NFE Sells Stake in its Fleet to Raise $1.1 Billion for Novel LNG Plans

On Tuesday, New Fortress Energy announced that it has reached an agreement to sell 11 of its LNG vessels to a new joint venture with private equity company Apollo. The deal gives NFE $1.1 billion in net proceeds - money which it can use for the development of its "Fast LNG" offshore liquefaction terminal concept.

NFE will retain a 20 percent stake in the new JV, with Apollo buying the remaining 80 percent. NFE will charter back 10 of the vessels for up to 20 years, effective right away or after the expiration of the vessels' current long-term charters (depending on each ship's circumstances).

The vessels include six FSRUs, three floating storage units and two LNG carriers. All are high-demand vessel classes in today's tight LNG market.

“Together with Apollo, we are creating a leading LNG marine infrastructure platform to help accelerate the energy transition while freeing up capital to continue to invest into our Fast LNG and downstream LNG projects worldwide,” said Wes Edens, Chairman and CEO of New Fortress Energy.

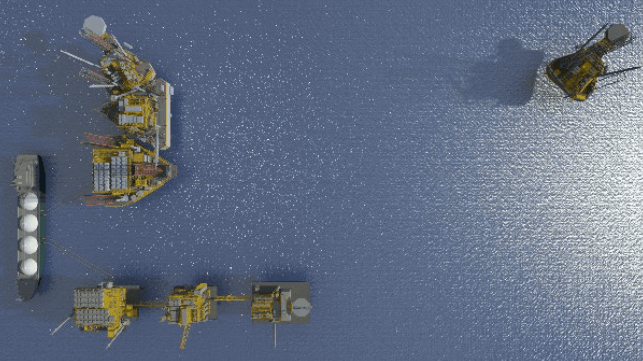

New Fortress is building a vertically-integrated portfolio of LNG projects, from liquefaction and marine transport to downstream receiving and regasification. It is developing a novel "Fast LNG" concept for deployment in the U.S. Gulf of Mexico - a platform-based offshore LNG plant with modular, small-scale liquefaction trains. Work is already under way on the first units at a shipyard in Texas.

Though small, the 1.4 mtpa units would offer a number of advantages, like low cost and speed to market - a critical factor at a time of high demand and geostrategic importance for LNG. The company has plans for two liquefaction trains off Louisiana, and it plans to apply for permits for six more off the coast of Texas.

On Tuesday, NFE also announced a rare foreign investment deal with Mexican state oil company Pemex for the development of a floating LNG terminal in the Gulf of Mexico. The agreement involves the joint development of the Lakach gas field for Pemex; the field will supply natural gas to the Mexican domestic market and to NFE for export to global markets, using a small 1.4 mtpa floating LNG (FLNG) plant.

Uniquely, the agreement has the explicit endorsement of Mexican president Andrés Manuel López Obrador. Under Obrador, the Mexican government has worked to return control of the oil and gas sector to the state; his approval for a JV with New York-based New Fortress Energy is a departure from recent trends in the nation's oil and gas sector.

that matters most

Get the latest maritime news delivered to your inbox daily.

"We appreciate the continued support of President López Obrador, admire his resolve to deliver reliable energy to the people of Mexico, and value the opportunity to partner with Pemex to enhance global energy security," said Wes Edens, chairman and CEO of NFE.

On the same day, New Fortress also announced a agreement with Mexican state utility CFE to develop a new "LNG hub" off the coast of Altamira, Tamaulipas. NFE will deploy multiple small FLNG units of 1.4 mtpa each, and will draw on CFE’s pipeline gas capacity for feedstock. As part of the agreement, CFE would share in the production and marketing of a part of the LNG volume.