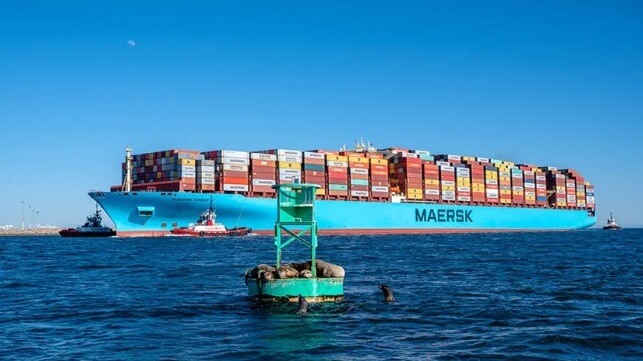

Maersk Reports Record Quarter While Cautioning of “Warning Clouds”

Shipping and logistics giant A.P. Moller – Maersk confirmed earlier forecasts for a record start to 2022 with profits coming in at their highest levels while also continuing to sound notes of caution over current market conditions and the outlook. Seen as a bellwether not only for the shipping industry but the global economy, Maersk is pointing to issues from rising operating costs, inflation’s impact on consumers, and the effects of the situations with Russia and China as creating uncertainties beyond the company’s previous forecast of a leveling off in the shipping markets in the second half of 2022.

“In Q1 we delivered the best earnings quarter ever in A.P. Moller - Maersk with growth across Ocean, Logistics, and Terminals. The increased earnings are driven by freight rates and by contracts being signed at higher levels,” said Søren Skou, CEO of A.P. Moller – Maersk. Pointing to the success of the company’s strategy to expand the operations in logistics and terminals, he highlighted that the terminal division had its best quarter ever.

Maersk’s shipping business reported a 64 percent increase in revenue during the first quarter of 2022 driven by strong freight rates. The strength of rates helped to drive the total company’s revenues in the quarter up 55 percent to $19.3 billion with earnings more than doubling over 2021 to $9.1 billion (EBITDA). The company generated $6 billion in free cash.

Maersk had previously said that it expected to see a normalization for the ocean shipping business starting in the second half of 2022 after the surges driven by consumer spending and the impacts of COVID-19 on global markets. Last month, Maersk tempered its forecast saying that based on emerging issues in the market they expected global container demand would be between a negative one percent and a positive one percent versus earlier forecasts for two to four percent growth in 2022.

Skou told the Financial Times in an interview today that he sees “warning clouds” gathering for the second half of the year. While saying it is too early to know the full impact he pointed to forecasts for a U.S. recession, slowing consumer spending, and lowered business confidence in Europe due to Russia’s invasion of Ukraine.

Maersk reduced the value of its Russian assets on its books as the company ended all business with the country. The last Maersk container ship left Russia at the beginning of this week after completing the remaining contracts in its system after it announced it was no longer accepting shipments to and from Russia. However, Maersk estimates it left 20,000 containers behind in Russia. In addition, they are negotiating the sale of their interest in Global Ports while also writing down the $485 million value of the investment. In total, Maersk reported impairment losses and write-downs totaling $718 million related to its Russian businesses.

While the lockdowns in Shanghai had little impact on the first quarter, Maersk is also raising concerns about further disruptions in the global supply chain and its shipping operations due to the Chinese lockdowns. They warned of the potential for worsening congestion in coming quarters related to China’s COVID-19 restrictions saying the global supply chain remains under significant pressure.

Operating costs for the company were up by 21 percent with fuel being the biggest factor. Maersk reported on average a 54 percent increase in bunker costs saying it was however being offset by freight rates and contracts being signed at higher levels.

that matters most

Get the latest maritime news delivered to your inbox daily.

The Financial Times reports that Skou told them that regulators are continuing to look at the profits in the shipping industry, but the investigations had concluded that “the higher profits were merely down to supply and demand dynamics.”

Those same issues are expected to continue to drive the company’s performance. Maersk repeated its forecasts that despite all the market issues it will earn $30 billion (EBITDA) in 2022 producing $19 billion in free cash flow that can be used to continue to drive the acquisitions and expansion of the company focusing on building out the logistics operations.