Three Maritime Transition Scenarios: Decarbonization Playbook Part 1

[By Mikael Lind, Wolfgang Lehmacher, Jeremy Bentham, Kirsi Tikka, Wim Thomas, Theo Notteboom, Steven Fries and Risto Penttilä]

The maritime transportation network is exposed to mounting risks caused by climate change-driven rising sea levels and more frequent and violent storms in addition to increasing societal pressure as a result of climate-driven environmental changes and events. Shipping as a critical component in global trade is forced to decarbonise to avoid that goods shift to other modes of transport in coastal and inland trades. In its own interest, therefore, the shipping industry needs to act urgently, collaboratively, and comprehensively across multiple dimensions on global warming to put the industry on a path to zero emissions. This need for rapid collective action is acknowledged by many of the industry’s major stakeholders and has been recognized recently in several publications.

The 2015 Paris Agreement commits countries to limit the global average temperature rise to well below 2°C above pre-industrial levels and to aim for 1.5°C and, additionally, the International Maritime Organization (IMO) has challenged the shipping industry to cut annual greenhouse gas (GHG) emissions by at least half by 2050, compared to 2008. Yet, while there is an increasing consensus that human activity has been causing more GHG emissions than the planet can handle, agreements or views on how to tackle this challenge are still patchy. Decision-makers in the public and private sector, and across the maritime value chains which are the object of decarbonisation, need better visions of plausible futures if they are to make choices that are robustly attractive in the face of inevitable uncertainties. Such perspectives can be prepared with the help of scenario thinking.

To choose strategically, decision-makers require powerful and practical planning tools. Outlining alternative maritime transition scenarios helps to identify different pathways towards a low-carbon zero-emission future. This can not only stimulate the development of new options for action, it also helps in assessing their resilience in the face of unavoidable uncertainties.

This article, derived from a study about decarbonising shipping, brings forward scenario thinking as such a foundational approach for strategic decision-making. Scenarios can help cargo owners / transport buyers, charterers / shipping companies / ship operators, ports, manufacturers, shipbuilders, energy companies, financial institutions, insurers, and regulators on national or global level envision the concerted and resilient actions that can decarbonise shipping.

How scenario thinking helps decarbonisation

Scenarios offer plausible alternative views of how the macro-environment might develop in the future, typically in the long term. Scenarios are not strategies in themselves, but alternative possible environments which strategies have to deal with. Scenario analysis is used in conditions of high uncertainty. The point of scenarios is more to learn than to predict.

Shell has recently published three energy transformation scenarios with clearly defined boundaries that shape pathways towards different futures. They consider the impact of different balances of socio-political priorities in the coming years as societies recover from recent and ongoing crises. All societies seek wealth, security, and health / well-being, but specific geo-economic circumstances and political choices may lead to one factor being particularly emphasised more than the others. This leads to different possible pathways for industrial development, energy transition and decarbonisation of the global economy across individual sectors.

The three Shell scenarios are Waves with wealth prioritised first, Islands with security first, and Sky 1.5 with health / well-being first (figure 1). The primary interests indicate where decarbonisation is placed on the agenda. Only in Sky 1.5 is the decarbonisation effort a continuous high priority, with its focus on well-being, learning from experience and from others, and reforming institutions whose weaknesses have been exposed through recent crises. In Islands, with its focus on autonomy and self-sufficiency, decarbonisation mainly happens when it fits into the local parameters, e.g., the local energy supply. In Waves, with its initial focus on short-term economic growth, decarbonisation initially happens only when financially viable in the short-term without targeted policy support or effective alignments between stakeholders (globally) to open new opportunities. Subsequent backlashes in Waves, however, occur eventually when extreme weather events are blamed on previous lack of action, leading to knee-jerk regulation driving rapid but disruptive decarbonisation.

Figure 1: The three Shell transition scenarios

Figure 1: The three Shell transition scenarios

Starting later than required to meet the goal of the Paris Agreement, Waves achieves an energy system with net-zero emissions eventually, thus implying a late but accelerated, disruptive and costly decarbonisation; the Paris goal is approached but not met in time. The Islands world overshoots the timeline significantly and does not achieve the goal of the Paris agreement. This scenario signifies a late and slow decarbonization, leading to a relatively costly adaptation compared to the other scenarios. In Sky 1.5, leading economies achieve the goal of net-zero by 2050, supporting less developed nations. The stretched aim of the Paris Accord is met supported by an accelerated decarbonisation now - coordinated and planned and, therefore, at lower cost compared to the two other scenarios.

Although this may only be a snapshot based on current sentiment, many think that we are living in a Waves environment with increasing tendencies towards Islands. Our priorities are not pure but mixed and gravitate towards one or two poles. Today the world gravitates strongly towards Waves because financial capital and short-term financial returns are perceived as dominant factors in securing resilience. But we also seem to move towards a stronger Islands future because of the current security concerns (homeland, food, energy etc.) influenced among other factors by the SARS-CoV-2 pandemic and a changing geopolitical landscape initiated by the war in Ukraine. Although this mixed reality may persist, there would be longer-horizon benefits from swiftly transitioning towards the behaviours explored in Sky 1.5 where lessons are learned from, e.g.:

- the successful combination of competitive and collaborative dynamics that drove accelerated vaccine development and spread of good medical practices in the face of the Covid-19 pandemic,

- the effectiveness in job creation of government supports for investments in developing and deploying new green technologies in responding to the 2008/9 global financial crisis,

- the domestic industrial advantages surfaced in the past by green technology development and deployment (e.g., in solar photovoltaic and electric vehicles) and the commercial competitive races this initiated

We cannot know in advance in detail which scenario will unfold, and we need to recognise this inescapable uncertainty, but scenario thinking can help guide us towards decisions most likely to be robust and attractive.

Three maritime transition scenarios and the need for pushing the boundaries

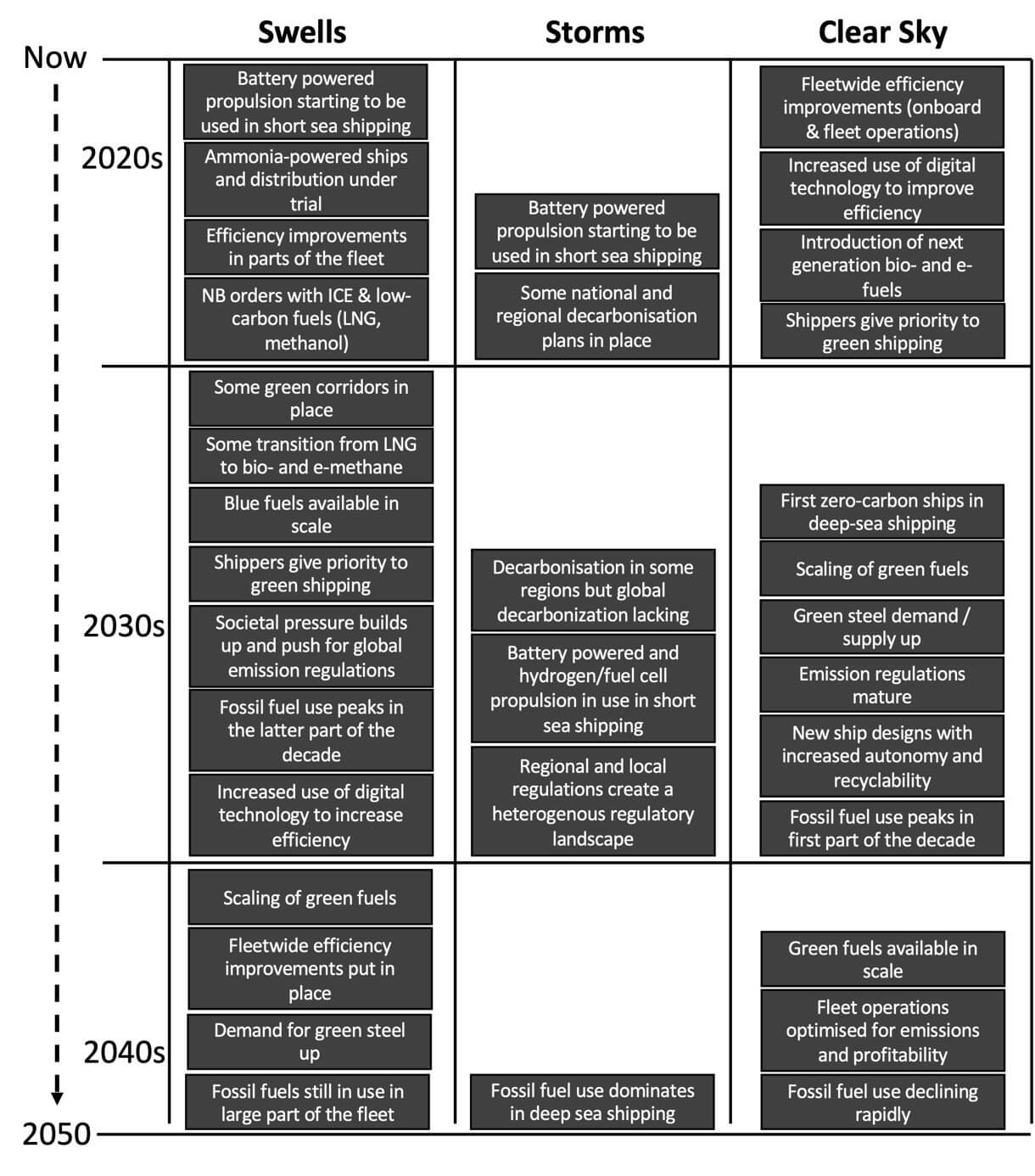

In the focused study we have undertaken, the three futures developed by Shell were expanded into the maritime transition scenarios Swells which puts economic recovery first, Storms with local / regional interests first, and Clear Sky with global maritime decarbonisation first – driven by competitive interests and alignments (figure 2).

Figure 2: Maritime Transition scenarios derived from the general (Shell) scenario narratives

Figure 2: Maritime Transition scenarios derived from the general (Shell) scenario narratives

Swells is the continuation of the fossil-fuel powered maritime sector until climate-related socio-political pressures have built up to such an extent that there is forced undertaking of everything thinkable and do-able to decarbonise shipping. Storms suffers from reduced global knowledge exchange and coordination due to its focus on local / regional solutions which may benefit decarbonising inland waterways shipping, shortsea shipping, and ferry services but not deep-sea shipping. In this scenario, therefore, progress in deep-sea operations is the result of initiatives launched by pioneering private sector players and partnerships transcending the silos. Only the Clear Sky maritime transition scenario brings global exchange, widespread alignments and collaboration that drives a steady decarbonisation of the maritime industry across the globe over all sub-segments and types of business models.

Different futures (scenarios) result in different pathways of decarbonisation in shipping in terms of intensity and timing. Mapping those scenarios helps us to make better decisions through encouraging the consideration of the robustness and attractiveness of actions across different circumstances.

However, while some of the wide-ranging futures that we have explored hold the potential to meet (or at least approach) the Paris goal across the global economy, none of the specific maritime pathways that we have envisaged brings the shipping industry anywhere close to the IMO 2018 ambitions on CO2 emissions, as offsets in other sectors and several external abatement measures were found. Under the influence of the different economic, policy and technical forces explored in the scenarios, shipping CO2 emissions initially grow from today’s level but are in decline at different rates by 2050. However, in absolute terms, they are actually still at a similar level to today. This is far in excess of the collective industry ambitions expressed through the IMO.

The good news is that scenarios are not cast in stone, but a tool to adjust our plans and actions to create a future that is most suitable to us. In the next section, we explore the pathways that the industry can promote that should drive strategies that ensure that the sector is aligned with the Paris agreement and exceeds the IMO 2018 ambitions.

The pathways that may take the maritime industry to zero by 2050

The three scenarios foster specific measures, with Clear Sky promoting widespread alignment and collaboration to introduce an entire range of decarbonisation measures called decarbonisation enablers within the shortest period possible.

Swells, with wealth first, sees the promotion of decarbonisation enablers that primarily deliver shorter term returns on investment. LNG is seen as a safe bet with favourable economics once the market re-stabilises after the Ukraine crisis. Some pioneers drive the first inroads into alternative fuels like using biodiesel in shortsea operations in the Baltic Sea and installing dual-fuel engines that are running also on methanol to reduce GHG emissions in deep-sea shipping. But the measures remain modest, and only when the socio-political climate-change backlashes are getting hyper-disruptive does the maritime ecosystem activate all steps to drive carbon dioxide emissions down as fast as possible. Therefore, the bundle of actions is largely backloaded and uncoordinated which causes a disruptive, overwhelming, and costly accelerated decarbonisation.

In Storms, countries and economic blocs focus primarily on self-sufficiency and what appears to be the narrowly defined interests of their nations. Local and regional decarbonisation enablers enjoy priority. China drives electricity-powered solutions in inland waterways navigation and shortsea operations. The EU drives the most aggressive decarbonisation agenda. Decisions within the local and regional areas are taken and implemented but bring tensions and additional costs for international operators. Hence some important measures are taken early on, but progress flattens later and there are frictions to innovation from depressed economic growth and limited diffusion of insights and new developments. So, in the 2040s the world finds itself in a deadlock.

In Clear Sky, self-interest is more broadly conceived both nationally and by individual businesses which pursue paths towards learning from experience and generating value through pursuing decarbonisation first and urgently. While remaining open to global alignment and collaboration, there is steady development and activation of decarbonisation enablers to generate domestic and commercial competitive advantages. Investments in innovation and global exchange of knowledge, experiences and best practices empowers every country to contribute to the global effort. The developed world is the main driver, but also assists developing countries in preparing, financing, and implementing their decarbonisation roadmaps. Governments align regulations, standards, and norms, and bring legislation for financial frameworks for investors and banks to encourage, enable and force decarbonisation, also through projects that foster collaboration such as coalitions that pursue accelerated maritime decarbonisation. The implementation of enablers is largely planned and prepared in the 2020s reaching its peak in the 2030s.

Figure 3: Major tipping point moments identified in decarbonising shipping

Figure 3: Major tipping point moments identified in decarbonising shipping

The scenarios also show that eventually the reality of technological, socio-political, and economic developments will prevail whatever we decide to do or not to do individually. Irrespective of the direction the world may take in the short run, sooner or later the stakeholders in the maritime industry will activate their respective bundles of decarbonisation enablers, either voluntarily or forced by regulators, economic or external realities. If the industry fails act early, the cost of later decarbonisation can be abrupt and needlessly high for the laggards.

Conclusions

The three maritime transition scenarios illustrate how the maritime industry will possibly perform against the IMO 2018 ambitions. These scenarios depict how the world may evolve and what possible roadmaps of sector decarbonisation may look like. They can also provide indicators in future on whether we are on track or fall short of our ambitions.

- Scenarios are good for raising our understanding about plausible futures to drive or stress-test our strategies and to stimulate the consideration of new possibilities

- They can ensure that our strategies are robust whatever the circumstances

- This can contribute to de-risking our investments in the future

- Scenarios also help actors to align forces in decarbonisation or crisis situations

- Pioneers can anticipate developments and give impetus to the industry while improving their own position in the market

The implications of the three explored maritime transition scenarios send a clear message: in its own interests, the maritime industry needs to act now and drive for more climate action. The private sector on the one hand can push boundaries to accelerate decarbonisation irrespective of the scenario that may play out, anticipating the costs of inaction and the value of future competitive advantages. The public sector on the other hand can facilitate the efforts by ensuring a level playing field and bridging the gaps that the private sector cannot close alone.

About the authors

Mikael Lind is the world’s first Professor of Maritime Informatics and is engaged at Chalmers, Sweden, and is also Senior Strategic Research Advisor at Research Institutes of Sweden (RISE). He serves as an expert for World Economic Forum, Europe’s Digital Transport Logistic Forum (DTLF), and UN/CEFACT. He is the co-editor of the first book of maritime informatics and the follow-up book recently published by Springer.

Wolfgang Lehmacher is operating partner at Anchor Group and advisor at Topan AG. The former head of supply chain and transport industries at the World Economic Forum and President and CEO Emeritus of GeoPost Intercontinental is also advisory board member of The Logistics and Supply Chain Management Society, ambassador of The European Freight and Logistics Leaders' Forum, advisor of GlobalSF, and founding member of the think tanks Logistikweisen and NEXST.

Jeremy Bentham is the Co-Chair (Scenarios) at World Energy Council and retired member of strategy leadership team at Shell. Leading scenarios expert. Previously Head of Shell Scenarios Team and Vice President of Global Business Environment at Shell International.

Kirsi Tikka has over 30 years of shipping experience, member of several boards and advisor to maritime start-ups, former Executive Vice President of American Bureau of Shipping.

Wim Thomas is energy scenario expert and former chief energy advisor at Shell. Non-Executive Director at MARIN, a world leading maritime research institute in the Netherlands.

Theo Notteboom is Professor at the University of Antwerpen. Professor in port and maritime economics and management with about 30 years of experience in this area in Europe and the Far East. Has published widely on port and maritime economics.

Steven Fries is an economist with expertise in energy, climate change and finance. Senior Associate Fellow at INET–Oxford, Nonresident Senior Fellow at the Peterson Institute for International Economics, and former chief economist at Shell and the UK Department of Energy and Climate Change.

Risto Penttilä is the CEO of Nordic West Office and Secretary General of the European Business Leaders’ Convention. Prior he was CEO of Finland’s Chamber of Commerce and Trustee of the International Institute for Strategic Studies. He has founded a political party, been a member of the Finnish parliament, and has worked for the World Economic Forum and Oxford Analytica.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.