[Watch] Big Year for Johan Sverdrup Installations

Statoil has published a video of the recently-completed installation of the Johan Sverdrup drilling platform jacket. The jacket – engineered and constructed by Kværner Verdal – is now the second visible structure on the Johan Sverdrup field, and the launch marks the beginning of the biggest installation year for the Johan Sverdrup project – with three jackets, two topsides, more than 400 kilometers (250 miles) of pipelines, 200 kilometers (125 miles) of power cables, and more, to be installed this year.

Johan Sverdrup is one of the five largest oil fields on the Norwegian continental shelf. With expected resources of between 2.1 - 3.1 billion barrels of oil equivalents, it will also be one of the most important industrial projects in Norway in the next 50 years.

Phase 1 of the development is expected to be operational in late 2019. To promote synergies, Statoil is already issuing letters of intent for the development of phase 2. Contracts will be awarded later this year. Production start for phase 2 is planned to start in 2022.

The Johan Sverdrup field will be operated by electrical power generated onshore, reducing offshore emission of GHG gases by 80 - 90 percent compared to a standard development using gas turbines.

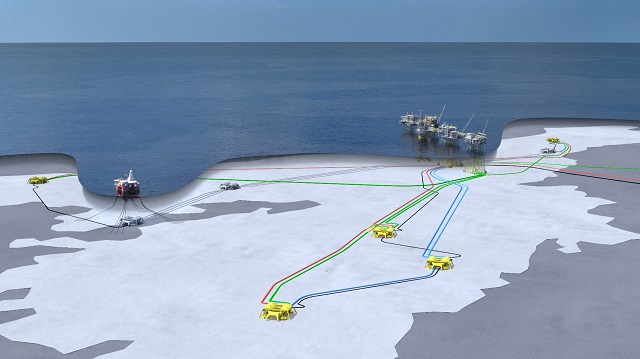

Phase 1 includes the development of four platforms (utility- and living quarters, processing platform, drilling platform, riser platform), three subsea installations for water injection, power from shore, export pipeline for oil (Mongstad) and gas (Kårstø). The project is expected to cost NOK 88 billion ($11 billion) with a break even expected below $15 per barrel.

Phase 2 includes development of another processing platform for the field center and the Avaldsnes, Kvitsøy and Geitungen satellite areas. It is expected to cost less than NOK 45 billion ($5.8 billion) and lead to a break-even price of less than $20 per barrel.

The project partners are operator Statoil (40.0267 percent) along with Lundin Norway (22.6 percent), Petoro (17.36 percent), AkerBP (11.5733 percent) and Maersk Oil (8.44 percent).