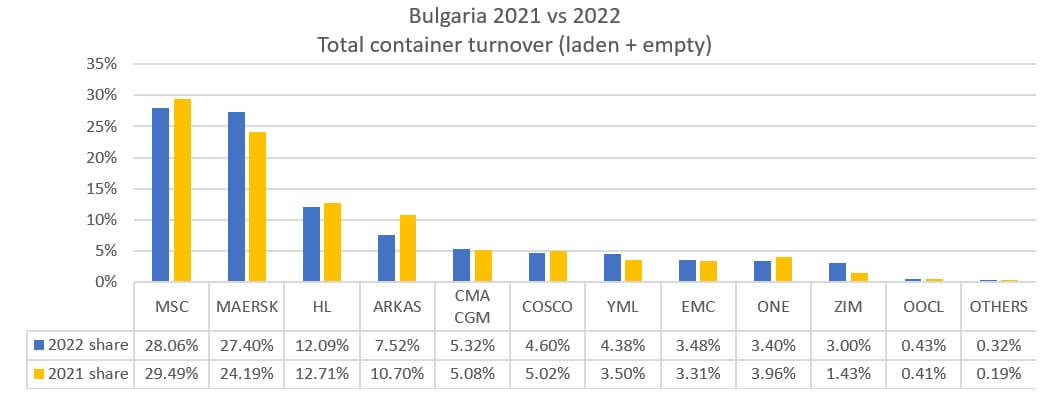

Bulgaria

In contrast to the significant volume growth experienced by neighboring Romania in 2022, the Bulgarian container industry remained relatively stagnant. Despite some Ukrainian container traffic passing through its container terminals in Varna at the beginning of the war, the total laden volume increase was only 0.8 percent year-on-year, resulting in approximately 208,000 TEU.

While Bulgaria's container industry may not have experienced the same level of development as its neighbors, the country remains an important player in the region's logistics landscape. Bulgaria provides an essential link in the supply chain of goods moving across the coast from Turkey to Eastern Europe countries and Ukraine in particular. Furthermore, its relatively stable supply chain in the face of external challenges, such as the Russian invasion of Ukraine, provides a level of reliability for regional stakeholders that is increasingly valuable on the Black Sea war-disrupted market.

Georgia

The Georgian market has emerged as the fastest-growing among all the countries in the Black Sea region in 2022, with a remarkable 22 percent growth that led to nearly 302,000 laden TEU. This expansion can be attributed to a multitude of factors, including the traffic along the "Middle Corridor," which connects Chinese exporters with the European Union (EU) market through Georgia, and the emergence of Russian container transit traffic which began to move via alternative ports due to international sanctions. Moreover, Georgia's GDP growth as well as mass migration of Russian citizens to Georgia in 2022 also contributed well into the country’s laden container turnover as demand for imports grows.

Interestingly, China is eyeing the ‘Middle Corridor’ as a possible means to establish a foothold on the Black Sea and improve connectivity via its Belt and Road Initiative (BRI). Georgian strategic location between the Black and Caspian seas positions it as an East-West corridor, which makes the country a gateway to Europe, bypassing Russia. Central Asian nations such as Kazakhstan, Uzbekistan, Turkmenistan aiming to diversify their supply routes and limit their dependence on Russia and China for exports, consider Georgia as a viable alternative. With Russia's ongoing war against Ukraine, there has been a surge of interest in Georgia's transit potential.

Interestingly, China is eyeing the ‘Middle Corridor’ as a possible means to establish a foothold on the Black Sea and improve connectivity via its Belt and Road Initiative (BRI). Georgian strategic location between the Black and Caspian seas positions it as an East-West corridor, which makes the country a gateway to Europe, bypassing Russia. Central Asian nations such as Kazakhstan, Uzbekistan, Turkmenistan aiming to diversify their supply routes and limit their dependence on Russia and China for exports, consider Georgia as a viable alternative. With Russia's ongoing war against Ukraine, there has been a surge of interest in Georgia's transit potential.

However, the Middle Corridor leg connecting Georgia and Romania via container liner service has not yet proven its viability. Many intermodal operators are utilizing railway routes via Turkey, avoiding time-consuming transshipment via the ports of Poti and Constanta. The potential of Georgia to establish itself as a key player in the Black Sea region is still uncertain. The country's economy, which is heavily reliant on imports, has resulted in a significant imbalance in container equipment (with only 13 percent of goods being exported compared to 50 percent imported) and hindered the growth of its industries. Unless the geopolitical landscape in Georgia undergoes a drastic change, the country's strategic location and transit potential will continue to attract the interest of global players seeking to improve their access to European market.

Black Sea container terminals performance 2022 vs 2021

The Russian military blockade of five Ukrainian terminals -namely CTO, BKP, DP World TIS, CRK FISH and CRK - for over 10 months in 2022 reshaped the Black Sea container market. This had a significant impact on the industry, resulting in a redistribution of market share among the terminals. As a result, DP World Romania, NUTEP Russia and POTI Georgia handled almost 67 percent of total container turnover in the Black Sea in 2022.

Report prepared by Informall Business Group team:

Vassiliy Vesselovsky – CEO

Alexander Khromov – Project Manager

that matters most

Get the latest maritime news delivered to your inbox daily.

Daniil Melnychenko – Data Analyst

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.