At ASBA, Navig8 Forecasts Stabilizing Tanker Supply

Leading tanker operators Teekay and Navig8 say that weak tanker day rates have had an effect on shipowners and on vessel values, but with a fall-off in vessel ordering activity, better times may be ahead.

In August, rates for mid-size dirty tankers fell below $10,000 per day; part of this was seasonal, Teekay said in its latest market update, but the firm also notes some additional structural factors weighing on the market.

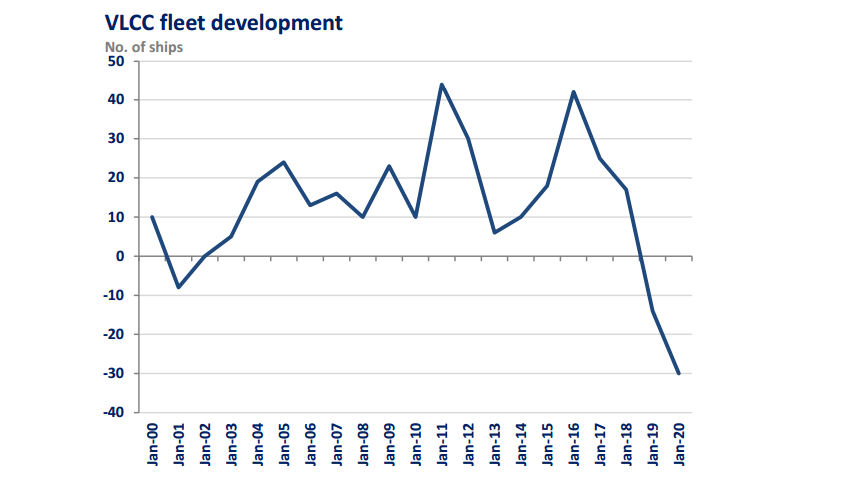

First, fleet growth has accelerated this year, with monthly tonnage deliveries of Aframax vessels and larger hitting twice the pace seen last year.

Second, with low oil prices, crude production has been flat this year; and with falling Atlantic volumes, long hauls from the Atlantic to Asia have tailed off.

Third, crude and refined product storage levels are high, cutting into demand.

In a presentation at the Association of Ship Brokers & Agents conference in Miami, Jason Klopfer of Navig8 concurred that high crude and product inventories and a growing fleet have weighed on tanker rates – and noted that these have had an impact on vessel asset values, too. As spot tanker earnings began to tail off in December last year, one year time charter rates fell as well, dragging down secondhand tanker values by roughly one quarter.

However, Kopfler was more optimistic over the medium term, noting that the tanker fleet is likely to settle at a more manageable size in future years due to a drop-off in ordering activity.

Since his comments, benchmark VLCC Persian Gulf-to-Far East rates have recovered somewhat from the lows seen earlier this year, rising above the 50 Worldscale mark for the first time in four months, Platts reported on Thursday.

Some brokers are optimistic that the run could continue. Last week, a European tanker broker told Reuters that "rates have come from $10,000 per day and owners have been able to whack it up to $20,000 day. They have doubled earnings in a week – this momentum is not something you can easily curb."

Much of the change can be attributed to strong demand in West Africa and in the Middle East. In Nigeria, Shell lifted force majeure at its Bonny terminal in early September, providing a large number of extra supertanker cargoes, and shipments of Nigerian Qua Iboe crude are set to resume in October.