UK Now a Net Fossil Fuel Importer

The United Kingdom is the largest producer of oil and the second-largest producer of natural gas in the European Union, but following years of exports, the country became a net importer of all fossil fuels for the first time in 2013.

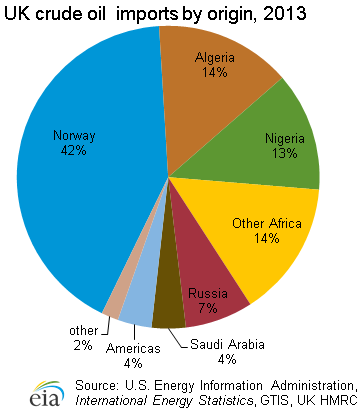

Although aggressive targets for renewable energy are in place, oil remains important to the UK energy balance and contributed 37 percent of total energy consumption in 2013. Once a major producer of oil from the North Sea, aging reservoirs and infrastructure have affected UK's oil production over the past few years with production declines and widespread outages as a result of technical problems. Falling production has made the UK increasingly reliant on imports of both crude oil and petroleum products.

Higher tax rates have made the UK fields less competitive at a time when they were already strained by high operating and decommissioning costs. The UK government does not hold a direct interest in oil production, but this sector remains important to the government because Corporation Tax and Supplementary Tax income from the sector accounts for about 25 percent of UK corporate tax receipts, according to the offshore industry association Oil & Gas UK.

Higher tax rates have made the UK fields less competitive at a time when they were already strained by high operating and decommissioning costs. The UK government does not hold a direct interest in oil production, but this sector remains important to the government because Corporation Tax and Supplementary Tax income from the sector accounts for about 25 percent of UK corporate tax receipts, according to the offshore industry association Oil & Gas UK.

As a result of the significant increases in taxes in 2011, United Kingdom Continental Shelf (UKCS) projects have become even less competitive. Increases in operating costs coupled with higher taxes have resulted in decreased investment in both brownfields and new exploration. Even without the increased taxes, operating costs in the UKCS were prohibitively high, exacerbated by the high decommissioning costs of old facilities, which also discourage investors.

Almost immediately after the new tax rates were implemented, development on several start-ups was suspended, including Statoil's Mariner and Chevron's Bressay fields. In addition, Centrica launched a review of all of its exploration activities, as many projects were deemed uneconomical under the new rates. Given a nearly 16 percent decline in production following the implementation of the new tax rates, the UK government has introduced new incentives for producers to counter some of the increase in taxes.

In March 2013, the UK government outlined plans to encourage continued development of the oil and gas sectors because the latest trade statistics indicated that net energy imports rose to the highest level since the 1970s. These plans included providing the industry with tax certainty, supply-chain support, and workforce skills development.

Declining production

UK oil production had peaks in the mid-1980s and late 1990s after oil companies developed a number of oil fields in the North Sea. However, oil production in the United Kingdom has been gradually declining since the 1990s. In 2013, UK produced approximately 0.8 million barrels per day (bbl/d) of crude oil, almost all of it from offshore fields.

UK oil production had peaks in the mid-1980s and late 1990s after oil companies developed a number of oil fields in the North Sea. However, oil production in the United Kingdom has been gradually declining since the 1990s. In 2013, UK produced approximately 0.8 million barrels per day (bbl/d) of crude oil, almost all of it from offshore fields.

The Energy Information Administration’s (EIAs) Short-Term Energy Outlook expects UK oil production to continue to decline through 2015. The main reason for this decline is the overall maturity of the country's oil fields and diminishing prospects for new substantial discoveries in the future. Although its proximity to major consuming markets makes UK exploration attractive, recent increases in taxes will continue to affect the attractiveness of the UK fields in the longer term.

In addition to production declines from maturing fields, constant storms and adverse weather conditions also hamper production in the North Sea. A number of oil fields, including the key Buzzard field, had reduced production in 2013 because of maintenance and unplanned outages.

Reserves

According to the Oil & Gas Journal (OGJ), the UK had 3.0 billion barrels of proven crude oil reserves as of January 2014, the most of any EU member country but 4.6 percent below the January 2013 level. This drop marks a major downward trend in oil reserves in the UKCS because of cost increases (making some projects uneconomic) and re-appraised key projects, according to Oil & Gas UK. The major project that will offset some of this decline is the Mariner field, which was discovered in 1981. DECC approved development of the field in February 2013, and Statoil expects production to start in 2017, rising to 55,000 bbl/d before 2020.

The vast majority of UK's reserves are located offshore in the UKCS, and most of the oil production occurs in the central and northern sections of the North Sea. Reserves are generally found in smaller fields, with only a third of fields having more than 50 million barrels of oil. Although there is a modest amount of oil produced onshore, in 2013 more than 90 percent of total UK production took place offshore. However, despite record investments of 14 billion pounds (23 billion USD) in 2013 to new projects, UKCS production continues to decrease at a steady rate. Offshore crude oil production decreased by nine percent between 2012 and 2013.

Operators

Nexen was the largest operator in the UK in terms of oil production, with a total of approximately 188,000 bbl/d produced in the five fields it operated in 2013, according to the UK's Department of Energy and Climate Change (DECC). Nexen-operated fields accounted for about 24 percent of total UK production in 2013.

BP is also a significant operator in the UK, although its production has declined over the last few years as the company refocused its exploration and production elsewhere. It operates 18 fields in the UK, which are located offshore with a total output of approximately 72,300 bbl/d in 2013, according to DECC.

The UK's largest producing field in 2013 was the Nexen-operated Buzzard oil field, which produced an average of 178,900 bbl/d during the year. This production volume was short of its production capacity of more than 200,000 bbl/d, as the field continued to experience technical and operational issues during the year. Buzzard field came online in 2007 and reached full capacity in 2008. Average annual production at the field has declined every year until 2013, when Nexen was able to reverse some of the declines.

Despite the large declines in oil production over the last few years, the UK is still one of the largest petroleum producers and exporters in Europe and exported 576,000 bbl/d of crude oil in 2012.

Exports

Once a major exporter of oil, the UK exports have dropped in tandem with decreasing domestic production. However, despite being a net importer of crude oil and petroleum products, the UK is still one of the largest petroleum producers and exporters in Europe and exported 576,000 bbl/d of crude oil in 2012.

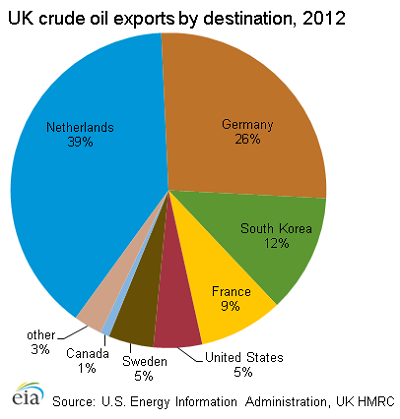

UK customs export data show that the vast majority of crude oil exports (over 80 percent) were destined to EU countries, mainly Germany and Netherlands. Most of the non-EU export trade was with South Korea and the United States. The UK’s two largest markets in the EU are Germany and the Netherlands; the bulk of the exports to Germany are for refining and consumption there, while the exports to the Netherlands include oil destined for onward trade to other countries.

Natural Gas

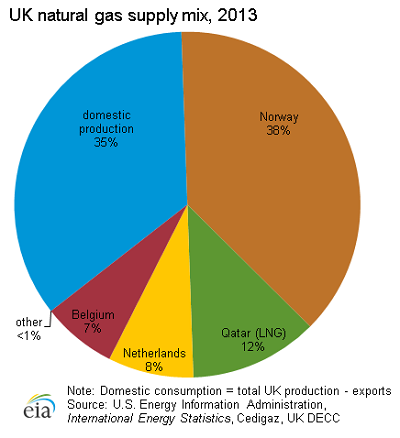

UK's natural gas production has been on a long-term declining trend, although the country continues to produce sizeable natural gas volumes. In 2013, domestic natural gas production accounted for just over a third of the UK's natural gas supply.

UK's natural gas production has been on a long-term declining trend, although the country continues to produce sizeable natural gas volumes. In 2013, domestic natural gas production accounted for just over a third of the UK's natural gas supply.

The UK's natural gas production has been on a long-term declining trend, although the country continues to produce sizeable natural gas volumes. Since domestic production of natural gas peaked in 2000, the UK has become increasingly reliant on imports to satisfy its demand. In 2013, domestic natural gas production accounted for just over a third of the UK’s natural gas supply, according to DECC.

In 2011, the UK demand for LNG surpassed that of Spain for the first time, and UK became the largest market for LNG imports in the EU. That year, UK imported a total of 892 Bcf of natural gas. However, in 2012 the UK LNG demand fell behind Spain's at 504 Bcf, according to PFC Energy. LNG imports in 2012 fell as pipeline imports rose, mainly those from Norway, as LNG cargoes were diverted to higher-priced markets in Asia.

LNG imports, particularly from Qatar, fell by 30 percent between 2012 and 2013 because of declines in UK gas demand and strong competition for LNG in global market, particularly from Japan after the country closed its nuclear facilities following the Fukushima plant meltdown. LNG imports accounted for 18 percent of the total in 2013, down from 28 percent in 2012. Qatar accounted for virtually all LNG imports in 2013.

Renewables

that matters most

Get the latest maritime news delivered to your inbox daily.

The UK government has introduced a number of regulations to increase the amount of renewable energy in the country. These regulations call for an increase in the use of renewables to 30 percent of total electricity generation in 2020. While these plans include hydropower, wind resources are central to the government's plans.

Renewables accounted for nearly 15 percent of total generation in 2013. Renewable electricity generation increased by 28 percent from 2012, with wind generation up by 40 percent. The UK is a world leader in offshore wind capacity, and the government approved plans for the 1.2 GW Triton Knoll offshore wind farm in summer 2013.