Hanwha Ocean Discontinues Efforts to Acquire Austal

South Korean shipbuilder Hanwha Ocean is discontinuing its pursuit of Austal after reports of repeated financial offers to take the Australia-based shipbuilder private. Austal had publicly rejected the offer repeatedly saying it doubted the combination could win regulatory approval in Australia and possibly the United States due to the national security nature of the business.

In a statement attributed to Shin Yong-in, Chief Financial Officer of Hanwha Ocean, the company said, “We have decided to discontinue discussions with Austal's management and board of directors regarding the acquisition of Austal (Australian shipbuilding/defense company) as of September 25, 2024, and have notified the other party of this.”

Hanwha Ocean labeled the stock exchange filing a response to market rumors citing reports dating to April of an offer to pay US$673.6 million to acquire Austal. Media reports said the offer was increased several times and stood at just over US$700 million.

The Australian Financial Review is reporting that it saw a letter from Hanwha Ocean’s CEO to the board of Austal saying the decision to not pursue the offer was due to a “wholly unreasonable condition of due diligence access.” AFR reports that Austal’s board insisted on a US$5 million termination fee that the board could invoke at any time if it determined regulatory approval would not be obtained.

Hanwha Ocean, according to AFR, contends Austal’s board had been willing to proceed with the due diligence providing access to the operations but canceled two days before it was scheduled to begin. They contend it was done without notice or explanation but the sticking point was the termination fee.

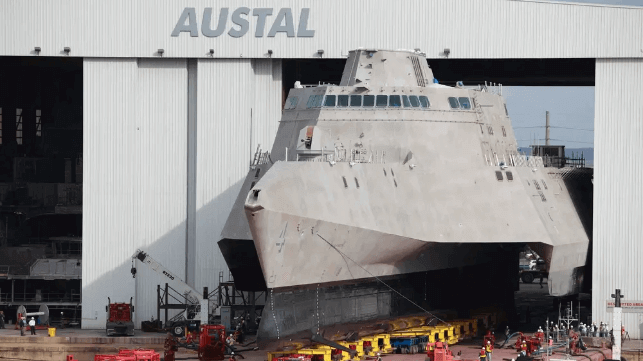

This comes as both companies have been moving to expand their naval work, especially with the United States, and as Austal is poised to compete in the AUKUS program as tenders are expected for the submarine contraction. Austal just highlighted its expansion of its submarine component work in the U.S. reporting a program to expand capacity at its shipyard in Mobile, Alabama while it is also participating with a private equity investor to buy the neighboring facility of the Alabama Shipyard.

Hanwha Ocean had dismissed the concerns over regulatory issues with the acquisition citing its current work with military projects for Australia and its expanding relationship with the U.S. Navy. Hanwha Ocean was recently certified and received a U.S. Navy support ship for an extended repair project at its yard in South Korea. The company has also agreed to acquire Philly Shipyard in the United States citing the opportunities to expand into more work with the U.S. Navy and Maritime Administration.

The Australian Financial Review cites Austal’s growth while also noting that the company will require capital to overhaul its shipyard as part of the effort to participate in AUKUS. Last month, Austal reported a strong financial turnaround for FY 2024. While revenues were down as expected by approximately seven percent, the company posted a strong turnaround and profit. Management cited an orderbook valued at A$12.7 billion (US$8.7 billion). They predicted the yards would be busier in FY 2025 noting the company is now undertaking 14 different vessel programs, providing the company with diversity and a long runway of work and revenue.