Oil Price Drop and Sanctions Puts the Squeeze on Iran and Russia

After several years of relative stability in the global oil market, notwithstanding the war in Ukraine and attacks on shipping in the Red Sea, recent weeks have seen some shifting in the market. Brent crude was selling at $82 per barrel on January 15, and has since drifted downwards to below $65 per barrel on June 5, accelerating in recent weeks the steady downward trend in pricing seen over the last two years.

The oil market tends to be cyclical, with producers attracted into the market boosting production when prices peak, with high-cost producers then reducing activity as surplus inventory depresses the market. But behind the recent fall in prices are some factors, of particular relevance to the shipping market.

After a period of curbing output to maintain prices, both OPEC and OPEC+ are now unwinding production cuts. A leading voice for this change in direction has been Saudi Arabia, which has lost market share which it now seeks to recapture before the transition to renewable energy sources begins to reduce overall demand.

A reduction in price will hurt the finance ministries of those states particularly in the Gulf which are heavily dependent on oil revenues. But it will help the traditional producers recapture market share from high-cost fracking producers in America. It will also prove attractive to purchasers of heavily discounted Russian and Iranian crude, who since January have been facing sanctions that are wider in scope and which are being enforced with renewed vigor. Teapot refiners in China’s Shandong Province, as well as some Indian purchasers are becoming increasingly wary of taking Russian and Iranian crude off dark fleet shipping, or which has obviously been transshipped off Malaysia and elsewhere.

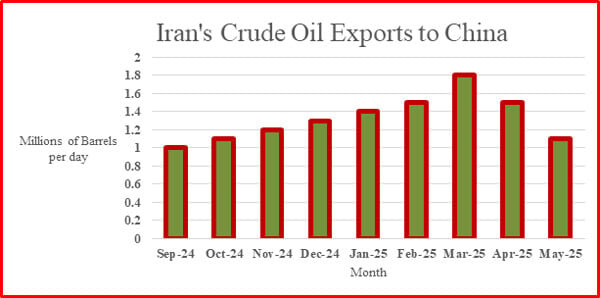

This trend can now be seen in estimates of Iranian oil exports to China, where refiners took advantage of still-low prices at the beginning of the year to stock up, but who are now facing tougher sanctions.

Iranian crude exports to China from Kpler and Vortexa estimates (CJRC)

Since President Trump issued National Security Presidential Memorandum 2 on February 4, the U.S. Treasury has issued three rounds of sanctions, in the latest listing the refiner Hebei Xinhai Chemical Group, the Shandong Jingang Port company, three ship managing agents, and adding Corona Fun and Viola to at least ten other shadow fleet vessels sanctioned since January. The U.S. Treasury is now also sanctioning long-standing shadow fleet ship captains, Indian nationals Ketan Agarwal and Lincoln Francisco Viegas being designated in the latest sanctions round.

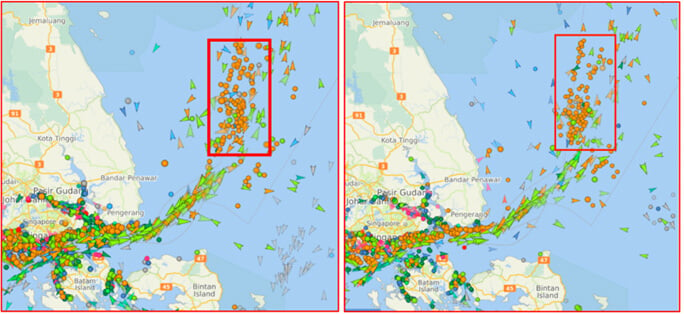

The limited effectiveness of sanctions against determined entrepreneurs is apparent however in a review of activity in the well-established crude oil transshipment box in international waters off the Malaysian coast. The number of static vessels in the area seems to be even higher now than in April, when Bloomberg estimated, using satellite imagery, that there had been a significant increase from the 20 daily trans-shipments which it considered were occurring daily in 2024. Treasury Secretary Scott Bessent may have had this in mind when he commented recently that “the United States remains resolved to intensify pressure on all elements of Iran’s oil supply chain.”

June 5, 2025 (Left) - Oil transshipment activity off Malaysia - April 13, 2025 (right) - source: Vesselfinder.com/CJRC

Lower pricing and improved sanctions enforcement will pressure Iran and Russia in particular, who already are in competition with each other to sell their discounted crude and may need to fight each other with further discounting. In the changed environment, many who previously bought from Iran and Russia will be looking for supply elsewhere, with the narrowed price differential no longer justifying the risk of breeching sanctions. For the global maritime community, looming over the whole market however is a much larger disruptive event; the European Union plans to prohibit all new oil and gas contracts and existing short-term spot contracts with Russian suppliers by the end of 2025, and then to ban all remaining imports by the end of 2027.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.