Iranian Oil Exports: Rising When They Should Be Falling?

President Trump’s strategy of cajoling Iran into negotiations appears to have gotten off the ground. A successful initial meeting has been held between US Middle East envoy Steve Witkoff and Iranian Foreign Minister Abbas Araghchi in Muscat on April 12, with the prospect nurtured by the Omanis that this will lead to a continuing dialogue.

Iranian leaders are reported to have reluctantly agreed to engage with the mediation effort in Muscat in large part because of fears that the internal security situation within Iran is fast deteriorating, jeopardizing the regime’s grip on power. This has been prompted by the worsening domestic economic situation and the loss of authority faced by the leadership following the series of reverses that the regime and its allies have suffered on the battlefield, with its Axis of Resistance strategy now thoroughly discredited.

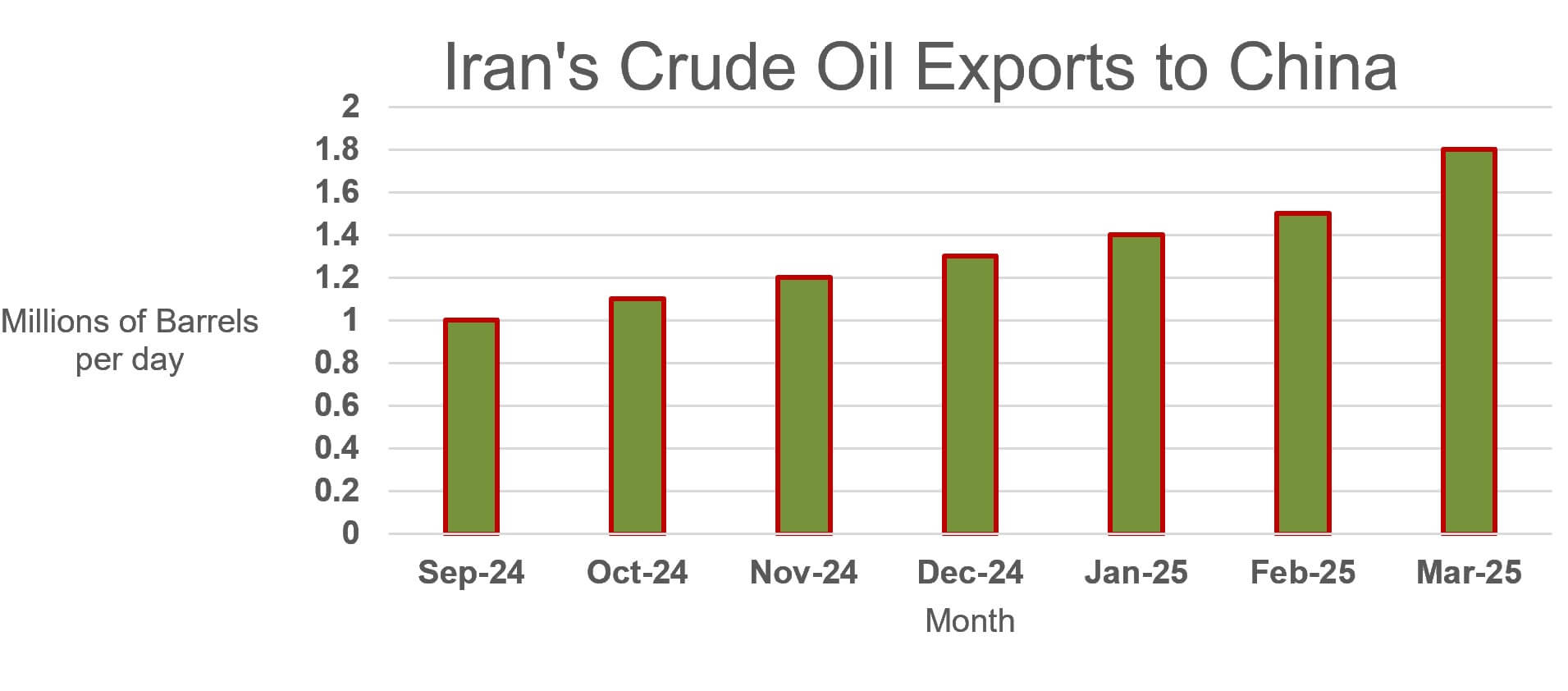

President Trump had intended to add to this mounting domestic pressure by sharply reducing the revenues Iran’s government relies on from oil exports. To encourage such a development, the Trump administration has accelerated a tightening of the oil sanctions regime on Iran which began in the latter days of the Biden presidency. In sanctions rounds announced on October 11 and December 3, 2024 and again on February 24 this year, the US Treasury expanded the lists of ships, brokers, tanker operators and shipping companies subject to OFAC sanctions for involvement in selling and transporting Iranian crude.

Kpler/Reuters data/CJRC

As yet, however, oil exports appear not to have been curbed, but indeed have accelerated to record levels. With some variation in figures reported by different agencies, the trend in Kpler data reported by Reuters shows Iranian exports increasing consistently since the presidential election, to reach a new high at the end of March. Some of this rise can probably be attributed to Chinese refiners buying while they still can, taking advantage of a $6 discount per barrel on sanctioned Iranian crude. Prior to the re-imposition of sanctions, Iran was exporting about 2.2 million barrels per day.

China is the recipient of about 90% of Iran’s oil exports. Kpler believes that in March, 16% of China's total imports of crude by sea came from Iran. While some reports suggested that private ‘teapot’ refiners were beginning to turn away Iranian crude, the evidence suggests that this is rarely yet happening. For example, Kpler reported that at the beginning of April, Aframax tankers Nereus Sophia (IMO: 9266853) and Turaco (IMO 9247780), both recently sanctioned by OFAC, discharged Iranian crude at the ports of Yangshan (Shanghai) and Dongying (Shandong Province), both of which service teapot refiners. Moreover, with China and the United States now engaged in a mutual tariff war, Chinese inclination to respect OFAC sanctions has probably reduced rather than tightened.

Agents still appear to be practicing deception by trans-shipping oil between shadow and non-sanctioned tankers in the anchorage east of Singapore, on paper converting Iranian into Malaysian-origin crude. Vesselfinder.com on April 13 shows a high concentration vessels transiting the Straits of Malacca as one might expect, but also of at least 50 static vessels static in international waters northeast of Bandar Penawar, in this traditional trans-shipment area.

Bloomberg has estimated, using satellite imagery, that 10 trans-shipments were occurring daily in 2020 and 20 per day in 2024. It appears from the concentration of the vessels in the box this week that the number of trans-shipments may have doubled again over the last 12 months.

All along the sanctions-busting chain, traders and shippers have developed skills and techniques to circumvent sanctions, and sanctions enforcement seemingly has not kept pace to the same degree. For US-led sanctions to be effective, a degree of willingness of other sovereign countries to cooperate is needed, and this may have been eroded in recent months as the tariff wars have commenced. Moreover, there is now competition in the black market from Russia, with it being no surprise that purchasing activity for end-of-life Supermaxes and VLCCs suited for dark fleet operations has increased recently. As volumes of discounted but sanctioned oil sales have increased, there has in consequence been knock-on downward pressure on market pricing of legitimately-trade crude.