Fall in Bunker Prices Reduce Fuel Costs Dramatically

For a ship that burns 24 tonnes of fuel per day while steaming, fuel costs will be reduced by as much as USD 1 million a year if current price levels stay put. Assuming a difference from the average of the first half of 2014 at USD 578 for 380 cSt, High Sulfur Fuel Oil (HSFO) in Rotterdam, to a new level of USD 412, and a sailing time of 70%.

On an industry-wide scale, the drop has reduced the entire international shipping industry’s daily bunker costs by USD 117 million per day, assuming an annual market for bunker fuels of 257 million tons bought at spot price and a drop in prices by USD 166 per mt on HSFO. Actually, it may be even slightly higher, as prices for Marine Gas Oil (MGO) have slid USD 215 per mt, but no adjustment made for that.

Chief Shipping Analyst at BIMCO, Peter Sand, said: “The drop in oil prices mirrors the disappointing development in global GDP growth figures, where we have seen one downward revision followed by another this year.

"Despite the lower prices, bunkers remain the single most significant cost item for owners and operators. For a Handymax in current markets using abt. 24 tonnes a day, bunker costs amount to USD 10,000, close to twice the amount spent on OPEX (abt. USD 5,500 per day).

“Slow steaming is expected to remain an integrated part of shipping going forward in spite of the falling prices, as bunker costs are still significant and so is overcapacity in the freight market.

“The fall in oil prices and a strong start to the Winter season has spurred demand for tankers, lifting earnings within all tanker segments considerably.

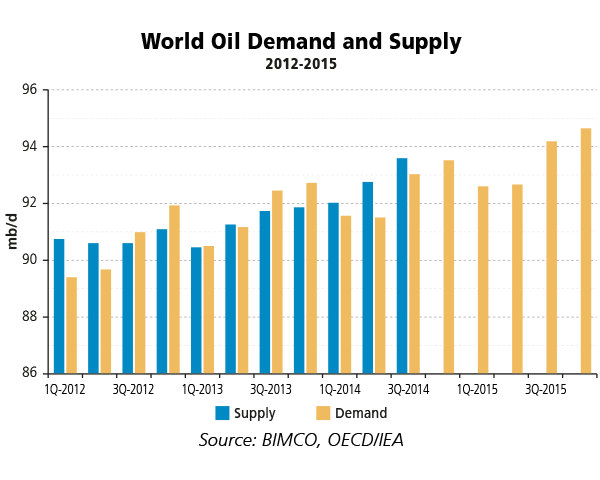

The unrest in the financial markets starting in Q3 and continuing into Q4 has sent the global oil prices down, due to more than adequate supply and less than adequate demand. The demand side is the real problem for ongoing world economic recovery and keeps “postponing” the arrival of a sustainable global and regional economic growth level.

According to IEA: “Specific economic concerns regarding Europe, China and Russia act as a drag on the forecast, removing 0.4 mb/d from the 4Q14 estimate compared to last month's Report [September], but year-on-year (y-o-y) growth still accelerates to 765 kb/d for 4Q14."

The upside from the slide in oil prices is lower energy costs for all, including the shipping industry, which welcomes lower bunker prices.

Going into the heating season in the northern hemisphere it is relevant to remember that money not spent on energy consumption may boost private spending on other goods and by that, lift private consumption and help the fragile recovery along.

1. During first half of 2014, average bunker fuel prices were: HSFO 578 per mt and MGO 911 per mt. For crude oil prices were: Brent 109 per barrel and WTI 101 per barrel.

2. Since mid-June, prices have known only one way, and that has been down.

3. According to Marine Bunker Exchange (MABUX), the current prices (20/11) are as follows: HSFO 412 per mt, MGO 696 per mt, Brent 79 per barrel and WTI 76 per barrel. The percentage falls have been respectively: 29%, 24%, 27% and 25%.

New data on key indicators sheds light on present, near-term and future shipping markets. This news piece follows up on BIMCO market reports and comments to commercial developments for the three main shipping segments.

---

Source: https://www.bimco.org