Retailers See Slow TEU Volume Climb After Positive January Trade Data

A positive tick-up in trade numbers for January 2023 reported by the U.S. government on Wednesday followed by a forecast for a slow climb back for U.S. retail imports created the first glimmer of hope for a potential recovery for shipping volumes in 2023. Many in the shipping industry ranging from the major carriers in their financial reports to port operators have all said they believe retailers would be key to a resumption of growth in container volumes.

“There are many uncertainties about the economy, but we expect imports to show modest gains over the next several months,” said Jonathan Gold, Vice President for Supply Chain and Customs Policy at the National Retail Federation. The retail trade association said in its monthly Global Ports Tracer that “Growth is a positive sign, but levels are still far below normal and retailers will remain cautious as they work to keep inventories in line with consumer demand.”

The revised January trade data from the U.S. Commerce Department showed imports increased three percent to $325.8 billion overall. Consumer goods were up nearly four percent with imports of motor vehicles, parts, and engines the highest on record. Imports of goods from China drove much of the growth with the overall trade numbers showing a fourth monthly decline breaking the steady growth trend that started back in September 2020.

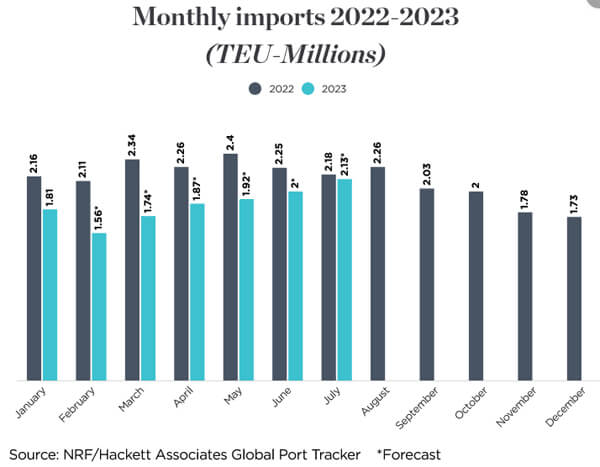

An economist speaking to The Wall Street Journal cautioned despite the positive report that they did not believe the data signaled the start of a sustained recovery. The NRF shared the same view that the growth would be slow while also reporting that January was the first month that showed a month-over-month increase in TEU volumes since last August. At 1.1 million TEU, January was up 4.4 percent from December but remained down 16.5 percent from the year ago.

“Retailers are maintaining reduced inventories in anticipation of rebuilding with new seasonal stock once they have a clearer take on expected levels of consumer spending,” predicted Ben Hackett, Founder of Hackett Associates. “While import volumes remain low, the tight labor market and strong wages are helping consumers absorb the impact of inflation and continue to spend.”

that matters most

Get the latest maritime news delivered to your inbox daily.

Volumes are typically weak in February due to the fewer days, holidays in China and Asia for the Lunar New Year, and the fact that retailers are in a lull between the end-of-year holidays and sales and the spring shopping season. The NRF forecasts when the final numbers are in for February 2023 it will show the softest levels since February and March 2020 at the beginning of the pandemic. The NRF is predicting import levels of 1.56 million TEU, down nearly 14 percent from January and down more than 26 percent versus a year earlier. The association slightly lowered its forecasts for both February and March versus last month’s report.

“Beginning this month, imports are expected to climb at least through mid-summer, but nonetheless remain below last year’s levels,” the NRF forecasts. They see monthly declines ranging between 17 and 26 percent till June when volumes are expected for the first time to exceed the 2 million TEU level last seen in October 2022. By July 2023, the NRF is calling for declines of just 2.5 percent over the strong volumes last year as retailers head to the traditional back-to-school and the end-of-year holiday retailing seasons.