Shipowners Weigh Tough Choices in Push for Cleaner Fuels

The IMO’s long-anticipated decarbonization strategy has been welcomed as monumental or slammed as a watered-down compromise. However one looks at it, the course is now charted for the industry’s journey toward emissions reduction, setting the tone for the next 25 years or so. With other specifics to be determined, its main three pillars are: net-zero by or around 2050; “indicative checkpoints” in 2030 (20-30%) and 2040 (70-80%); and 5-10% uptake by 2030 of zero/near zero emissions fuels, technologies or energy sources.

According to Clarksons, 44% of the orders during 1H 2023 were already alternatively fueled before the MEPC decision. Thus, one likely effect - compounded by the recently approved FuelEU Maritime - will be to accelerate the adoption of alternative fuels like ammonia, hydrogen, LNG or methanol (and applicable bio-versions).

When it comes to capital investments, however, such an assortment leaves shipowners and managers with a tough choice - one that comes with commercial, operational, financial, and technical risks, not to mention the sizable long-term extra costs. Such a predicament is not unprecedented in times of rapid change, when a widely accepted technology has yet to take hold. The aggregate decisions of market players and the availability of bunkering will be important and mutually reinforcing factors. A mix of common sense, emulation and coordination can help rationalize the system in the face of regulatory and societal pressures. In this regard, the orientation industry participants have been taking can help us gauge where things may be headed, with LNG and methanol emerging as the top alternative fuels.

Market favorability

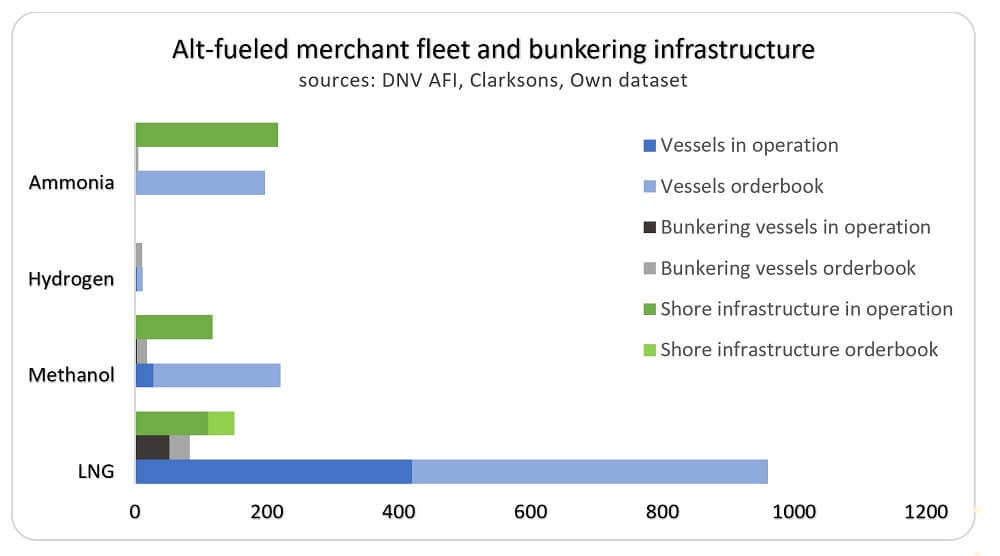

LNG enjoys a tried and tested technology, smoothly operating supply chain, and fungibility in terms of other uses. The EU’s decoupling from Russia has bolstered these advantages. LNG powers 93% of the active alternatively fueled fleet and 57.5% of the booked one. Bunker sales at Rotterdam in 2Q 2023 highlight its pick up, buoyed by lower than usual prices.

Methanol is the next choice, thanks to the ease of handling, lower GHG rating and growing interest of large players and other stakeholders. Today, it has small but fledgling bunkering fleet and a widespread shore infrastructure. It powers 6.3% of the alternative-fuel active fleet and 20.5% of the orderbook, but is set to top new orders in 2023.

Ammonia can count on a granular distribution infrastructure and 21% of the alternate-fuel orderbook. There are no active ships and only a handful of bunkering units at approval stage. Moreover, it still raises safety and environmental concerns. On the other hand, hydrogen has been trumpeted and shelved since the 1800s, but with its contemporary revival, investments have started to flow. The commissioning of planned infrastructure, new cheaper production methods including geological hydrogen could change the game.

Bunkering options

The widespread availability of reliable bunkering at key trading areas is another key consideration.

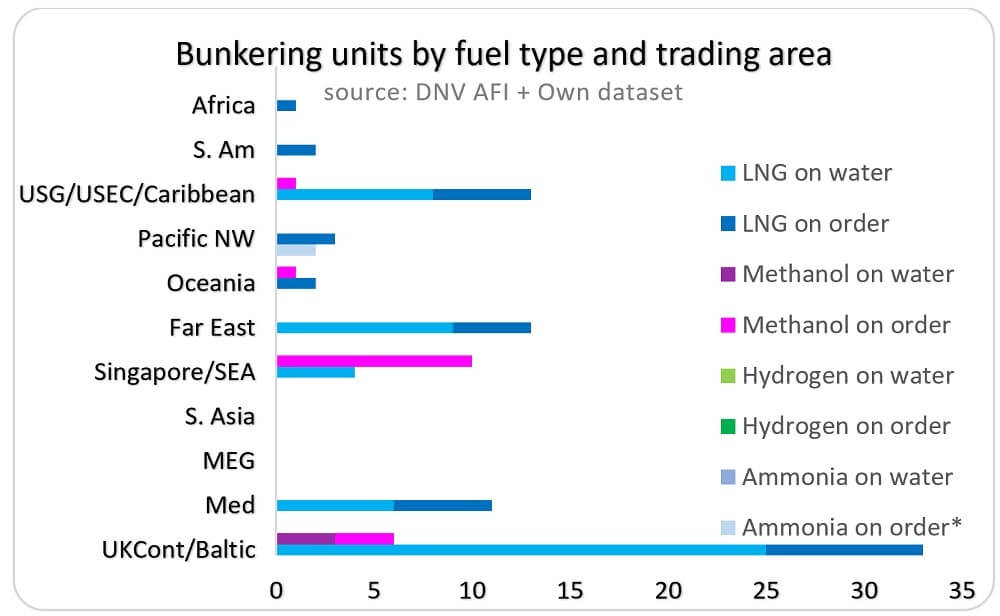

As far as mobile bunkering is concerned, LNG has the largest and most geographically spread fleet and will do for the foreseeable future. Some 52 tankers and barges are active: 25 in the UK/Continent/Baltic area, 6 in the Med, 4 around Singapore, 9 in the Far East, 8 in the US Gulf/Caribbean/USEC area. The fleet should reach 83 units by 2026, with coverage extended to Africa, Oceania, the Pacific Northwest and South America, as declared by owners/charterers.

Methanol trails far behind with only three dedicated bunkering vessels in service concentrated in the UK/Continent/Baltic area, and 15 on order. However, the technical standards for methanol seaborne carriage and ship-to-ship transfer are rather unspecific, making the designation of appropriate chemical tankers for bunkering relatively simple.

By contrast, there are currently no hydrogen or ammonia bunkering units afloat, but a handful of designs for the latter have received approval.

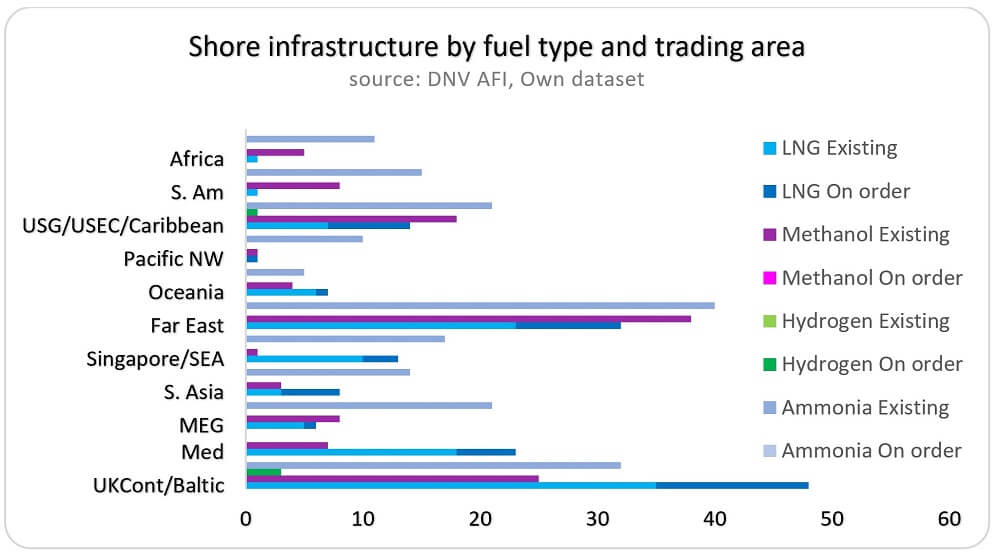

The shore infrastructure tells a slightly different story. Here, ammonia enjoys the most geographically diverse network thanks to its use as a fertilizer and feedstock. There are 217 installations worldwide with 32 in UK/Continent/Baltic, 31 in the Med, 21 in the Middle East, 14 in South Asia, 17 in Singapore/SE Asia, 40 in the Far East, 5 in Oceania, 10 in the Pacific Northwest, 21 in USGulf/USEC/Caribbean, 15 in South America, and 11 in Africa. By comparison, there are 118 locations for methanol, and 111 for LNG, which, however, has another 40 on order.

Alternate pathways

Despite receiving all the attention, “zero/near zero emissions fuels” are but one leg of a tripod of valid measures laid out by MEPC.

Another one is technology. This means that next generation scrubbers (such that can wash out CO2 particles) or biofuels can also foot the bill, within other constraints such as CII/EEXI and regional regulations. Some 5% of the merchant fleet is equipped with scrubbers and several innovative devices are entering the market that can capture carbon for disposal or to recycle it into the value chain. Shipowners will thus compare the net costs of capturing against newbuild/retrofitting.

The third leg is represented by zero/near zero energy sources. That could be anything from batteries to fuel cells to nuclear power.

Conclusion

The explosion in innovation that maritime’s environmental turn has set in motion is fascinating. But the durability of the fossil economy lies in the substance’s fungibility: one commodity, refining technology and supply chain to propel transportation, heating, energy, petrochemical manufacturing, trading, private and public finance, and money itself (the petrodollar). Such unmatched scale is mirrored in a price that, notwithstanding normal fluctuations, usually benefits fuel oils. The alternative fuels’ higher baseline describes the kind of challenge of shifting to a basket of fuels, with efforts to scale up all hampering the scalability of each. Related is the suboptimal yield of green energy when used to produce alternative marine fuels, heightened if the same limited input has to feed multiple processes.

that matters most

Get the latest maritime news delivered to your inbox daily.

Reflected in the 2023 Strategy, matters of sustainability were actually not lost on the MEPC, as the proliferation of asymmetric costs could alter the level playing field freight markets are known for. Hence the importance of squaring environmental and economic concerns.

Nicola Contessi is a Research Associate at the York Centre for Asian Research, Toronto specializing in Shipping and Transport.