Chinese Fund Invests in Russia's Yamal LNG

More than 40 Chinese insurance companies and asset managers have jointly started an investment firm, raising 40 billion yuan ($6 billion) for a first fund to finance energy and infrastructure projects overseas, China's insurance regulator said.

The new firm, China Insurance Investment Ltd, will boost China's energy security by directing part of its first fund to finance Russia's $27 billion Yamal liquefied natural gas (LNG) project, the China Insurance Regulatory Commission (CIRC) said in an online statement on Monday, without providing any details.

The Yamal LNG project, due to start production of liquefied natural gas in 2017, has been struggling to raise funds because of international sanctions on Russia over its involvement in the conflict in eastern Ukraine.

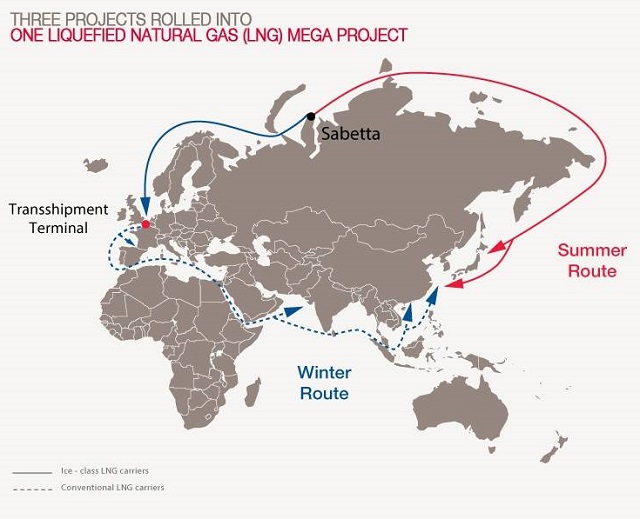

The project involves the construction of an LNG plant with a capacity of 16.5 million tons per year at the resource base of the Yuzhno-Tambeiskoe field, and creation of a corresponding unique transport and technological infrastructure for the year-round export of LNG to consumers. Plans include the use a fleet of 15 LNG carriers, each with a cargo capacity of 172,600 cubic meters and with Arctic ice class (Arc 7).

In the long view Yamal will be among three biggest gas production centers of Russia with the potential annual output reaching 310 to 360 billion cubic meters of gas by 2030 – over one-third of forecasted gas production in Russia for that period.

China’s Silk Road Fund

China’s Silk Road Fund

China's Silk Road Fund has already provided 700 million euro to Yamal LNG and obtained a 9.9 percent stake in the project. Chinese lenders are also set to provide $12 billion in credit.

China Insurance Investment Ltd, headquartered in the Shanghai free trade zone, was launched by 46 Chinese corporate shareholders, comprising 27 insurance companies, 15 insurance asset management companies and four private companies. The shareholders each have a stake of less than 4 percent.

The new investment vehicle has 1.2 billion yuan in registered capital and will acquire overseas assets, including stakes in emerging industries such as Big Data, cloud computing and clean energy, the CIRC said.

that matters most

Get the latest maritime news delivered to your inbox daily.

Its first fund will also help finance China Merchants Steam Navigation Co's port construction projects in Sri Lanka, Turkey and Djibouti, the CIRC said.

China Insurance Investment Ltd has signed 100 billion yuan worth of investment agreements, including 60 billion yuan for urban regeneration and infrastructure, the statement said.