Iranian Gas and LNG Potential Remains Undeveloped

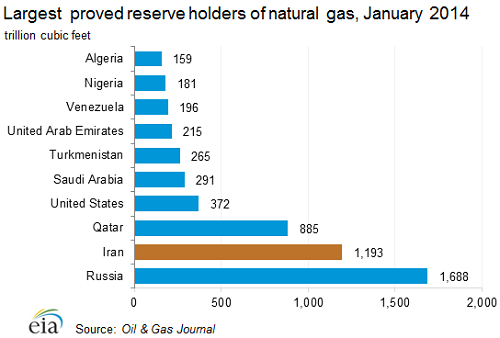

Iran is the second-largest proved natural gas reserve holder in the world, behind Russia. The country holds 17 percent of the world's proved natural gas reserves and more than one-third of OPEC's reserves. However, the vast majority of Iran's gas reserves are undeveloped.

According to Oil & Gas Journal, as of January 2014, Iran's estimated proved natural gas reserves were 1,193 Tcf. Iran has a high success rate of natural gas exploration, in terms of wildcat drilling, which is estimated at 79 percent compared to the world average success rate of 30-35 percent.

According to Oil & Gas Journal, as of January 2014, Iran's estimated proved natural gas reserves were 1,193 Tcf. Iran has a high success rate of natural gas exploration, in terms of wildcat drilling, which is estimated at 79 percent compared to the world average success rate of 30-35 percent.

Iran's largest gas field is South Pars, a non-associated gas field located offshore in the middle of the Persian Gulf. South Pars is a portion of a larger gas structure that straddles the territorial water borders of Iran and Qatar. It is called the North field in Qatar. South Pars reserves account for roughly 40 percent of Iran's total gas reserves, and the field is also estimated to hold 17 million barrels of condensate in place. Other major gas fields in Iran include: Kish, North Pars, Tabnak, Forouz, and Kangan. These fields and others also hold large amounts of condensate reserves. Iran is also estimated to hold 2 Tcf of proved and probable natural gas reserves onshore and offshore in the Caspian basin.

Exploration

Although finding new natural gas reserves is not a high priority because much of Iran's current reserves are undeveloped, there have been significant gas discoveries in recent years. In 2011, four sizeable new discoveries were announced: Khayyam (onshore), Forouz B (offshore in Persian Gulf), Madar (offshore in the Persian Gulf), and Sardare Jangal fields (offshore in Caspian Sea).

Although finding new natural gas reserves is not a high priority because much of Iran's current reserves are undeveloped, there have been significant gas discoveries in recent years. In 2011, four sizeable new discoveries were announced: Khayyam (onshore), Forouz B (offshore in Persian Gulf), Madar (offshore in the Persian Gulf), and Sardare Jangal fields (offshore in Caspian Sea).

In December 2011, Khazar Oil Company (a NIOC subsidiary) discovered the giant Sardare Jangal field approximately 150 miles offshore in the Caspian Sea. Based on initial assessments, the field is estimated to hold 50 Tcf of natural gas in place. Given the field's position in the Caspian Sea, it is possible that Iran shares the field with Azerbaijan. However, the lack of a border delineation agreement among littoral states could complicate the development of this field.

Production

Iran is the world's third-largest dry natural gas producer, after the United States and Russia, and accounted for nearly 5 percent of the world's dry natural gas production in 2012. Despite repeated delays in field development and the effects of sanctions, Iran's natural gas production is expected to increase in the coming years.

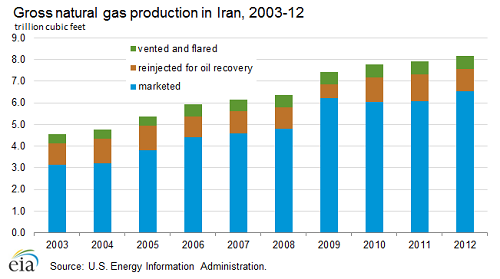

In 2012, almost 40 percent of Iran's gross natural gas production came from the South Pars field. Gross natural gas production totaled almost 8.2 Tcf in 2012, increasing 3 percent from the previous year. Of the 8.2 Tcf produced, most of it was marketed (6.54 Tcf), and the remainder was reinjected into oil wells to enhance oil recovery (1 Tcf) and vented and flared (0.62 Tcf).

In 2012, almost 40 percent of Iran's gross natural gas production came from the South Pars field. Gross natural gas production totaled almost 8.2 Tcf in 2012, increasing 3 percent from the previous year. Of the 8.2 Tcf produced, most of it was marketed (6.54 Tcf), and the remainder was reinjected into oil wells to enhance oil recovery (1 Tcf) and vented and flared (0.62 Tcf).

Reinjecting natural gas plays a critical role in oil recovery at Iran's fields. As a result, natural gas reinjection is expected to increase in the coming years. Some estimates indicate that NIOC will require 7 to 8 billion cubic feet per day (Bcf/d) of natural gas for reinjection into its oil fields in the next decade, according to FGE. Iran also flares (burns off) a substantial portion of its gross production. According to Cedigaz, Iran flared the second-largest amount of natural gas in the world in 2012, after Russia. Gas is flared because of the lack of infrastructure to capture and transport gas associated with oil production.

Much like in the oil sector, the natural gas sector has been hampered by international sanctions. Although sanctions targeting the Iranian natural gas exports were only recently enacted by the EU, lack of foreign investment and sufficient financing has resulted in slow growth in Iran's natural gas production. According to some analysts, Iran should have become one of world's leading natural gas producers and exporters given its large resource base. Development of its fields has been hampered by a combination of financing, technical, and contractual issues.

that matters most

Get the latest maritime news delivered to your inbox daily.

Nonetheless, Iran's natural gas production has grown, and output is likely to continue to increase in the coming years. FGE projects that Iran's gross natural gas production will increase to 10.6 Tcf in 2020, but that growth will depend on the pace of development of the South Pars field.

Although Iran's aspirations to build a liquefaction facility date back to the 1970s, the country has yet to build one. Despite ambitious plans, Iran has had to cancel or delay LNG projects because of U.S. and EU sanctions that made it impossible to obtain financing and to purchase necessary technology. Given the political constraints, Iran's LNG projects are years away.