Bands, Beams and Bytes

(Article originally published in Nov/Dec 2016 edition.)

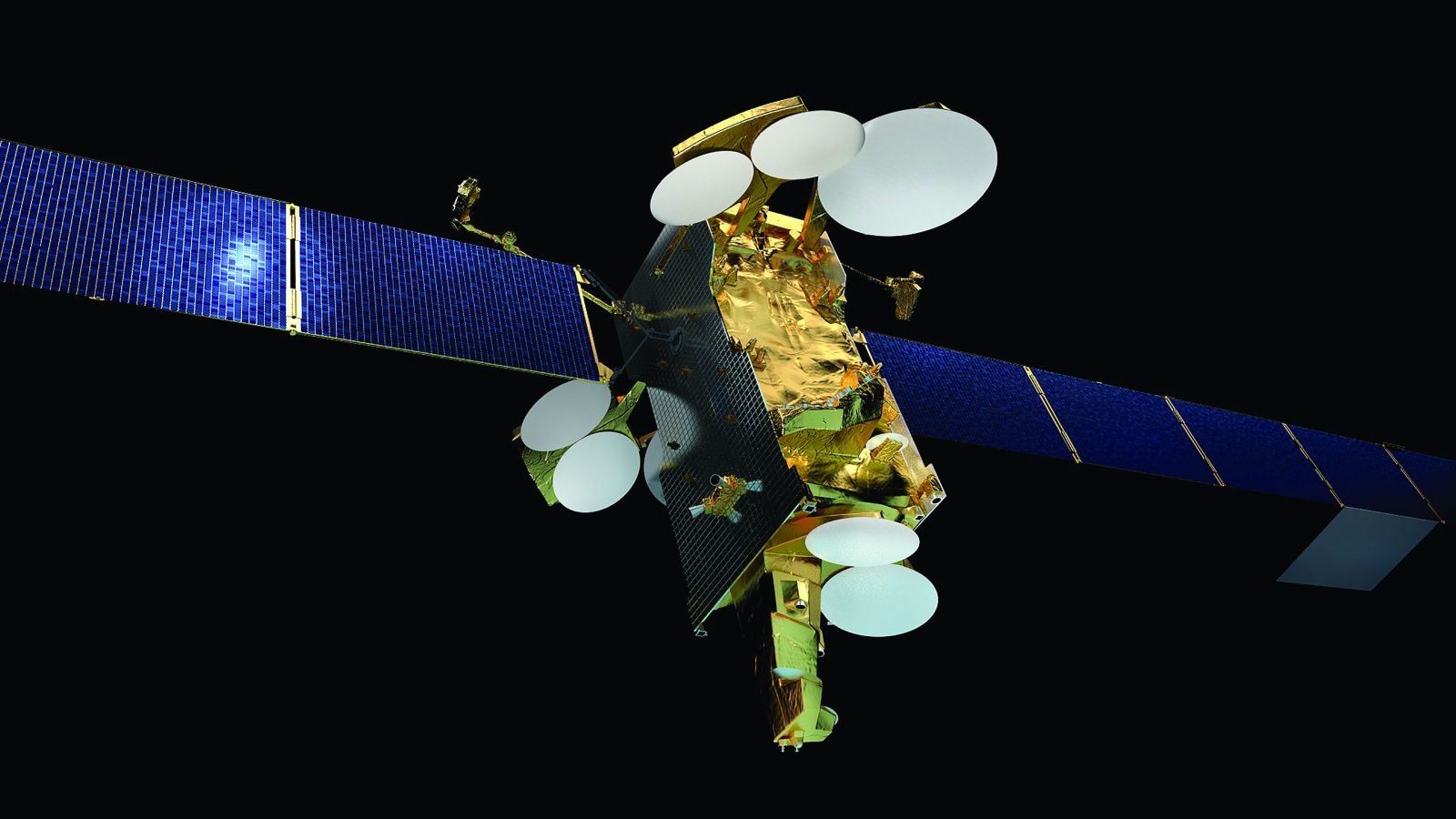

A new generation of satellites is helping meet the demand for high-throughput services.

By Wendy Laursen

Ship operators and satcom companies alike are talking up the perfect storm that is accelerating demand for high-throughput communications technology: bring-your-own-device connectivity, crew welfare and training, voyage planning, condition monitoring, cargo visibility, vessel management from shore and, ultimately, unmanned ships.

Global maritime data is expected to increase eight-fold over the next five years, and high-throughput satellites are proliferating. These geostationary earth orbit (GEO) or closer-to-earth medium earth orbit (MEO) platforms deliver vastly increased bandwidth by optimizing and reusing frequencies. This results in lower cost per byte and more affordable connectivity solutions, opening up an array of new possibilities.

Hybrid Platforms

To meet growing demand, Inmarsat spends around $1.5 billion on new satellites every three to five years. The company is now operating its third, fourth and fifth-generation satellite constellations and has announced that its next-generation I-6 satellites will launch in 2020.

I-6 will be a hybrid platform, a first for Inmarsat, and will combine Ka- and L-band payloads. “This will maintain and complement our existing services and at the same time demonstrate our continuing commitment to L-band for safety at sea,” explains Peter Broadhurst, Senior Vice President for Maritime Safety and Security.

The company’s latest service offering, Fleet Xpress, already features a redundant system, switching automatically between Ka-band and L-band for unlimited backup to meet its 99.95 percent availability target. Traffic is routed seamlessly over the available networks, and Broadhurst says Inmarsat offers data rates suitable for today’s manned and tomorrow’s autonomous vessels.

SES announced its new global Maritime+ service in September, which leverages the company’s fleet of over 50 satellites with capacity in C-, Ku- and Ka-bands. The company acquired O3b Networks in August to add high-throughput MEO platforms to its existing GEO infrastructure. Each O3b satellite has 10 spot beams that can be independently steered in real time to follow one or more ships.

O3b’s connectivity solution for offshore oil and gas, O3bEnergy, is an alternative to laying fiber cables. The low-latency, high-bandwidth solution makes high-speed connectivity between vessels or rigs and the shore possible, and RigNet and O3b are currently introducing it in the Gulf of Mexico. The steerable spot beams on the satellites also mean that any platform can be connected quickly and capacity can be easily moved or increased depending on the needs of the facility.

SES’s next series of GEO satellites, expected online over the next few years. will be hybrid platforms that have both high-throughput beams as well as traditional wide beams.

Boosting Throughput

Ka-band satellites typically implement wideband transponders (300MHz-600MHz) compared to the typical 27MHz-54MHz Ku-band transponders. Ka-band is more susceptible to atmospheric interference than Ku-band, which is more susceptible than L-band. Generally, Ka-band transponders can be combined with advanced VSAT transmission technology to achieve 10 to 100 times the throughput of traditional Ku-band satellites.

However, Intelsat says its new Ku-band EpicNG platform enables throughput at a rate about 10 times that of traditional satellites and three times that of next-generation Ka-band maritime solutions. Intelsat’s service providers deliver satellite connectivity to 298 of the world’s 316 largest cruise ships. The first EpicNG satellite was launched in January to provide coverage of the Caribbean and Atlantic routes. The second went into space in August to provide spot-beam coverage in the Mediterranean and Asia, Africa and the Middle East. Five other satellites will complete the company’s global EpicNG footprint over the next several years.

Intelsat has also made the strategic decision to remain with Ku-band when it launches its next round of satellites beginning in 2018. The company’s continued focus on Ku- and C-band frequencies means ships can use existing antennas rather than having to install new equipment, as is required for new Ka-band satellites.

New Applications

Service providers have already had success with the new platforms. Marel Electronics recently signed a contract with Hellenic Seaways for Telenor’s THOR 7 Ka-band high-speed connectivity services across its entire fleet, and Marlink will provide broadband connectivity using Intelsat EpicNG satellites to MSC Cruises’ 12 ships.

New applications have been making waves all year. Marlink launched a telemedicine service in September, XChange Telemed, and recently completed full integration of Inmarsat’s Fleet Xpress across its network, enabling access to a range of options that include its XChange communication management platform with bring-your-own-device crew connectivity.

Fleet Xpress is also fully integrated within the Speedcast SIGMA gateway, and in August Navarino entered into a new agreement to integrate Fleet Xpress into its service portfolio. Satlink Satellite Communications’ Satbox and Tracklite services will soon become integrated as value-added features of Fleet Xpress. Satlink’s customer base includes MSC Ship Management and Columbia Shipmanagement, and Inmarsat expects 12,500 ships to be using Fleet Xpress in five years.

KVH recently shipped its 6,000th VSAT system and already has a portfolio of applications in place for crew entertainment, training and ship operation. “We see data usage at sea going up every month for all areas of shipping,” says Chief Operating Officer Brent Bruun. However, the company’s usage-based airtime plans, now favored by a majority of customers including BW, Seaspan and SMIT Lamnalco, also cater to smaller data users by providing customers with the fastest speeds on the network regardless of how much data they have committed to on a monthly basis. This contrasts with many other plans that only deliver the fastest speeds to customers buying the largest airtime packages.

KVH’s TracPhone V11-IP ensures seamless connectivity between C-band and Ku-band in all the major shipping lanes. “With other providers, there can be more of a patchwork approach so that hardware or software changes may be needed when moving among regions,” says Bruun. The ability of fleet operators to get satellite communications service and hardware in one package also helps ensure high performance and reliability.

In October, ITC Global released an enhanced version of ITC Crew LIVE for wireless communication and entertainment. The enhancements include increased upload and download speeds and regional-to-global beam-switching capabilities on a single antenna, supported by Panasonic’s satellite network. The system allows the separation of operational and crew networks onboard, and ITC Global says this feature removes the security risks associated with allowing crew to connect across the same link as corporate traffic.

Inmarsat is tackling cyber security with the launch of an end-to-end system in the first quarter of 2017. The service will be based on Unified Threat Management software from Trustwave, Singtel’s cyber security arm. It will be integrated with Inmarsat hardware and delivered through Fleet Xpress to offer defenses such as firewalls, anti-virus, intrusion-prevention and web-filtering.

The ever-increasing demand for higher data throughput has triggered development of more powerful hardware systems, including hand-held devices. Globalstar’s satellite phone now provides up to four times the data speed of many competitors to facilitate email and file transfers. “There appears to be a merger of technology, price and demand,” says Regional Sales Manager Ron Wright. “This has led to the development of inexpensive technology that can be mass-deployed to monitor personnel and equipment.”

Fixed equipment is also being revolutionized. Cobham has released a new version of its SAILOR 900 VSAT Ku-band antenna to suit the new satcom offerings. All antennas work on high-throughput satellite services including Intelsat's EpicNG. They can also be converted from Ku- to Ka-band operation on services like Inmarsat’s Fleet Xpress or Telenor’s THOR 7.

Intellian Technologies entered into a partnership with Inmarsat in September aimed at accelerating the transition to Fleet Xpress. The partnership will simplify the procurement and installation of shipboard equipment as Inmarsat’s value-added resellers can source all Fleet Xpress-related shipboard equipment, including the Intellian GX100 or GX60 above-deck unit and Intellian’s FleetBroadband 500 system, directly from Intellian.

Expanding Frontiers

Matthew Galston, Director of Product Management at Intellian, says so much is changing that it is important to consider the future: “There’s more to consider than just frequency band. Intellian’s v100 can be easily converted from Ku- to Ka-band. That’s the easy part. More complicated are the switches that may occur even within a single frequency. This is where technology features like single cable versus dual cable come into play. Today, people may look at a system that has a single cable connecting below deck and above deck as an advantage, but this is not really the case. A single cable has limitations from a radio frequency (RF) perspective, and it seems we’re already seeing the systems that have only the one cable reaching the limits of their performance capabilities.”

Galston adds that “As satellites get more powerful, you will need dual cables to support these new, higher throughput services that want more RF power, and those changes are probably coming sooner than we think.”

Also coming is a rethink on applications. “The shipping industry moves 90 percent of the world’s goods,” says Galston, “and it owns all of that data. What industries out there would pay for access to very high-resolution, very real-time information about the location, condition and flow of these goods? Wall Street? Insurance companies? Global big data companies such as Google, IBM or others? The time has come for that conversation to start on an industry-wide scale.” – MarEx

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.