U.S. GOM Rigs in Decline

As crude oil prices tumble, the number of active offshore rigs has declined by about 20 percent worldwide since 2014. In August 2015, there were 377 active rigs compared to just 304 in August 2015.

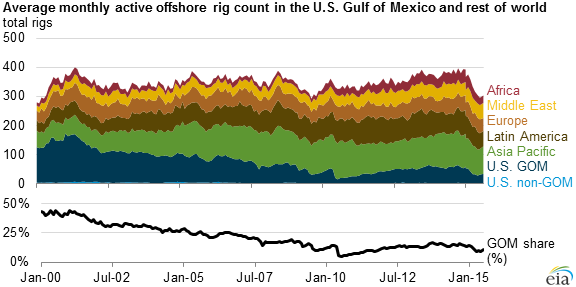

But the number of active offshore rigs in the U.S. Gulf of Mexico (GOM) has fallen more rapidly as more than 46 percent of the rigs are unused compared to 2014. Over the past 15 years, the U.S. GOM's share of active offshore rigs worldwide has declined significantly—from almost half of all active offshore rigs worldwide in 2000 to less than 20 percent since 2008.

In the U.S. GOM, technology advancements accelerated the development of the deepwater. The move to deeper waters prompted the departure of rigs operating in the shallow waters of the U.S. GOM.

Natural gas prospects in the U.S. GOM have also become less profitable, as the largely shale-driven increase in onshore natural gas supply contributed to decreases in U.S. natural gas prices. The number of active offshore rigs in the U.S. GOM declined from 122 in January 2000 to 41 in January 2010, before falling to 19 in June 2010 following the Deepwater Horizon offshore explosion and blowout.

The U.S. GOM active offshore rig count recovered to 57 by December 2014, and currently the number is 33.

From 2000 to 2006, the share of active rigs operating offshore in Asia Pacific, the Middle East, and Latin America grew significantly. That share remained steady over the past decade. The expansion of offshore drilling in India and China largely accounted for the growth in offshore rigs in the Asia Pacific region. During the early 2000s, Qatar and Iran accounted for much of the growth in active offshore rigs in the Middle East, with Saudi Arabia accounting for a large portion of the regional growth since 2006. Mexico accounted for the growth in active offshore rigs in Latin America in the early 2000s, as national oil company Pemex increased its offshore activity to arrest declining production from aging fields. Since 2006, Brazil has been responsible for much of Latin America's growth.

Most of the more recent growth in active offshore rigs outside the United States has occurred in Africa. Angola and Nigeria account for much of the growth in the region after 2010. Angola has more than 10 offshore oil projects expected to come online within the next five years. Nigeria's offshore activities have been focusing on the deepwater and ultra-deepwater; at least three deepwater projects are in development and are projected to come online within the next five years.

SOURCE: U.S. Energy Information Administration