Ship Operating Costs May Rise in 2016

With plummeting container rates, a persistently weak bulker market, a downturn in offshore oil, and widespread talk of consolidation, shipowners of all vessel types are looking for some bright spots in their forecasts. Even profitable tanker operators may have cause for concern beyond 2016, experts say.

It's hard to set profitable prices in an oversupplied market. With revenue in decline, owners from Maersk to Hornbeck have clamped down on cost by stacking ships, cancelling newbuilds, reducing head counts, and looking for efficiencies in fleet OPEX.

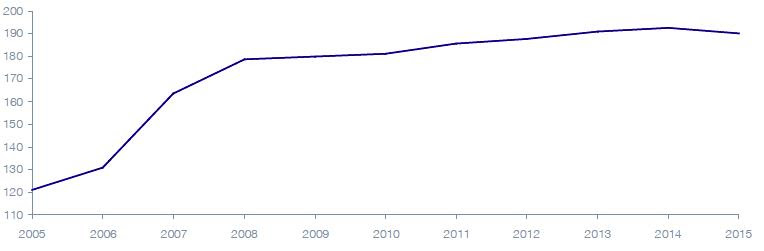

But maritime research firm Drewry says that reduced ship operating costs, which were down in 2015 by about 1 percent overall for cargo vessels, may not continue in 2016.

However, the cost of operating cargo ships is forecast to rise over the next two years after falling in 2015, according Drewry's Ship Operating Costs Annual Review and Forecast 2015/16.

“Operating costs are likely to rise in the future, as the scope for further cost cutting is in most cases quite limited. However, the expected increases in 2016 and 2017 are likely to be modest in nature as we anticipate only small rises in the cost of lube oils and other commodities; with a relatively weak global economy inflation is also expected to remain low,” commented Nigel Gardiner, Managing Director at Drewry.

Modest increases in manning costs are in the pipeline given the raises agreed to in International Transport Workers’ Federation (ITF) wage scales for 2016 and 2017. Additionally, if freight markets improve, hull values for modern vessels will rise and this should lead to higher hull and machinery (H&M) premiums, but only small increases are expected in 2016 and 2017.

Deferred maintenance over the past few years may also come back to affect costs.

“Expenditure on repairs and maintenance (R&M) has for many owners been cut back and when markets improve we expect some “catching up” to take place. Hence, the expectation is that expenditure on R&M will rise faster than inflation”, said Gardiner.

Drewry's full report includes cost analysis and five-year forecasts for nearly 40 vessel classes.

Drewry - total operating cost index (2000=100)

Low Oil Prices Could Help Control Cost

The bright spot for shipping companies could be in the bunker forecasts. Analysts have issued bearish outlooks for the future of crude oil and HFO prices. Bunkering has historically accounted for as much as 60% of vessel operating expenditures for container ships and other cargo ship classes.

World bunker averages track the price of Brent crude, and the benchmark BunkerWorld Index is down by nearly half since 2014 as oil prices have dropped.

But lately the details of that relationship have been changing, say analysts. MGO and HFO prices as a percentage of Brent crude have diverged as MARPOL VI requirements boost demand for MGO and cut it for HFO. Forecasts predict that MGO will become relatively more costly as HFO continues to fall – and spot prices for both may stay low, since crude is expected to remain inexpensive.

In October, the World Bank released a forecast for a 4% drop in inflation-adjusted Brent crude prices in 2016, followed by increases in the long-term forecast 2017-2025. Separately, a recent average of the crude index forecasts of 13 American investment banks found their predictions at below $60/barrel for 2016.