Sharp Increase in Containership Schedule Reliability

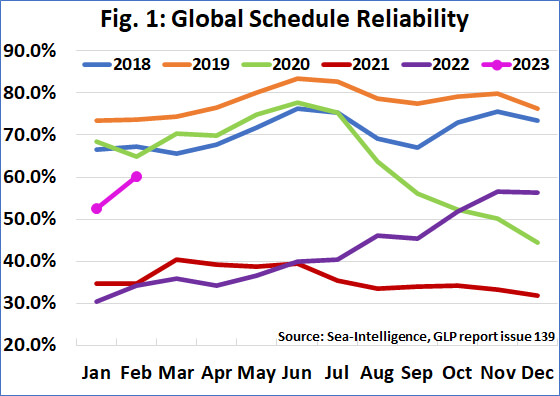

Coming back from the depths of the shipping surge experienced in 2021 and early 2022, the container shipping industry is recovering its schedule reliability to levels last seen at the onset of the pandemic. New data from Sea Intelligence shows the highest level of schedule reliability in 30 months reaching levels not seen since August 2020 and approaching pre-pandemic norms.

“Schedule reliability was a staggering 26 percentage points higher,” year-over-year highlights Alan Murphy, CEO of Sea-Intelligence. The analysis firm’s data shows that the industry bottomed out a year ago falling to a level where only one-in-three ships were on schedule. February 2022 showed just 34.2 percent global schedule reliability, continuing a two-year trend that began in January 2021 when reliability fell for the first time into the 30 to 40 percent range.

“Global schedule reliability increased sharply by 7.7 percentage points month over month in February 2023, reaching 60.2 percent,” says Murphy. Levels had begun nearly consistent monthly increases in May 2022 but February was the first time the level achieved the 60 percent level.

The year-over-year improvements came in across the board among the major carriers. Sea-Intelligence’s data shows that the 14 major carriers average 57 percent schedule reliability up from just 29 percent in February 2022. The strongest gains came from the Asian-based carriers with companies including Wan Hai, Evergreen, Yang Ming, PIL, OOCL, and COSCO all at least doubling their reliability, and each with better than half their vessels now on schedule. All top-14 carriers also recorded a month-over-month increase in schedule reliability in February 2023 reports Sea-Intelligence with PIL, ZIM, and Wan Hai all recording double-digit improvements.

The world’s largest container carrier, Mediterranean Shipping Company (MSC) also doubled its performance year-over-year. They rose from schedule reliability of just a third of the fleet to nearly two-thirds in 2023. MSC rose from an average performance last year to be tied with Maersk at the top of the 14 carriers. Maersk has consistently maintained among the best schedule reliability even during the worst periods of delays for all carriers.

The average delay for late vessel arrivals also decreased, although it has not improved at the same pace as schedule reliability for the industry. Murphy notes that the delay dropped by -0.07 days month-over-month in February 2023 to 5.29 days on average. Sea Intelligence notes that it is also down by -2.30 days year-over-year.

“In relative terms, the average delay for late vessel arrivals is now closer to the 2019 level than to the highs of 2021-2022,” said Murphy.

that matters most

Get the latest maritime news delivered to your inbox daily.

The average 5.29 days for late arriving vessels is similar to early 2020, but even during the first months of the pandemic, the industry was averaging under five days. In 2018 and 2019, the average delay for containerships was around four days.

The declines in volumes and the growing number of blanked sailings in 2023 have reduced the pressure both on container lines and ports. Many of the world’s ports report they have largely eliminated their backlogs and cleared the surge of containers and empties clogging the ports. Carriers however have also moved to idle ships with the number of ships laid up reaching back to levels seen during the last downturn several years ago.