Containership TEU Capacity Orders at All-Time High Says Alphaliner

Analysts have highlighted over the past few years the dramatic growth in containership newbuilding but according to the well-known group Alphaliner, the pace is not likely to slow both due to demand and the need to revitalize aging fleets. Carriers are under pressure to modernize and expand their fleets both to meet the need for additional capacity as well as the emerging environmental regulations.

The orderbook for containership construction continues to reach new heights with Alphaliner reporting in an analysis that in terms of TEU capacity orders are the largest they have ever been. Alphaliner’s closely followed Top 100 ranking of the sector shows container shipping has reached new levels with a capacity of nearly 30.9 million TEU. They calculate there are 7,125 active vessels representing a total of 366 million dwt.

Despite the dramatic growth, Alphaliner says orders are at a high with the Top 10 ocean carriers alone having placed orders for 431 containerships. While shipbuilding orders have overall slowed containerships remain strong. Clarkson Research said for example orders were down overall 25 percent year-over-year in September to a total of 90 vessels of all types representing 2.89 million CGT with a total backlog of over 149 million CGT.

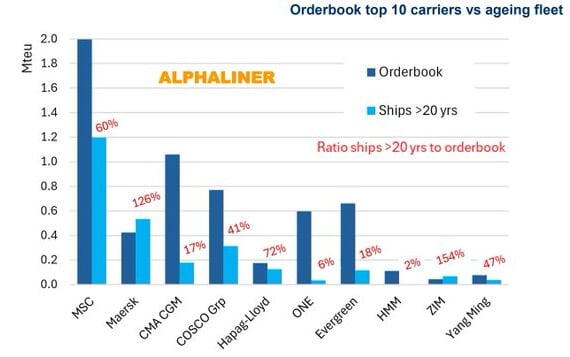

Alphaliner points to the largest container carriers' building spree. Current orders they report represent 5.9 million TEU among the Top 10 carriers. The number is more dramatic when considering the Top 10 currently have a capacity of approximately 25.8 million TEU meaning the orderbook is nearly 23 percent of current capacity. Some of the orders are not yet committed with long-term charters meaning it is likely to drive the numbers even higher this year.

Several major newbuilding deals are also currently under negotiation. Hapag-Lloyd for example is rumored to be moving forward with a significant order while many of the large carriers have declared publicly some of their orders. MSC also remains very active and never confirms its orders.

Top 10 carriers' aging fleet (Alphaliner)

“This year’s ordering frenzy was, at least in part, driven by carriers’ ambitions to increase vessel efficiency and make greater use of alternative fuels such as LNG or methanol,” observes Alphaliner. Apart from cost reductions, Alphaliner says the overall aim is to decrease CO2 emissions per container over a given distance.

The need for fleet renewal however is also a big driver behind the continuing orders says Alphaliner. They write that “some carriers simply need new tonnage to rejuvenate their fleets.”

Alphaliner calculates that among the Top 10 carriers, lines still operate 683 vessels 20 years or older. That is nearly a fifth (18 percent) of the total of approximately 3,800 vessels operated by the Top 10 carriers. These older vessels have a combined 2.6 million TEU of capacity.

Companies such as MSC have been sending a few of its oldest vessels for recycling. This week it was reported that MSC sold the MSC Adele (1,900 TEU) a 38-year-old vessel for demolition. Even smaller carriers such as Wan Hai in 2023 moved to recycle older ships by selling off 10 vessels dating to the early to mid-1990s for recycling.

that matters most

Get the latest maritime news delivered to your inbox daily.

Maersk in August detailed its fleet renewal efforts reporting it planned to add 50 to 60 new vessels with a total of 800,000 TEU of capacity. The ships which will be either owned or long-term charters will join the fleet between 2026 and 2030 the company said while it seeks to maintain overall capacity at around the current 4.2 million TEU level. Maersk had previously reported orders for 25 owned vessels representing 350,000 TEU of capacity.