Can China Use Offshore Wind to End Reliance on Foreign LNG and Coal?

And could that make Beijing more open to risk-taking, including vis-à-vis Taiwan?

[By Joseph Webster and Zoe Leung]

A worldwide scramble for energy supplies following Russia’s invasion of Ukraine has intensified China’s quest for energy security. The nation is doubling down on all forms of domestic energy generation – from coal to renewables – to lessen reliance on imports.

Major energy exporters to China, including the United States and Australia, have every reason to keep an eye on Chinese offshore wind development. China’s wind-generated power will significantly reduce and potentially eliminate its reliance on Australian thermal coal but is much less likely to remove China’s liquefied natural gas (LNG) needs.

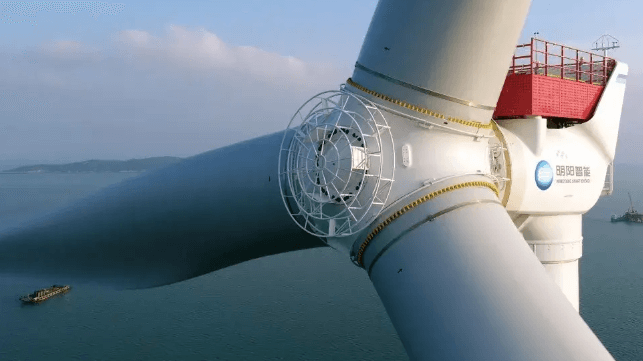

China’s offshore wind push

China’s primary energy policy objectives are security of supply and affordability, both of which have been affected by worldwide energy shortages triggered by surging post-Covid demand and supply disruptions from Russia’s invasion of Ukraine. Offshore wind electricity production is generated domestically, lessening China’s dependency on imported energy, especially as Chinese firms are dominant throughout wind supply chains.

Chinese offshore wind production enjoys strong economic and technical fundamentals. China’s southern coastal provinces have some of the world’s strongest offshore wind speeds. These provinces have comparatively high electricity prices yet relatively weak solar and onshore wind potential, and are far from domestic coal and natural gas production. Finally, China’s lavishly subsidized turbine manufacturing, shipbuilding, and steelmaking industries synergize with offshore wind.

But the push to develop offshore wind also has political elements.

China’s unrelenting offshore wind push supports China’s dual circulation strategy to shield its economy from external shocks while boosting indigenous innovation. Offshore wind generation is prominent in China’s current five-year plan lasting to 2025, which calls for mastering deepwater wind technologies and developing low-frequency power transmission systems to facilitate high-capacity offshore facilities. It also sets guidelines for large-scale offshore wind turbine demonstration projects. The development is also central to the country’s plan to build a “new energy system”, which highlights this decade as a period of “accelerated transition” on the way to China’s 2045 and 2060 goals.

These plans incentivize Chinese coastal jurisdictions to develop their offshore wind potential. Building local power generation is highly attractive to municipal governments, which own the rights to develop maritime resources. Moreover, local production leaves them less dependent on other provinces for electricity – and therefore less vulnerable to China’s extremely fraught inter-provincial power trade.

Coal imports are on the way out – LNG is here to stay

China’s offshore wind industry is massive, poised to grow further, and will enable coastal regions to displace coal consumption – and imports.

In 2022, coal accounted for 55 percent of China’s primary energy consumption and 61 percent of its overall electricity mix. China is also largely self-sufficient in metallurgical coal used for steelmaking but imports the thermal coal used for electricity generation, especially in southern provinces.

China’s offshore wind development will, all things being equal, reduce its needs for imported and domestically produced thermal coal for electricity generation. This will be especially true during winter, when China’s offshore wind speeds and generation peak.

Interestingly, China has also stockpiled record levels of coal, with inventories tripling in the past two years, according to Australia’s Department of Industry, Science and Resources. China’s development of offshore wind and other renewables, as well as its stockpiling of coal inventories, may enable it to zero out coal imports much faster than many anticipate. A 2021 Australian National University paper by Jorrit Gosens, Alex Turnbull, and Frank Jotzo predicting reduced Chinese overseas coal imports appears highly prescient.

China’s offshore wind electricity generation will reduce thermal coal consumption, pollution and carbon dioxide emissions. These are highly positive developments.

At the same time, and less favorably, China’s development of offshore wind and other renewables will lessen its reliance on energy imports. Consequently, Beijing might become more risk-seeking, including vis-à-vis Taiwan.

Offshore wind could also impact China’s natural gas imports, as coastal provinces that rely on LNG for power generation will, all things being equal, reduce imports as offshore wind generation rises. Offshore wind electricity generation cannot replace all of China’s natural gas demand, however. Industry and heating comprised 42 percent and 33 percent of Chinese natural gas consumption in 2022; electricity accounted for only 17 percent. Meanwhile, LNG accounted for 25 percent of all Chinese natural gas consumption in 2022.

Moreover, China is building dozens of gigawatts of new gas-fired baseload power capacity along coastal provinces, along with new LNG import terminals, suggesting LNG for power burn could rise, at least over the medium term. While Chinese natural gas data is not transparent, offshore wind electricity generation cannot by itself eliminate LNG imports.

Renewables, heat pumps, and clean hydrogen could – and likely will – eventually eliminate China’s LNG demand, but these developments are very far off, for now, barring a dramatic policy shift.

In sum, China’s offshore wind buildout is beneficial for the climate, yet it will also lessen Beijing’s reliance on hydrocarbon imports from Australia and the United States. Offshore wind will notably limit China’s exposure to Australia’s thermal coal exports. Western policymakers should continue to closely monitor Beijing’s energy security strategy for signs of potential aggression against Taiwan.

This article represents the authors’ personal opinions.

Joseph Webster is a senior fellow at the Atlantic Council’s Global Energy Center, where he leads the center’s efforts on Chinese energy security and specialises in energy geopolitics.

Zoe Leung is the former senior director of research at the George H. W. Bush Foundation for US-China Relations.

This article appears courtesy of The Lowy Interpreter and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.