Ørsted Pulls Plug on Shipping E-Methanol Fuel Project Citing Slower Demand

Renewable energy giant Ørsted further highlighted the problems in the nascent sustainable fuel market for the shipping industry highlighting that it was unable to secure a contract at a reasonable for the offtake from its pioneering plant. The company surprised investors by reporting today that it has decided to defer the program known as FlagshipONE, which was under construction and due to begin production in 2025.

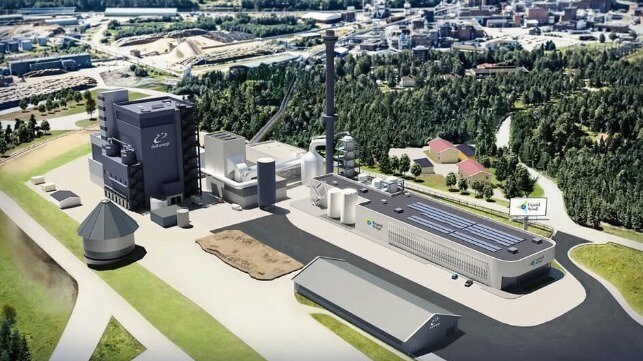

FlagshipONE was hailed as a game-changer in 2022 when Ørsted acquired the project while it was in the design phase from Swedish e-fuels company Liquid Wind. Expected to produce around 50,000 tonnes annually of e-methanol the project was using wind power in northern Sweden along with biogenic carbon from the nearby forestry industry. It was to use renewable energy and captured biogenic carbon dioxide in production while sharing steam, process water, and cooling water with a nearby plant and returning excess heat from production into the regional heating system.

“The liquid e-fuel market in Europe is developing slower than expected, and we have taken the strategic decision to de-prioritize our efforts within the market and cease the development of FlagshipONE,” Mads Nipper, Group President and CEO of Ørsted announced during the company’s half-yearly results announcement.

FlagshipONE's construction began in May 2023 with reports saying the company was expected to invest $175 million in the development of the pilot project. They said at the time it would signal a new era in green shipping.

Nipper said the company however was unable to secure long-term contracts for the e-methanol at a “viable price.” Based on this, Ørsted reports it has shut down the project and is taking an impairment charge of over $220 million this quarter related to ceasing execution of FlagshipONE.

“We will continue our focus and development efforts within renewable hydrogen, which is essential for decarbonizing key industries in Europe and closer to our core business,” Nipper told investors.

There continue to be discussions across the shipping industry and regulators about the challenges of developing a supply of sustainable fuels for the industry. One of the big concerns is the anticipated high prices far above traditional fuels with repeated calls for establishing surcharges and funds to help bridge the gap and build demand for the new fuels. Maersk, a strong proponent of methanol, recently admitted continuing challenges and confirmed it was looking at other biofuels and LNG as it moves forward this year with a fleet renewal effort for as many as 50 to 60 ships.

Ørsted’s decision to cease the methanol project comes as the company continues to execute a revised strategy after recording significant charges in 2023 including the ending of two planned large offshore windfarm projects in the U.S. It took further charges this quarter revising the value of the leases but reversed a charge for the Sunrise Wind project in the U.S. which it has decided to move forward after it was successful in its rebid with New York State.

In a further development which Nipped called “frustrating and unsatisfactory,” the company cited further problems in the “early stage” U.S. offshore wind energy market. While saying Ørsted’s portfolio overall is performing well, he said they are now experiencing delays related to Revolution Wind, a 704 MW project that has started construction offshore between Connecticut and Rhode Island.

“Despite encouraging progress on our U.S. offshore wind project Revolution Wind, the construction of the onshore substation for the project has been delayed,” Nipper announced today. “This means that we have pushed the commercial operation date from 2025 into 2026, which led to an impairment.”

that matters most

Get the latest maritime news delivered to your inbox daily.

The company recorded a nearly $309 million impairment charge due to the delays at Revolution Wind as part of an overall impairment charge of $470 million this quarter for all parts of its business. Reuters quotes Nipper as saying that it is no longer a supply chain problem in the U.SD. wind sector but a specific challenge with substation. He said offshore work at Revolution Wind was “going according to plan.”

Overall, he told investors that Ørsted’s operations are performing well and particularly the earnings from its offshore wind farms. He highlighted that it was maintaining EBITDA guidance for the full year, and increasing earnings expectations for Ørsted’s offshore wind business.