Study: Six EU Ports Handle Almost All of Russia's Arctic LNG

While the European Union has largely ceased its consumption of Russian pipeline gas, it continues to import or transship large volumes of Russian LNG. The pattern is driven by a near-exclusive trading relationship with Novatek's Yamal plant: the EU buys alomst all of Yamal's output, and Yamal supplies almost all of the EU's Russian LNG.

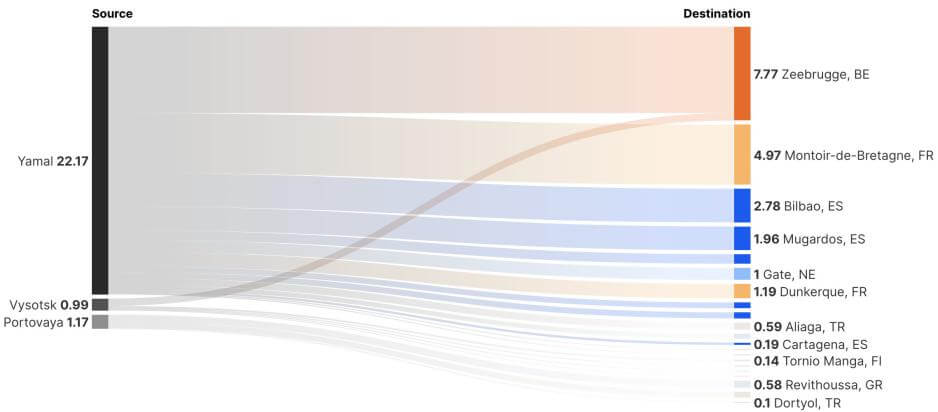

According to an analysis of AIS and trade data by the German NGO Urgewald, six European ports - dominant leader Zeebrugge, plus Montoir, Dunkerque, Bilbao, Mugardos and Rotterdam - handle LNG cargoes from Yamal. In addition, terminal operators in Zeebrugge and Montoir enable transshipment between Yamal's specialized icebreaking LNG carriers to conventional LNGCs for transport to customers in Turkey, China and Taiwan. This cuts the ton-mile utilization of Novatek's unique and costly vessels in half, freeing them up to do the task that only they can do: carry Russian LNG through icy waters.

The Zeebrugge terminal offloading da Yamal icebreaking LNG carrier, foreground, with a conventional LNGC moored at the adjacent pier (Fluxys / P. Henderyckx)

Since the start of the invasion of Ukraine, Yamal has shipped 34 million tonnes of LNG to EU ports, according to Urgewald, with about 20 percent of the total transshipped for onward delivery outside of the EU. That total includes about 1.8 million tonnes a month from Yamal, according to data from Kpler and the research group IEEFA.

IEEFA / Kpler

"The German federal government must ensure that the EU completely bans the import of Russian LNG and sanctions ships that call at Russian LNG ports. As a result, Yamal's exports would practically come to a standstill because Novatek simply lacks alternatives," said Urgewald campaigner Sebastian Rötters. "New Arc7 tankers are not in sight due to US sanctions. The EU must finally use this effective lever."

that matters most

Get the latest maritime news delivered to your inbox daily.

The EU is considering such a measure, but it is divided on how to do it. Russian LNG (virtually all from Yamal) accounted for about seven percent of the block's gas supply last year, according to the European Commission, and the imports are concentrated in some nations.

The current plan would give each EU member state the option to keep importing Russian LNG or block it, depending on its circumstances. Spain, a heavy importer of Russian LNG, has voiced concern that a patchwork of national sanctions could simply move the cargoes from one EU nation to a more lenient neighboring nation. The Belgian government is also concerned that the measure may not be strong enough to break the 20-year contract that governs the transshipment relationship between the Zeebrugge terminal and Novatek, according to High North News.