The "Real Time" Decision to Scrap

Greeks are leading the way in scrapping bulk carriers, reports World Maritime News. The title of the article, however, which states that they have scrapped the most "in 2015", is premature - after all, we are only in July 2015 which still leaves over half of Q3 and all of Q4. But the general trend does appear to be positive, as recently confirmed by BIMCO.

The Greeks are followed by the Chinese in tonnage scrapped; taken together, the two nations have caused the (timely) demise of 125 vessels, including 27 Capesizes. We are looking at approximately nine million deadweight tons (dwt) out of commission between the two countries (according to BIMCO, the dry bulk dwt demolished in the first half of 2015, in total, worldwide, was 20 million dwt).

That is certainly enough to make a dent in the market, but the order book for 2015 indicates that around 50 million dwt are to be delivered.

.png)

So given that newbuildings still exceed scrapped ships by a factor of five, what is the cause of the gradual improvement in dry bulk charter rates? In 2013, BIMCO/Clarksons projected that newbuild deliveries in 2015 would equal roughly 50 million dwt and demolitions would be equal to roughly 16-17 million dwt.

So we have 50 million dwt which are to be delivered in 2015 (this matches the estimate from 2012), but at the halfway mark of 2015 we already have as many dwt demolished as estimated for all of 2015. Demolitions are proceeding faster and more intensively than anticipated. If this rate continues, demolitions ought to be double what the above estimate would have indicated for the ongoing year, if not more.

Although it is perhaps coincidence (or rather correlation, instead of causation), the Baltic Dry Index reached an historic low early in 2015, plunging to just over 500 points in February from just under 800 points in January. Assuming some modest lead time in order to find scrapyard capacity, move ships around and get all of the legal paperwork in order, we see a peak of demolitions in April and then a drop-off in May and June, when rates started to recover.

.png)

.png)

June, when the recovery was in full swing, sees a sudden drop in scrapping.

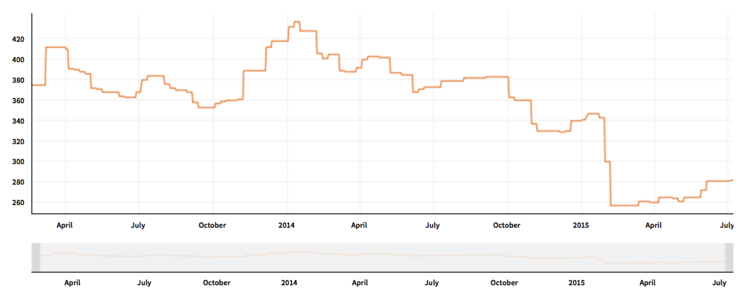

If we look now at U.S. shredded steel scrap prices for the time period from April 2014 to July 2015, we see that the growth in scrapping activity coincides with a decline of scrap metal prices on U.S. exchanges (which are reflective of global scrap metal prices). It makes sense that the peak in scrapping ships takes place in the month of April, which led to a massive influx of scrap metal into the market and contributed to a collapse in scrap metal prices. Millions upon millions of tons of scrap metal entering the market depressed prices by increasing supply.

Since in shipping, the market is almost always fully utilized; all capacity is deployed and charter rates contain very little slack - they represent costs in "real time." Few if any ships simply lounge around awaiting charterparties; such demurrage is too costly. Whether or not it makes sense to scrap a ship is thus driven by such "real time" considerations as well.

The fall-off in scrap metal prices thus does not signify good times ahead, given that savvy shipowners will understand that the residual scrap value in their ships is a fraction of what it was a year ago.

Given that Baltic Dry Index improvement is going hand in hand with a drop off in the scrap value of ships, it will be more desirable to use bulkers as bulkers rather than as scrap metal. It is quite likely, in our view, that on account of these economic considerations, scrapping activity will slow down and that order books will increase in reaction to these two trends.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.