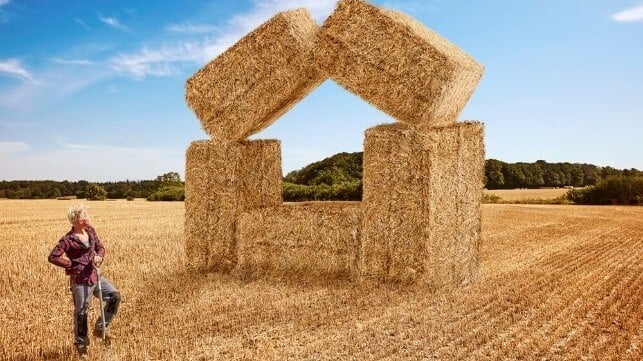

Making Hay

It's a banner year for shipping.

(Article originally published in May/June 2024 edition.)

“Make hay while the sun shines” – isn’t that how the old saying goes? And it’s certainly true for shipping, which is on a roll.

The results are in and, according to multiple first-quarter earnings reports, it’s going to be a record year. With few exceptions, earnings have exceeded Wall Street’s expectations – even for the beaten-down container sector – and there’s nothing but smooth sailing ahead. Who’d ‘a’ thought?

And that’s good news for the economy too because robust demand for shipping reflects a strengthening global economy. Shipping – and transportation in general – is often regarded as a leading indicator of economic growth, and a rare combination of favorable factors is making 2024 a breakout year. Those factors include geopolitical disruptions like the war in Ukraine and Red Sea attacks, stretched-out supply chains, growing demand for fossil fuels, supply-demand imbalances and limited newbuilds.

The conflict in the Red Sea changed everything, further disrupting supply chains already reeling from the war in Ukraine and forcing vessels to make the long voyage around Africa. As long as the Houthis are allowed to attack merchant ships transiting that vital artery with virtual impunity, the boom in freight rates will continue – padding shipowners’ pockets.

Balanced Portfolio

Monaco-based Navios Maritime Partners (NMM) recently reported its best first quarter ever. The combination dry cargo/tanker operator, whose stock is up more than 50 percent this year and trading around $47, had first-quarter net income of $73 million on revenue of $319 million.

“In the first quarter of 2024, regional conflict, particularly in the Middle East, continued to drive transportation,” noted Angeliki Frangou, Chairwoman & CEO. “The U.S. and European economies were generally healthy. As a result, this was Navios Partners’ strongest first quarter financial performance ever.”

Navios is one of those rare companies that has its foot in three different sectors – dry bulk, containers and tankers. It owns and operates a fleet of 176 vessels including 76 dry bulk vessels, 46 containerships and 54 tankers. It’s a balanced approach that takes into account the notorious cyclicality of the maritime business and its various segments. Right now, for instance, dry bulk and tankers are booming while container shipping is in recovery mode.

Fully aware of this, Frangou noted that, despite the sterling results, “We remain cautious as this robust maritime environment can change quickly. As usual, we focus on things that we can control, such as reducing leverage and modernizing our energy-efficient fleet. We are taking long-term cover where available, as rates are around or exceeding long-term averages. For example, we recently chartered-out a Capesize vessel for 2.9 years at a net daily rate of $28,500.”

Printing Money

Perhaps the best-performing sector of all is product tankers, which have benefited enormously from the Russia-Ukraine war, the Red Sea attacks and continued strong demand for distilled products like gasoline, diesel and jet fuel.

Leading operator Scorpio Tankers (STNG) reported first-quarter net income of $214 million on revenue of $391 million – a stunning 55 percent return on sales. Its 109-vessel fleet is profiting from soaring freight rates and the geopolitical conflicts mentioned earlier, and its stock is up more than 25 percent year-to-date at a recent price of $80.

“Geopolitical chaos has been a boon for product tanker owners,” commented veteran industry observer Greg Miller in Lloyd’s List. And he points to another factor as well: reduced debt levels, allowing operators to lower their breakevens and increase free cash flow. The article, titled “Product tanker owners savour heady mix of geopolitics, strong demand and shrinking debt,” calls Scorpio Tankers the “poster child of this dynamic.”

By reducing debt and lowering cash breakeven levels, companies can literally print money. In Scorpio’s case, its current breakeven is roughly $16,000/day and it’s negotiating to prepay another $233 million of debt, which would lower its cash break-even to $12,500/day. At multiyear charter rates of roughly $40,000/day, you’re talking real money. And that means more money for shareholders in the form of higher dividends or increased stock buybacks, which STNG has promised to do.

Another attractive company in the product tanker space is Cork, Ireland-based Ardmore Shipping (ASC). With only 26 vessels, it’s much smaller than Scorpio, but it pays a nifty dividend of roughly six percent and its stock is up more than 50 percent year-to-date. Ardmore’s dividend is variable and equal to one-third of adjusted earnings, which meant a payout of $0.31/share in the most recent quarter. The stock currently trades around $22.

Gas Carriers

Another sector rolling in cash are the gas carriers like Dorian and Cheniere. Demand for their products – liquefied petroleum gas (LPG) and liquefied natural gas (LNG), respectively – is growing at an impressive clip, influenced both by geopolitical events and strong demand, particularly in Asia.

The U.S. is once again leading the world in fossil fuel production – nevermind the clean-energy agenda of the Biden Administration – and that includes growing exports of oil and gas products. The U.S. produces so much gas that the price fell below $2/mcf earlier this year, boosting exports of both LPG and LNG to record levels.

That’s a big plus for Dorian (LPG) and Cheniere (LNG), both of which are U.S.-based and benefiting from the huge growth in U.S. energy exports. Cheniere, as you savvy MarEx readers know, was the first U.S. exporter of LNG and remains the largest. Its stock is actually down for the year, trading around $155 from a high of $170, and represents a golden buying opportunity. Meanwhile, it continues to generate cash, pay down debt and buy back its stock.

If you’re looking for dividends, try Cheniere’s sister company – Cheniere Energy Partners (CQP), a master limited partnership – which currently yields a nifty eight percent.

Dorian (LPG), which operates a fleet of 25 VLGCs (very large gas carriers) had blockbuster results for its fourth quarter and fiscal year ended March 31. In the fourth quarter alone, it earned $79 million on revenues of $141 million for a remarkable 56 percent return on sales – right up there with Scorpio Tankers.

Its vessel operating expenses per day were $10,699 versus an average TCE (time charter equivalent) rate was $72,202 per day, so do the math. That’s real money and shows how profitable the industry can be in flush times.

The stock had a big run last year, more than doubling, and has since cooled somewhat. Currently trading around $47, it has lots of upward potential and yields a very attractive nine percent. Committed to paying out excess cash in the form of dividends, the company recently announced an “irregular” dividend of $1/share, with more to come.

Offshore

It’s such a good year for shipping that even the longsuffering offshore business is booming.

Industry bellwether Tidewater (TDW) reported another record-breaking quarter ended March 31, and its stock is up nearly 60 percent this year at $107, continuing a bull run that’s lasted more than two years. It doesn’t yet pay a dividend but continues to buy back its stock at an encouraging pace.

Here’s President & CEO Quintin Kneen on the quarter’s results:

We remain encouraged by the outlook for demand over the coming years and by the persistent tightness in vessel supply. Newbuilding vessel orders still have not materialized in any meaningful way, providing for a significant runway of time before new vessel supply can enter the market. We reiterate our full-year revenue guidance of $1.40 to $1.45 billion and gross margin guidance of 52.0% and we remain optimistic on the continued pace of offshore activity acceleration as a result of the constructive leading indicators we observed during the first quarter.

that matters most

Get the latest maritime news delivered to your inbox daily.

The offshore rebound has legs – just like everything else in shipping these days. Enjoy the ride and Roll Tide!

Jack O'Connell is the magazine's senior editor.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.